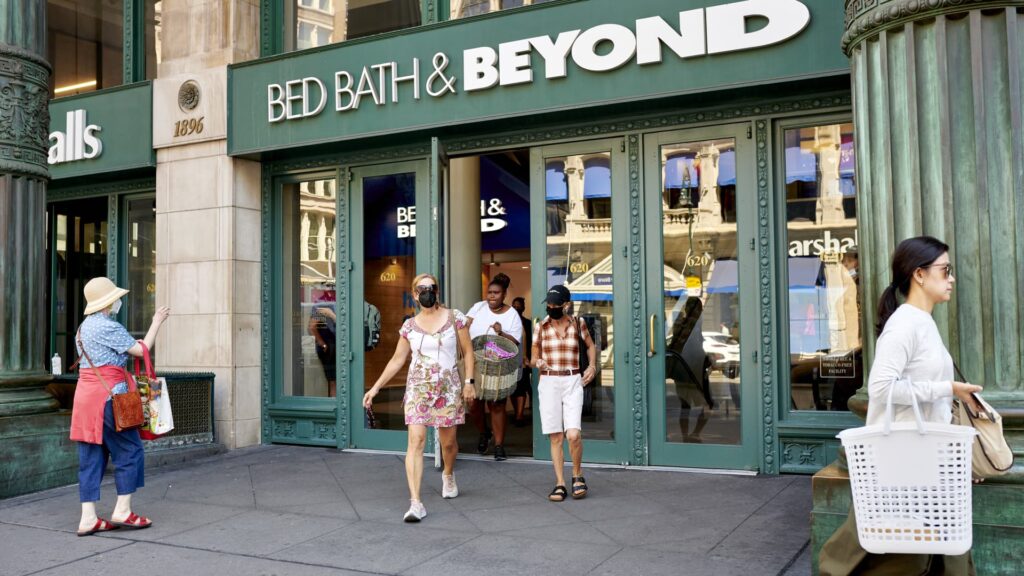

Signage exterior a Mattress Bathtub & Past retail retailer in New York, Aug. 25, 2022.

Gabby Jones | Bloomberg | Getty Photographs

Try the businesses making headlines in noon buying and selling.

Silvergate — Shares of the crypto-focused financial institution tumbled greater than 42% after Silvergate disclosed large buyer withdrawals in the course of the fourth quarter. The financial institution stated it $3.8 billion in belongings from digital asset clients on the finish of December, down greater than 60% from three months earlier. The corporate additionally bought off extra the $5 billion of debt securities to cowl the withdrawals, leading to a loss on these gross sales of $718 million.

Mattress Bathtub & Past — The house items retailer plummeted 24% after reporting it is working out of money and is contemplating chapter, citing weaker-than-expected gross sales. The corporate stated it’s exploring monetary choices together with restructuring, in search of further capital or promoting belongings, along with a possible chapter.

Lamb Weston Holdings — The meals processing firm jumped 9% after it smashed quarterly earnings and income estimates. Lamb Weston additionally raised its monetary steering for the complete 12 months.

Walgreens Boots Alliance — The pharmacy operator tumbled greater than 8% regardless of beating Wall Road’s earnings expectations and elevating its full-year outlook. Walgreens posted a web loss in relation to an opioid litigation settlement.

CrowdStrike — Shares of the cloud-based software program firm slid greater than 8% to hit a brand new 52-week low after Jefferies downgraded CrowdStrike to carry from purchase. The Wall Road agency stated 2023 “might be a tougher basic 12 months for progress names.”

Constellation Manufacturers — The alcoholic beverage maker’s shares fell 8.8% after quarterly earnings got here in barely decrease than analysts anticipated, in keeping with FactSet. The corporate reported wine and spirits gross sales slipped for the quarter and shipments slipped by 14.8%.

Shopify — Shares fell greater than 4% after Jefferies downgraded Shopify to a maintain from a purchase ranking, citing unsure macro challenges forward for the e-commerce inventory.

Conagra Manufacturers — Shares rose practically 3% after Conagra Manufacturers topped expectations in its newest earnings outcomes, and raised its fiscal 2023 steering. The meals firm reported earnings of 81 cents per share on income of $3.31 billion in income. It was anticipated to earn 66 cents per share on income of $3.28 billion, in keeping with consensus estimates on StreetAccount.

Amazon — The e-commerce large fell practically 2% after saying it is reducing 18,000 jobs, changing into the most recent know-how firm to chop again after increasing quickly in the course of the pandemic.

GE Healthcare Applied sciences — Shares of the brand new public firm fell 3% on their second day of buying and selling, after rallying 8% on Wednesday. The corporate was spun off from Basic Electrical as a part of the conglomerate’s plan to interrupt up into three separate corporations. GE’s vitality section is predicted to separate off subsequent 12 months, leaving GE to focus solely on aviation.

American Specific — The worldwide built-in fee firm’s inventory shed greater than 2% after being downgraded to underweight from equal weight by Stephens. The agency stated it was involved about American Specific’ cushion heading right into a recession and lower its value goal on the inventory to $134 per share from $146.

Ally Monetary — Ally dipped 1.8% after Financial institution of American downgraded the inventory to a purchase, saying slowing mortgage demand might damage the corporate.

— CNBC’s Sarah Min, Michelle Fox, Samantha Subin, Jesse Pound, Yun Li, and Alex Harring contributed reporting