(Bloomberg) — US inflation information within the coming week are anticipated to remain in keeping with a gradual step-down in price pressures, and can assist decide the scale of the Federal Reserve’s subsequent interest-rate improve.

Most Learn from Bloomberg

The buyer worth index excluding meals and power, often known as core CPI and seen as a greater underlying indicator than the headline measure, is projected to have risen 0.3% in December.

Whereas barely greater than November, the month-to-month advance could be according to the common for the quarter, and nicely beneath the 0.5% common seen from January by September amid the best inflation in a technology.

Thursday’s figures will probably be a number of the final such readings coverage makers will see earlier than their Jan. 31-Feb. 1 assembly and charge determination, the primary with a brand new rotation of voting members. Economists are penciling in a 25 basis-point improve within the Fed’s benchmark charge, although officers have indicated a half-point hike is feasible.

The Labor Division’s CPI is predicted to indicate core inflation elevated 5.7% from a yr earlier. That might be the best December-to-December print since 1981. Whereas it’s nicely above the Fed’s purpose, and helps clarify coverage makers’ intention of conserving charges greater for longer, year-over-year worth progress is moderating.

The report will floor almost every week after the most recent US jobs report confirmed that wage progress, a key issue within the inflation outlook, cooled in December.

Learn extra: Fed Will get ‘Goldilocks’ Report: Slower Wage Progress, Strong Hiring

The CPI figures spotlight a comparatively quiet information week that additionally consists of weekly jobless claims and January client sentiment. The Washington-based World Financial institution will launch its bi-annual financial outlook on Tuesday, and in an summary warned of recession dangers.

What Bloomberg Economics Says:

“The favorable inflation developments aren’t a results of Fed charge hikes — they’re largely defined by China’s ugly exit from Covid-zero, and an normally heat winter. Nonetheless, the decline in power costs has helped to sharply cut back near-term inflation expectations and has made inflation dangers extra two-sided. If this development continues, it could possibly be the ‘compelling’ proof the Fed must see earlier than it pauses or considers reducing charges.”

—Anna Wong and Eliza Winger, economists. For full evaluation, click on right here

Elsewhere, information anticipated to indicate sooner worth beneficial properties in Japan and China, plus an evaluation of how German financial progress cooled in 2022, will draw the eye of traders.

Click on right here for what occurred final week and beneath is our wrap of what’s arising within the international financial system.

Asia

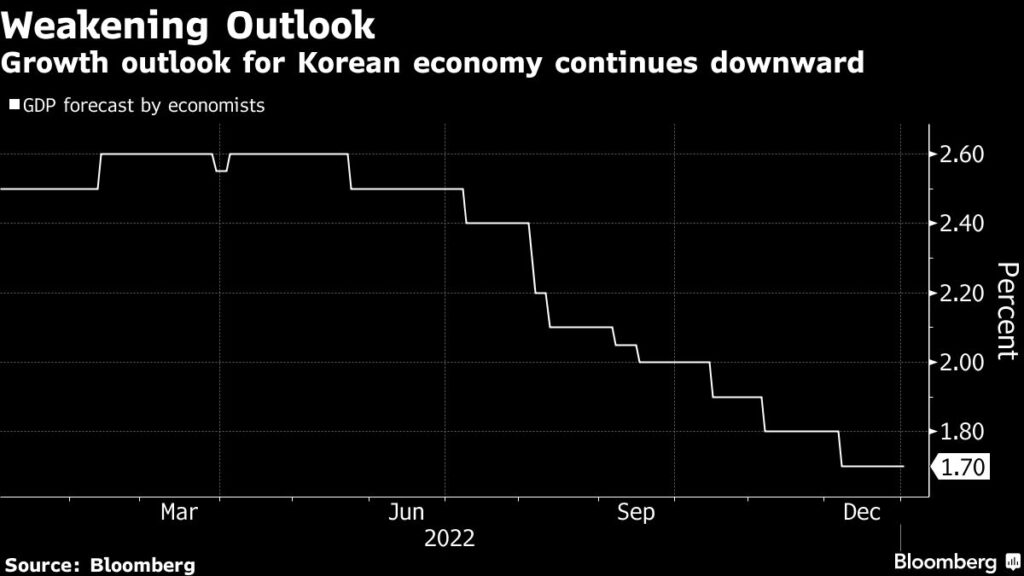

South Korea will kick off this yr’s Asian central financial institution choices, with the Financial institution of Korea on Friday set for what could possibly be the final charge hike of its present tightening cycle as progress issues develop.

Governor Rhee Chang-yong is conserving the concentrate on inflation whereas being more and more cautious of the influence of elevated borrowing prices on the financial system’s momentum.

In Japan, Tokyo CPI numbers on Tuesday are prone to present an additional acceleration in inflation as traders preserve a detailed eye on the Financial institution of Japan following December’s shock financial coverage transfer.

Down Underneath, Australia is about to report retail gross sales and CPI numbers, with inflation anticipated to proceed to realize tempo.

China’s inflation information on Thursday are anticipated to indicate PPI remaining near deflation in December, whereas client inflation ticked up barely.

The Folks’s Financial institution of China is because of publish month-to-month credit score information, which will probably be carefully watched to evaluate whether or not financial stimulus is flowing by the financial system.

India will launch inflation information, which is able to probably present a cooling in costs for a 3rd straight month.

Europe, Center East, Africa

The primary main international financial convention of 2023 takes place in Stockholm on Tuesday, targeted on central financial institution independence and hosted by newly-installed Riksbank Governor Erik Thedeen.

Fed chief Jerome Powell and friends from the UK, Canada, the Netherlands and Spain are anticipated to talk. European Central Financial institution Govt Board member Isabel Schnabel can also be scheduled to seem.

Friday will function a number of information releases. Statisticians in Germany will publish an estimate of financial progress in 2022. Usually the primary such evaluation from among the many Group of Seven industrialized nations, the report could trace at efficiency within the fourth quarter.

The numbers are prone to sign how the post-pandemic rebound in Europe’s largest financial system was smothered by the power disaster following Russia’s invasion of Ukraine. Officers reckon Germany is at present in recession.

Within the wider euro area, industrial manufacturing for November due the identical day could present a partial rebound from a drop the earlier month. ECB statistics displaying whether or not banks repaid additional long-term loans can even be printed.

UK progress information for November, additionally on Friday, are anticipated by economists to indicate a decline from October. The report could assist verify the Financial institution of England’s fears that the financial system there’s slumping too.

Days after euro-zone inflation slowed to single digits in a launch that also confirmed sturdy underlying pressures, consumer-price information from Norway, Sweden, Denmark and the Czech Republic will punctuate the week. Russia and Ukraine will launch equal statistics.

Amongst central financial institution choices, Romanian officers are anticipated to additional improve the important thing charge on Tuesday, whereas their Serbian counterparts could do the identical two days later. Kazakhstan’s financial determination is on Friday.

Latin America

Mexico on Monday posts each full month and bi-weekly client worth experiences to shut out 2022, and most analysts forecast a slight acceleration again up towards 8%. Core readings over 8% and the comparatively extra speedy cooling of US inflation could strain Banxico to increase its file climbing cycle.

Brazil on Tuesday posts its December client worth information, with analysts anticipating a print round 5.6%, some 650 foundation factors beneath the 2022 excessive. Declining unemployment, slowing inflation and authorities money transfers probably buttressed November retail gross sales there.

Many economists have been marking down their 2022 Argentina client worth forecasts, with a consensus forming round 95% for the December year-on-year end result.

Hours earlier than the Peruvian central financial institution’s charge assembly final month, the nation’s president tried to dissolve congress and was subsequently impeached and put below arrest. Political upheaval and persistently elevated inflation makes an 18th straight hike greater than probably.

Again in Brazil, Latin America’s largest financial system outperformed for a lot of 2022 however indicators of flagging momentum abound. Preliminary estimates see a second straight decline within the November GDP-proxy studying posted Friday.

–With help from Nasreen Seria, Michael Winfrey and Robert Jameson.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.