(Bloomberg) — Russian President Vladimir Putin’s plans to squeeze Europe by weaponizing power look to be fizzling a minimum of for now.

Most Learn from Bloomberg

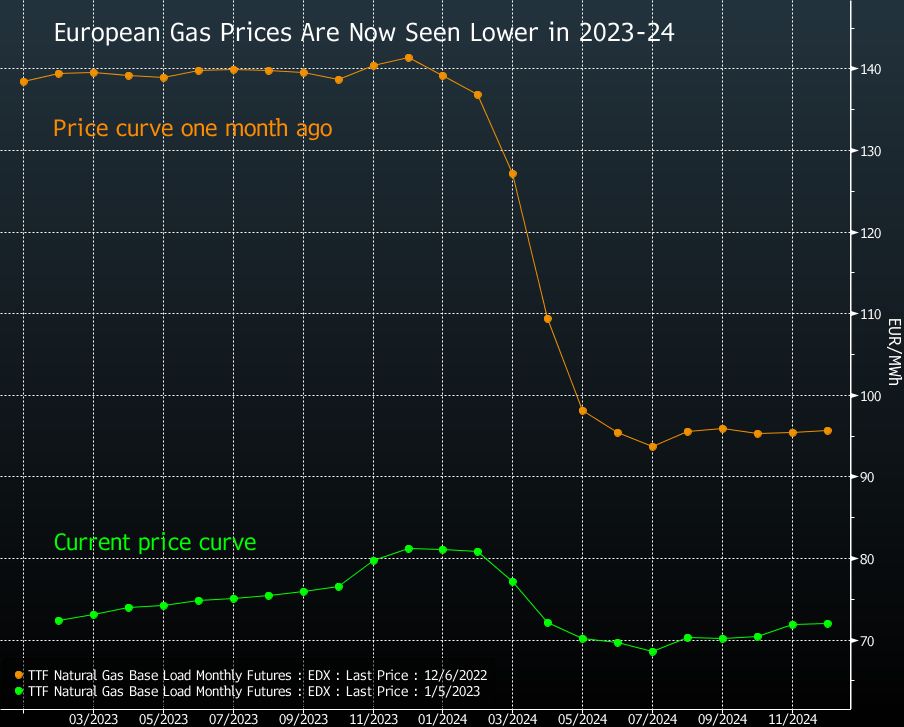

Delicate climate, a wider array of suppliers and efforts to scale back demand are serving to, with fuel reserves nonetheless practically full and costs tumbling to pre-war ranges. After the sharp turnaround over the previous month, Europe is probably going already by way of the worst of the disaster.

The mix of circumstances — together with China’s Covid woes blunting competitors for LNG cargoes — would take the sting off inflation, stabilize Europe’s financial outlook and go away the Kremlin with much less leverage over Ukraine’s allies, in the event that they persist.

Whereas a chilly snap or supply disruptions might nonetheless throw power markets into disarray, optimism is rising that Europe can now make it by way of this winter and subsequent.

“The hazard of a whole financial meltdown, a core meltdown of European business, has — so far as we are able to see — been averted,” German Economic system Minister Robert Habeck, a key architect of the nation’s response to the power disaster, mentioned throughout a visit to Norway, which has taken Russia’s place because the nation’s largest fuel provider.

The disaster, triggered by Russia’s invasion of Ukraine final February, has already price Europe near $1 trillion from surging power costs. Governments have responded with greater than $700 billion in support to assist firms and shoppers soak up the blow. Additionally they scrambled to unwind their reliance on Russian power, particularly pure fuel.

The European Union is not importing coal and crude oil from Russia and fuel deliveries have been considerably curtailed. The bloc has stuffed among the hole by growing provides from Norway and shipments of liquefied pure fuel from Qatar, the US and different producers.

In Germany, storage services are about 91% full, in contrast with 54% a 12 months in the past, when Russia had already been emptying services it managed. Chancellor Olaf Scholz’s authorities has since nationalized Gazprom PJSC’s native items and has spent billions of euros filling reserves.

Power-saving measures from business and households in addition to the warmest January temperatures in many years have helped protect that cushion.

“We’re very optimistic, which we weren’t actually again within the fall,” Klaus Mueller, head of Germany’s community regulator, mentioned in an interview with public broadcaster ARD on Friday. “The extra fuel we have now in storage services originally of the 12 months, the much less stress and value we are going to face in filling them once more for subsequent winter.”

Benchmark fuel costs have fallen to a fifth of data set in August, and regardless of considerations that cheaper charges might stoke demand, utilization remains to be declining — a silver lining of the weak economic system. European consumption is predicted to be some 16% under five-year common ranges all through 2023, Morgan Stanley mentioned in a report.

Learn extra: Germany’s Scholz Tells Residents They Have to Maintain Saving Power

Favorable circumstances and the growth of renewable capability can be serving to. Greater wind and photo voltaic technology will assist slash gas-fired energy technology in 10 of Europe’s largest energy markets by 39% this 12 months, based on S&P World.

The dynamic has shifted to such an extent that there’s now an excessive amount of LNG arriving, based on Morgan Stanley. Deliveries set a recent document in December, and the pattern is prone to proceed.

Germany, as soon as the largest purchaser of Russian fuel, is opening three terminals this winter, and Europe’s largest economic system expects its new LNG services to cowl a couple of third of its earlier necessities. Regular provides from non-Russian sources are prone to preserve market costs from surging to final 12 months’s peaks.

Learn extra: Germany Opens LNG Terminal in Quest to Exchange Russian Fuel

“The truth that Europe managed to refill its storage websites has actually created a buffer for costs for the upcoming winter,” mentioned Giacomo Masato, lead analyst and senior meteorologist at Italy-based power firm Illumia SpA. “The expectations shifted because the area began to have ample provides.”

Refilling reserves might be much less dramatic after this winter. Morgan Stanley and consultancy Wooden Mackenzie Ltd. anticipate storage websites about half full this spring if the climate stays gentle. That may be double final 12 months’s ranges.

Regardless of the optimistic developments, costs are nonetheless greater than historic averages and dangers stay. Russian pipeline fuel imports this 12 months will likely be only a fifth of traditional ranges — about 27 billion cubic meters — and the Kremlin might lower them utterly.

That’s “a large discount for a market that was consuming 400 bcm in 2021,” mentioned Anne-Sophie Corbeau, a researcher at Columbia College’s Middle on World Power Coverage.

LNG due to this fact will likely be crucial to securing sufficient provides for subsequent winter, and Europe might want to stay alert. A rebound in China’s economic system might stoke competitors, with provides tight till extra capability turns into out there in 2025. Russia additionally has the flexibility to trigger disruption available in the market as one in all Europe’s top-three suppliers of the super-chilled gas.

Nonetheless, the possibilities of a big rebound in Chinese language LNG demand is evaporating, because the nation turns to extra inexpensive gas choices, like coal, pipeline fuel and home manufacturing. The truth is, China could not even want any spot LNG shipments this 12 months, based on CICC Analysis.

The local weather disaster has contributed to an absence of demand for heating to date this winter and more and more unstable climate patterns should set off blasts of chilly, such because the latest arctic climate that swept throughout the US. Extended freezing temperatures can deplete storage websites to twenty% capability, based on Wooden Mackenzie.

To make sure clean stockpiling in the summertime, numerous components need to align, together with strong electrical energy provide from wind, nuclear and hydro turbines, secure LNG flows and continued power financial savings, Corbeau mentioned.

“Europe may be in a greater place in comparison with beforehand feared, however it’s not out of the woods but,” Wooden Mackenzie mentioned by e mail.

–With help from Iain Rogers and Stephen Stapczynski.

(Updates with particulars about China’s LNG demand outlook within the twentieth paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.