Synthetic intelligence (AI) is already being utilized in a number of functions. From picture recognition to healthcare, e-commerce to promoting to credit score scoring and plenty of different industries – all are making use of AI’s human-like capabilities. And with computing energy repeatedly enhancing, it’s set to get extra prevalent over time.

One latest instance of its affect is ChatGPT – the AI chatbot developed by OpenAI and launched final November. The device has shortly caught the general public’s creativeness with its skill to carry out totally different duties comparable to write articles, songs and even write code and its success has solely highlighted how AI will carry on impacting our lives.

After all, with any fledgling business, buyers will get a chance to purchase in and there are publicly traded corporations basing their total worth proposition round AI.

With this in thoughts, we delved into the TipRanks database and pulled out two AI-focused shares which have the consultants singing their praises. Let’s see what makes them interesting funding decisions proper now.

SoundHound AI (SOUN)

The primary AI inventory we’re taking a look at is SoundHound AI, a voice helping specialist. Through speech, its voice AI platform allows customers to work together with merchandise. This isn’t some esoteric phase of the market we’re speaking about. The corporate sees an enormous TAM (whole addressable market) of $160 billion forward; by 2024, there are anticipated to be 8 billion voice assistants in use with 75 billion linked gadgets working worldwide the next 12 months. SoundHound has some big-name shoppers on its roster comparable to Mercedes-Benz, Hyundai, Mercedes-Benz, Kia, Deutsche Telekom, Snap, Stellantis and Vizio.

SoundHound solely grew to become a public entity this 12 months, getting into the market by way of the SPAC route again in April. It has been a trial by fireplace, to say the least. The shares are down by 88% because the debut as SPACs went critically out of favor in 2022’s bear.

Nonetheless, regardless of worries concerning the firm with the ability to face up to the powerful macro circumstances amidst continued losses, it has been posting some spectacular progress. In Q3, income climbed by 178% YoY to $11.2 million. The corporate noticed a cumulative bookings backlog of $302 million, amounting to a 239% YoY enhance – representing a fourth consecutive quarter of triple-digit progress and an organization file.

In November, the corporate launched a brand new product known as Dynamic Interplay, a conversational AI device that allows companies to make use of voice AI know-how when servicing clients.

Cantor’s Brett Knoblauch thinks it could possibly be a “game-changing know-how because it pertains to how people work together with computer systems, and extra broadly talking, know-how.”

“We consider there are quite a few use-cases that this know-how could possibly be utilized for, with low-hanging fruit being inside customer-service settings like eating places,” the analyst went on so as to add. “We consider this product 1) additional expands upon SOUN’s conversational AI benefit; 2) offers us larger visibility into SOUN’s income trajectory; 3) will speed up the mix-shift of income in direction of subscription income; and 4) expands SOUN’s addressable market.”

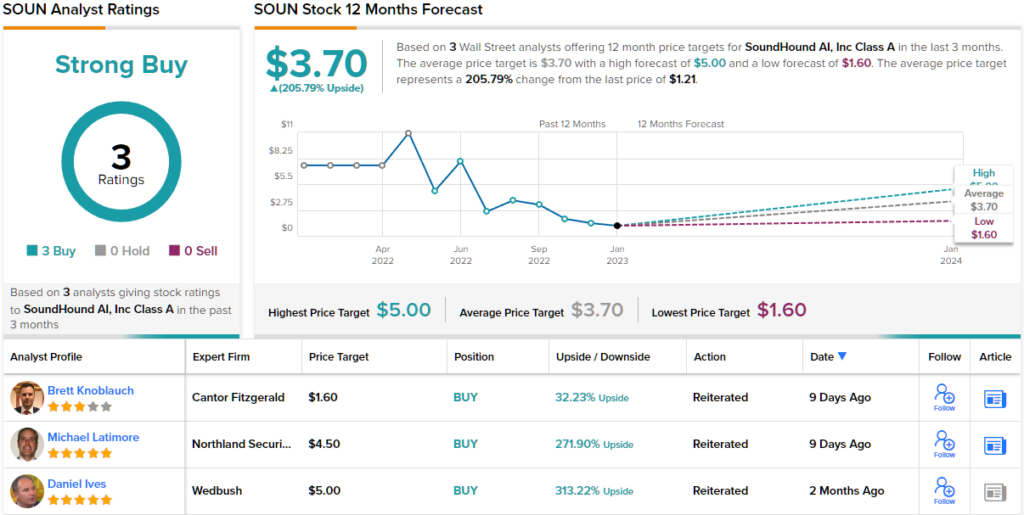

Conveying his confidence, Knoblauch charges SOUN as Obese (i.e., Purchase) and backs it up with a $1.60 worth goal, implying shares will transfer ~32% greater over the one-year timeframe. (To observe Knoblauch’s observe file, click on right here)

Knoblauch, whereas bullish on the inventory, is considerably conservative in comparison with the final Wall Avenue view right here. The common worth goal is greater than Alexanders, at $3.70, implying a robust upside potential of ~206% from the $1.21 share worth. Unsurprisingly, SOUN has a Robust Purchase analyst consensus score, primarily based on a unanimous 3 Buys. (See SOUN inventory forecast)

Good Corp (PERF)

The subsequent AI inventory we’ll have a look at is Good Corp, primarily a SaaS firm with a twist. The distinctive promoting level is that it presents augmented actuality and synthetic options to the style and wonder sectors. So, how does that work?

With using facial 3D modelling and deep studying tech, the firm’s AI/AR make-up and hair options enable customers to attempt on make-up and totally different hairstyles and dyes digitally. Mainly, AI-powered digital try-on choices. In a world the place a lot is shifting on-line and customers anticipate partaking experiences catered to their very own type, the corporate is an early mover with a market main place on this area of interest. Fashioned in 2015, a number of the world’s most well-known cosmetics corporations are already on board; Estee Lauder Group, Coty, Kose, LVMH, and Shiseido are all utilizing the options.

The corporate has solely been on the general public markets because the finish of final October when it IPOd by way of the SPAC route; on the finish of November, Good introduced unaudited monetary outcomes for the 9 months of the 12 months. Pushed by an uptick in AR/AI cloud options and subscription revenues, whole income elevated by 22.1% year-over-year to $36.2 million, whereas gross revenue rose from $25.6 million in the identical interval a 12 months in the past to $31.1 million. Even higher, internet revenue swung dramatically from a internet lack of $3.1 million a 12 months in the past to $28.5 million.

For Oppenheimer analyst Brian Schwartz, that’s simply one of many causes that makes Good an interesting funding selection.

“The enterprise is a confirmed disruptor of the wonder business, has achieved scale, and is profitably rising at a quick price,” the 5-star analyst mentioned. “We predict the pedigree, know-how imaginative and prescient, sturdy tradition, and business expertise of its CEO and management crew will set the corporate as much as be a vertical SaaS chief and grow to be compounding progress funding… The sweetness and style markets for AI/AR options are early in evolution; PERF is arguably the perfect progress asset within the classes for funding.”

Accordingly, Schwartz charges PERF shares an Outperform (i.e., Purchase), whereas his $10 worth goal implies 12-month progress of ~25%. (To observe Schwartz’s observe file, click on right here)

Wanting on the consensus breakdown, 1 Purchase and a pair of Holds have been printed within the final three months. Consequently, PERF will get a Reasonable Purchase consensus score. (See PERF inventory forecast)

To search out good concepts for AI shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.

15 Comments

Hi jhb.news webmaster, You always provide valuable feedback and suggestions.

Hello jhb.news administrator, Your posts are always well written.

Dear jhb.news administrator, You always provide useful information.

Dear jhb.news webmaster, Great content!

Hello jhb.news admin, Your posts are always informative and up-to-date.

To the jhb.news owner, Great content!

Hi jhb.news webmaster, Your posts are always well-supported by facts and figures.

Dear jhb.news admin, Your posts are always informative.

Hi jhb.news webmaster, Your posts are always informative and up-to-date.

Hi jhb.news owner, Thanks for the well written post!

Hi jhb.news owner, Thanks for the informative post!

Dear jhb.news admin, Keep up the good work, admin!

Hi jhb.news owner, Your posts are always a great source of knowledge.

To the jhb.news administrator, You always provide clear explanations and definitions.

Hello jhb.news administrator, Your posts are always well thought out.