MILAN, Jan 19 (Reuters) – Italy’s UniCredit (CRDI.MI) might have room to pay out extra to shareholders from 2022 earnings than the 12 months earlier than, doubtlessly including to rewards that have been already among the many most beneficiant amongst European banks, its CEO stated on Thursday.

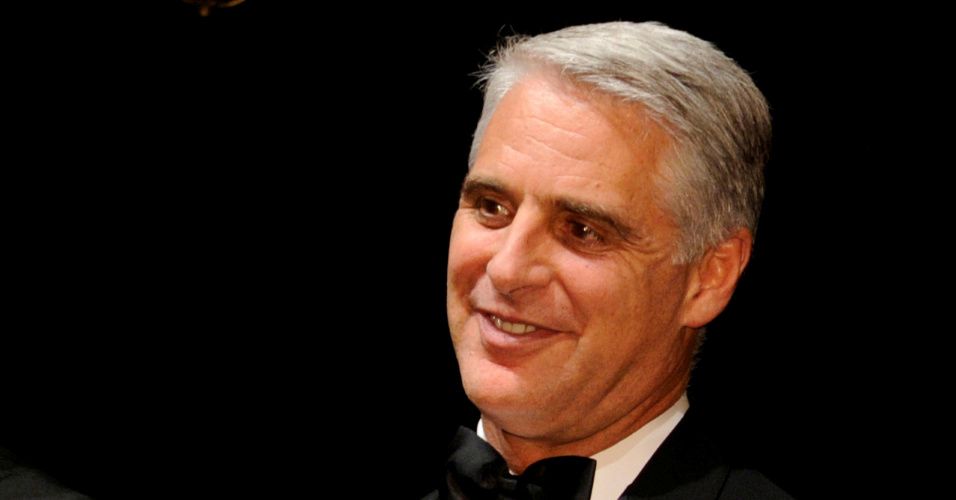

Talking in Davos to Bloomberg Tv, Andrea Orcel stated credit score losses have been nonetheless shrinking regardless of the anticipated financial shock forward from greater rates of interest and the price of dwelling disaster.

“We see the uncertainty, all of us anticipate a possible shock however the indicators are all excellent. The inventory of non performing loans goes down and the price of danger remains to be compressing,” he stated.

Shares in UniCredit have been little modified mid-session with analysts and merchants saying the rally in banking shares and UniCredit particularly already anticipated a powerful finish to 2022.

UniCredit would be the first Italian financial institution to report full-year outcomes on Jan. 31.

Requested whether or not shareholder payouts for 2022 might beat 2021 ranges, Orcel stated: “Our capital distribution ambition for 2022 was to be in line or greater than 2021, based mostly on the numbers we had on the nine-month mark we might be greater.”

UniCredit paid out 3.75 billion euros in dividends and share buybacks final 12 months, or 100% of its 2021 underlying internet revenue, according to Orcel’s technique of specializing in companies that generate capital to be returned to shareholders.

Orcel has pledged to satisfy the vast majority of a three-year payout aim of greater than 16 billion euros even in a “extreme recession.”

UniCredit has been forecasting a light recession and Orcel stated on Wednesday the most recent indications pointed to Europe presumably with the ability to escape a recession altogether.

The upbeat tone of financial institution CEOs, who’re reaping the advantages of upper charges on lending margins whereas funding prices and mortgage losses are nonetheless low, is in distinction with business supervisors’ name for warning given the uncertainty forward.

Reporting by Valentina Za Modifying Federico Maccioni and Mark Potter

: .