Barry Silbert, Founder and CEO, Digital Forex Group

Anjali Sundaram | CNBC

Crypto commerce publication CoinDesk is exploring a possible sale, hiring advisors at Lazard to weigh a transfer that will take away it from Barry Silbert’s Digital Forex Group.

“Over the previous few months, we have now obtained quite a few inbound indications of curiosity in CoinDesk,” CEO Kevin Price stated in an emailed assertion. The Wall Road Journal was first to report on the media firm’s hiring of Lazard.

CoinDesk, which launched in 2013, broke the primary story about potential steadiness sheet improprieties at Sam Bankman-Fried’s Alameda Analysis. That reporting sparked a downward spiral at crypto trade FTX, finally resulting in the collapse of the corporate in November, the arrest of Bankman-Fried and a number of regulatory probes.

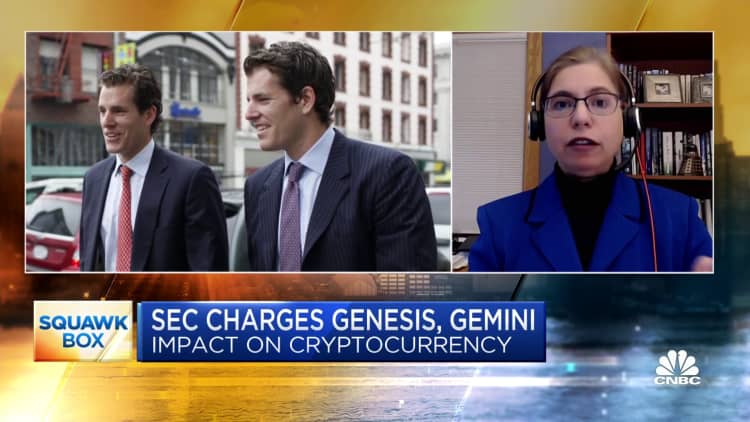

The contagion from the FTX meltdown hit CoinDesk sister firm Genesis, a crypto lender additionally owned by DCG that is employed advisors for a possible chapter submitting after freezing withdrawals and mortgage originations. Genesis can be the topic of a Securities and Trade Fee cost alongside crypto trade Gemini.

Price stated Lazard will assist CoinDesk “discover numerous choices to draw development capital to the CoinDesk enterprise, which can embrace a partial or full sale.”

A consultant for DCG didn’t instantly reply to requests for remark.

WATCH: The SEC fees Genesis for unregistered securities gross sales