2023 is thus far offering a platform for turnaround tales. Shopify (NYSE:SHOP) seems to be one such title benefiting from a change in sentiment; the shares are already up by 44% year-to-date, with 24% of these positive factors delivered on this week’s buying and selling.

Traders have been evidently proud of the e-commerce large’s newest transfer, with the surge coming off the again of modifications to its month-to-month pricing plans. These have an effect on Fundamental, Shopify, and Superior plans, with all rising by roughly 33-34%.

The essential plan will now value $39, up from $29, the Shopify plan will enhance from $79 to $105, and the Superior plan will value $399 vs. $299 beforehand.

The corporate justified the hikes by noting the pricing plans have hardly modified during the last 12 years. New retailers pays for the up to date plans instantly, whereas for present retailers, the brand new costs will go into impact by late April.

Considering a “comparatively small incremental churn,” with a complete take fee of ~3% in comparison with 2.9% earlier than, Baird analyst Colin Sebastian estimates 2023 will yield roughly a $200 million “subscription income profit.” On an annualized foundation, Sebastian anticipates incremental revenues within the area between $300-350 million. The analyst additionally estimates round 80% of Shopify retailers use month-to-month plans versus annual preparations.

“Shopify stays a comparatively low-cost e-commerce platform choice for retailers/manufacturers, and the corporate has not elevated costs in a few years,” famous the 5-star analyst. “Furthermore, we don’t suppose these costs warrant a change for the overwhelming majority of retailers, given the effort and time required to shift platforms, and our view that Shopify’s platform, in lots of respects, affords superior e-commerce performance at an inexpensive worth.”

Consistent with his optimistic strategy, Sebastian stays with the bulls. The analyst charges SHOP shares an Outperform (i.e., Purchase) (To look at Sebastian’s monitor report, click on right here)

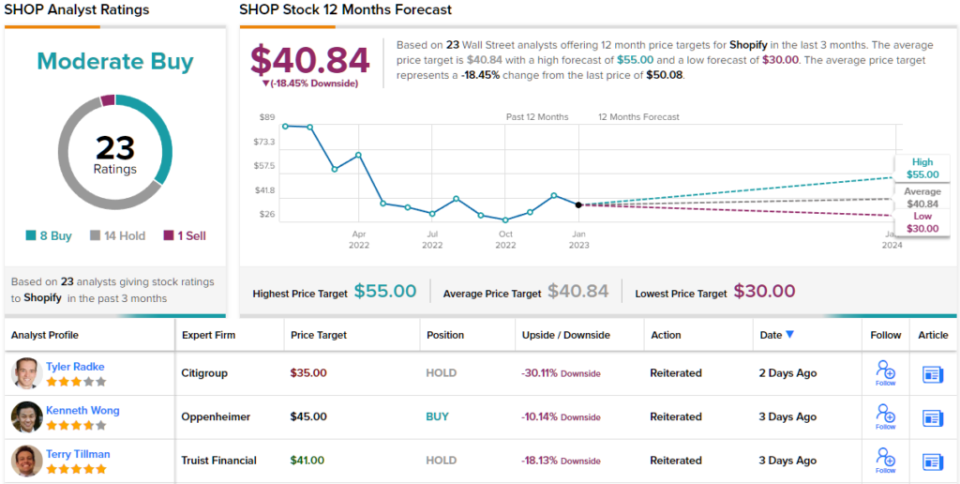

Trying on the consensus breakdown, based mostly on 8 Buys, 14 Holds and 1 Promote, Wall Road’s analyst corps fee SHOP inventory a Reasonable Purchase. Nevertheless, most suppose the shares have now surpassed their honest worth; the common goal stands at $40.84, suggesting the inventory can be altering arms for an 18% low cost in a 12 months’s time. (See Shopify inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is extremely necessary to do your personal evaluation earlier than making any funding.