Among the many most watched statistics within the Union Price range are earlier yr’s tax collections and projections for the subsequent fiscal yr. Listed below are 5 charts that spotlight some essential factors so far as taxes and the forthcoming Union Price range are involved.

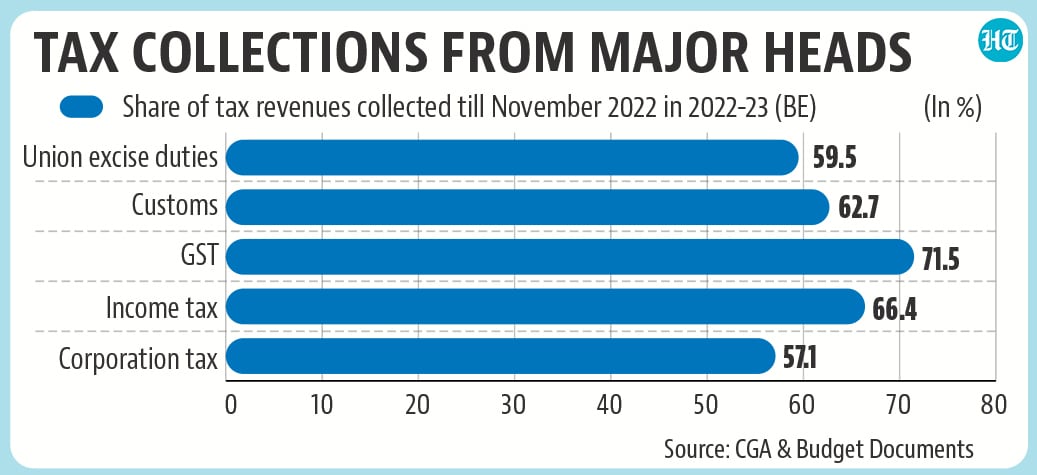

Ideally, tax collections in 2022-23 ought to exceed Price range Estimates

The 2022-23 Price range assumed a nominal development of 11.1% for the Indian economic system. First superior estimates of GDP for 2022-23 put India’s nominal GDP development to be 15.4%. Assuming that tax buoyancy – it’s change in tax per unit change in GDP- stays unchanged, 2022-23 tax collections needs to be larger than the Price range Estimate (BE) numbers. Whether or not it has occurred will probably be identified on Could 30, when the Controller Basic of Accounts (CGA), which works underneath the Union ministry of finance, releases provisional tax assortment figures for 2022-23. A comparability of newest knowledge on tax collections – it’s out there till November 2022-shows that 64.6% of the BE quantity has already been collected. This quantity was 69.5% in November 2021.

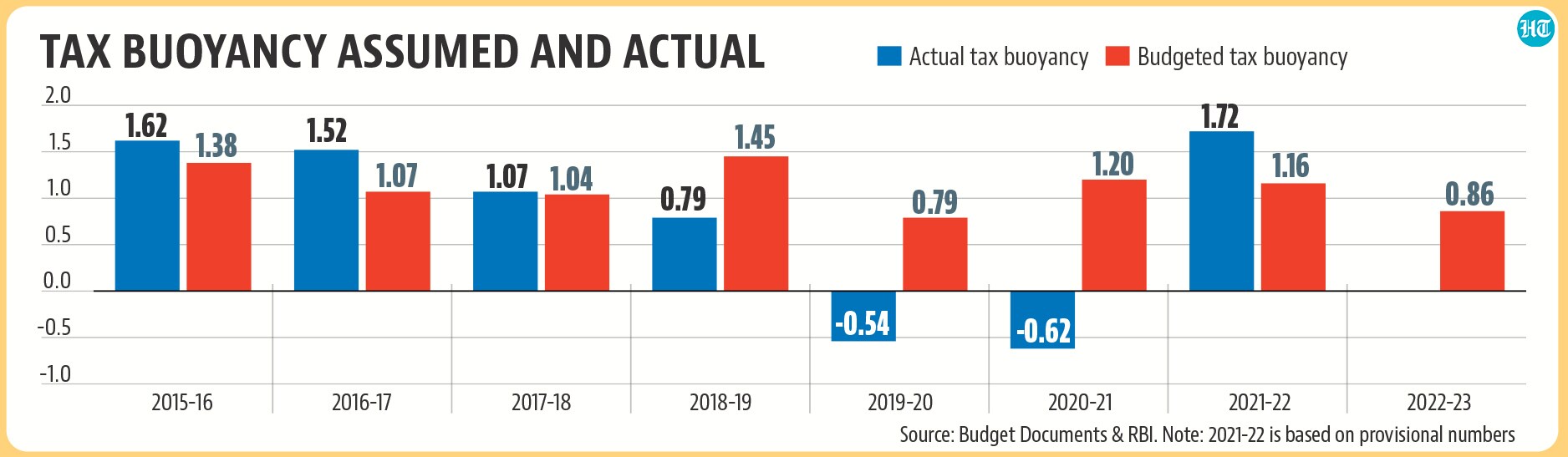

Tax buoyancy assumed within the Price range will probably be an essential quantity

It’s virtually a provided that the nominal GDP development in 2023-24 will probably be decrease than what it was in 2022-23. Most forecasters count on India’s actual GDP development to decelerate in 2023-24 and inflation – the GDP deflator carefully follows wholesale inflation – is predicted to reasonable considerably in 2023-24. If the nominal GDP development slowdown it important, it raises a query whether or not gross tax collections will develop at a a lot slower tempo in 2023-24.

To make certain, nominal GDP development will not be the one driver of general tax collections, because it additionally relies on the assumed tax buoyancy. In 2021-22, the precise tax buoyancy turned out to be larger than the assumed tax buoyancy, whereas this determine was overestimated within the earlier three budgets (since 2018-19). The 2022-23 price range had assumed 0.86. It’s to be seen if the federal government pegs a better or decrease buoyancy quantity than this determine for 2023-24.

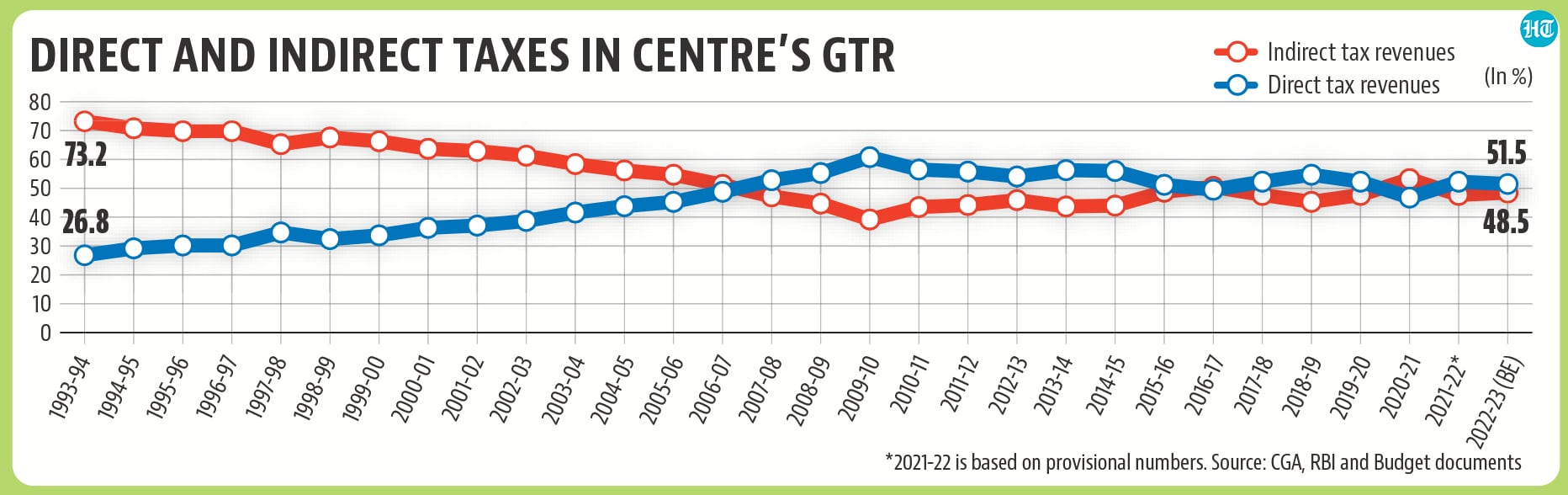

Will direct tax share proceed to recuperate?

As a result of the wealthy face a better burden of direct taxes, a better share of direct taxes in general tax income signifies a progressive tax coverage. A protracted-term comparability of direct and oblique tax shares in centre’s gross tax income exhibits that the share of former elevated within the reform interval after which began coming down firstly of the final decade. There was a short reversal on this development, however direct tax share fell to its lowest in 18 years (46.8%) in 2020-21. This quantity improved to 52.3% in 2021-22, however the budgeted determine was marginally decrease at 51.5% for 2022-23. The direct tax projections to be introduced within the 2023-24 Price range will probably be essential to search for.

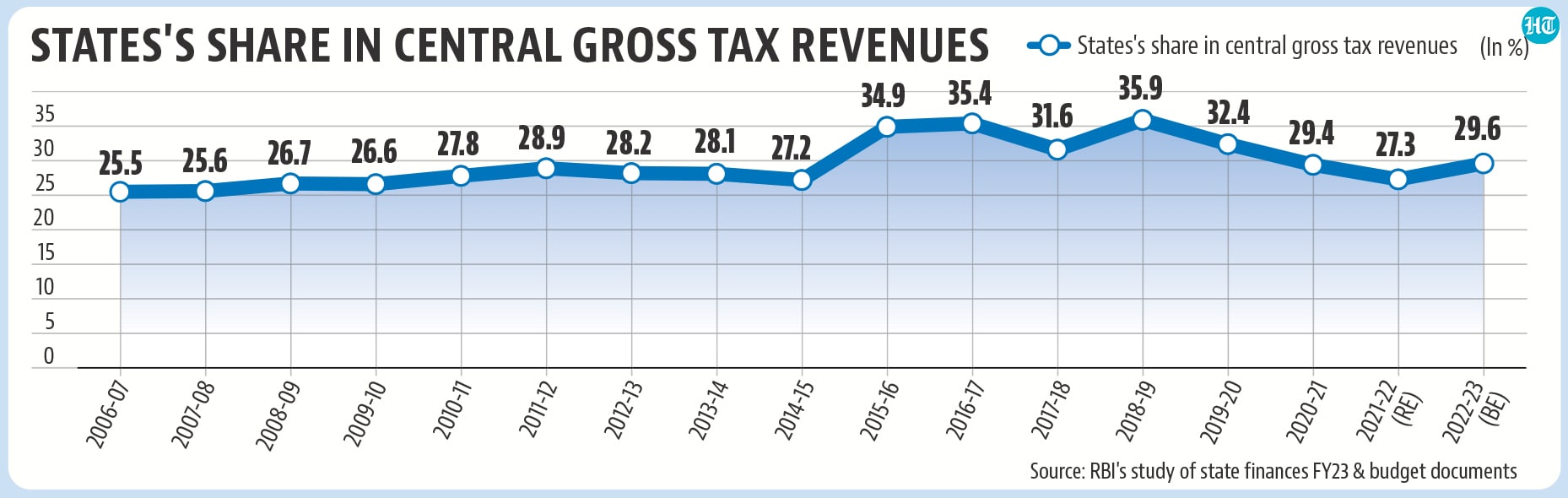

States’ share in Centre’s taxes is predicted to rise in 2022-23

The fifteenth Finance Fee has mandated that the Centre switch 41% of its gross tax income to states. Nonetheless, the share of budgetary allocation made for this train was 29.6% for 2022-23, which is decrease than what was prescribed.

The explanation states’ share in gross tax revenues of the Centre is decrease than the 41% mark is that cess and particular duties don’t from part of the divisible pool of taxes. It is going to be attention-grabbing to see what this quantity is for the 2023-24 Price range.

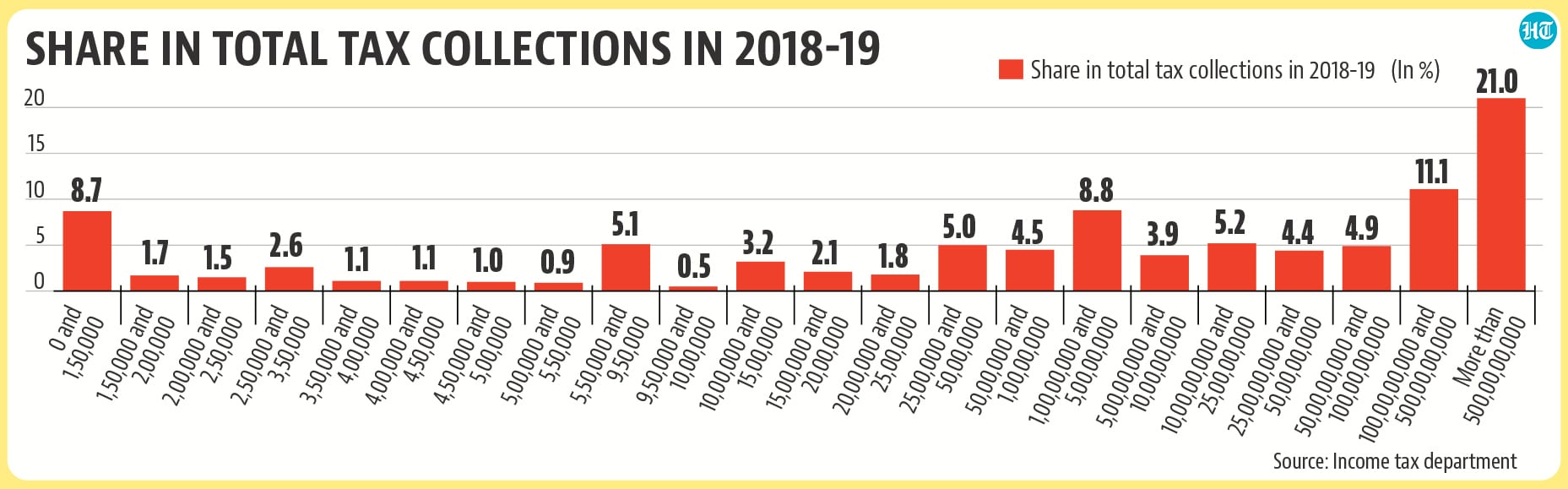

These incomes greater than 50 lakh/annum contribute almost two-thirds of I-T collections

The Union Price range attracts a variety of consideration from the salaried class in India attributable to the potential of revisions within the earnings tax slab charges annually. The earnings tax charges for people haven’t been modified since 2017-18, so it’s seemingly that the federal government might introduce some modifications in tax charges within the upcoming price range. Nonetheless, an HT evaluation exhibits that any such train focused on the decrease finish of the earnings tax slabs might supply marginal returns to the federal government relative to these on the upper finish of the earnings tax slabs. Earnings tax return statistics for 2018-19 clearly exhibits that 82% of tax collections was generated from these tax payers (this consists of people, corporations, corporations and others) with earnings greater than 75 lakh each year. To make certain, 64% of tax collections got here from tax payers with incomes above 50 lakh. It isn’t attainable to know these statistics for the newest yr because of the unavailability of information for the time being.

This Republic Day, unlock premium articles at 74% low cost

Get pleasure from Limitless Digital Entry with HT Premium