The earnings tax slabs have been final modified in 2014, when the non-public tax exemption restrict was revised, too. Whereas the 2020 funds launched an non-obligatory new earnings tax regime, which discovered few takers, the 2022 funds didn’t provide any respite for salaried professionals. The salaried class all the time expects earnings tax rebate each fiscal 12 months. From the upcoming funds 2023, taxpayers expect the present tax slab with fundamental exemption restrict of ₹2.5 lakh earnings to be elevated to ₹5 lakh, in lieu of rising inflation and value of residing.

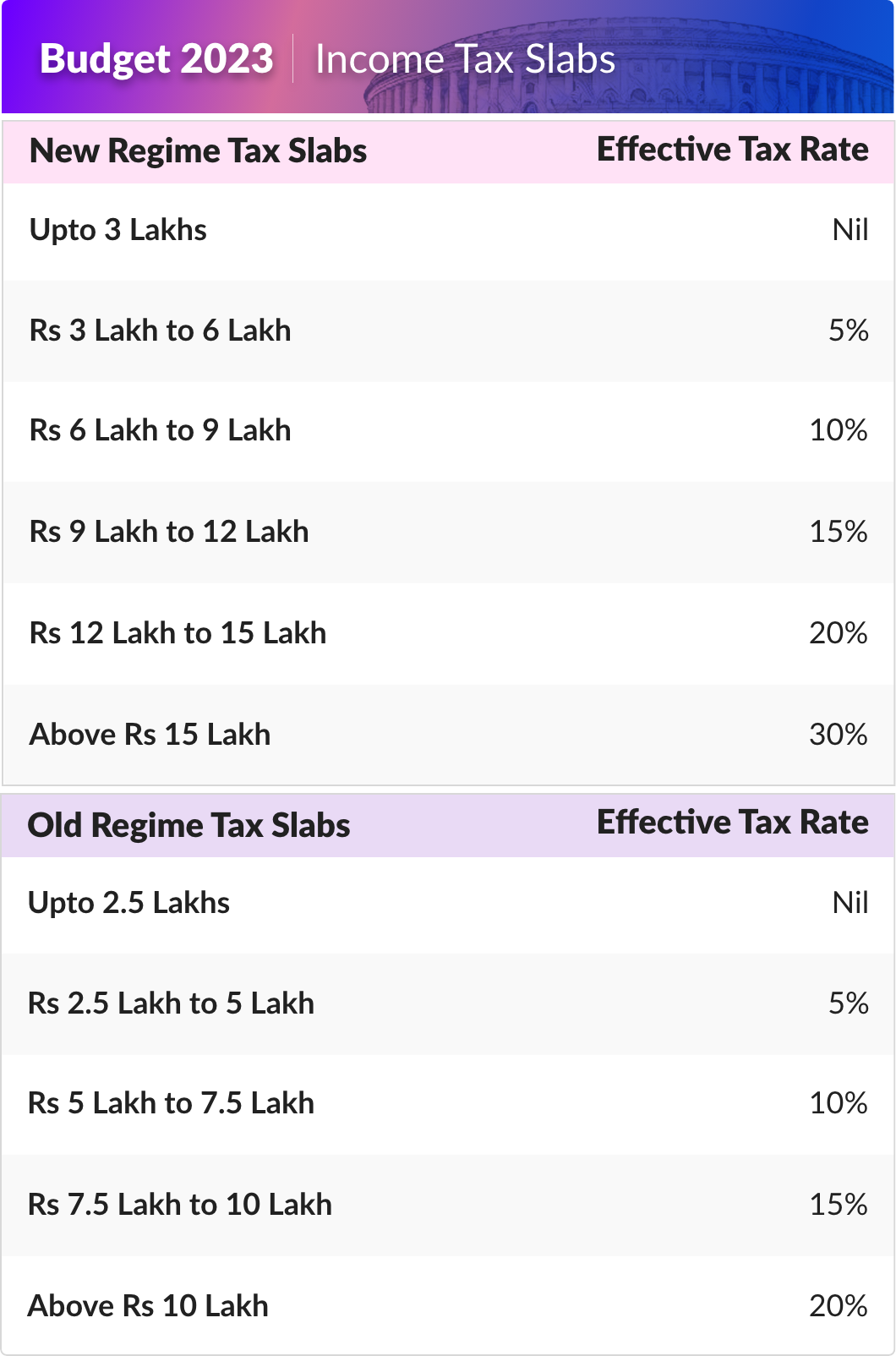

New tax slabs

1) Annual earnings of ₹2.5 lakh exempted from taxes

2) 5% tax on annual earnings between ₹2.5 lakh to ₹5 lakh

3) 10% tax on private earnings between ₹5 lakh and ₹7.5 lakh

4) 15% tax on earnings of ₹7.5 lakh to ₹10 lakh

Revenue above ₹10 lakh is categorised into three:

1. 20% tax on private earnings between ₹10 lakh and ₹12.5 lakh

2. 25% tax on ₹12.5 lakh to ₹15 lakh annual earnings

3. Annual earnings above ₹15 lakh will probably be taxed at a price of 30%

Previous tax slabs

1) As much as ₹2.5 lakh earnings is exempt from taxation

2) Revenue between ₹2.5 to ₹5 lakh taxed on the price of 5%

3) 15% taxation on private earnings between ₹5 lakh and ₹7.5 lakh

4) An earnings of ₹7.5 lakh to ₹10 lakh attracts taxation of 20%

5) 30% tax on private earnings exceeding ₹10 lakh

A uniform tax construction for capital beneficial properties, incentives for private mortgage debtors and rise in tax exemption restrict for house patrons are a few of the expectations of the salaried class from finance minister Nirmala Sitharaman for the upcoming funds.