Shares of Adani group of firms declined in morning commerce on Monday, with flagship firm Adani Enterprises falling over 4 per cent after credit standing agency Moody’s revised the score outlook on 4 firms of the conglomerate to ‘adverse’ from ‘steady’.

On the BSE, the scrip of Adani Enterprises dived 4.32 per cent to ₹1,767.60 apiece within the early commerce, whereas shares of Adani Ports and Financial Zone slipped 2.56 per cent to ₹568.90 per share.

Among the group corporations additionally touched their lower cost bands.

Within the morning session, shares of Adani Energy plummeted to ₹156.10, Adani Transmission to ₹1,126.85, Adani Inexperienced Vitality to ₹687.75 and Adani Complete Gasoline to ₹1,195.35 per share on the bourse. All these scrips declined 5 per cent every.

The scrip of Ambuja Cements plunged 3.34 per cent to ₹349, Adani Wilmar went decrease by 3.31 per cent to ₹421.65, NDTV nosedived 2.25 per cent to ₹203.95 and ACC fell 1.49 per cent to ₹1,853 apiece on the BSE.

Within the morning session, the 30-share BSE Sensex was buying and selling 393.56 factors or 0.65 per cent decrease at 60,289.14 factors.

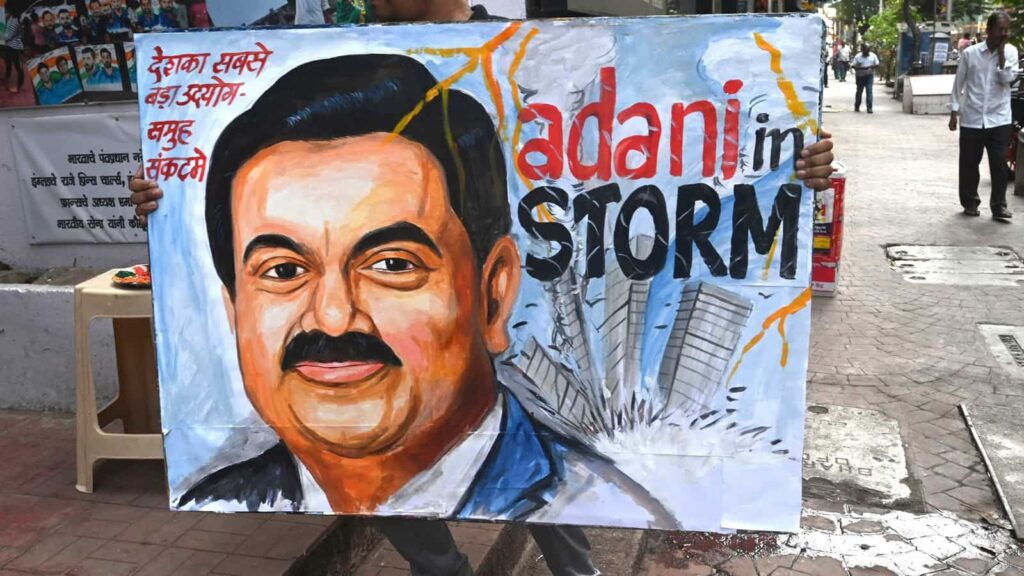

In a press release, Moody’s Investor Service on Friday mentioned that it has revised the score outlook on 4 Adani Group firms to adverse from steady after a big and speedy decline in market worth following a report by US-based brief vendor Hindenburg Analysis.

The mixed market cap of the group firms is down by 51 per cent as in comparison with that on January 24, when US-based activist short-seller Hindenburg Analysis by way of its antagonistic report made a litany of allegations, together with fraudulent transactions and share value manipulation on the Gautam Adani-led group.