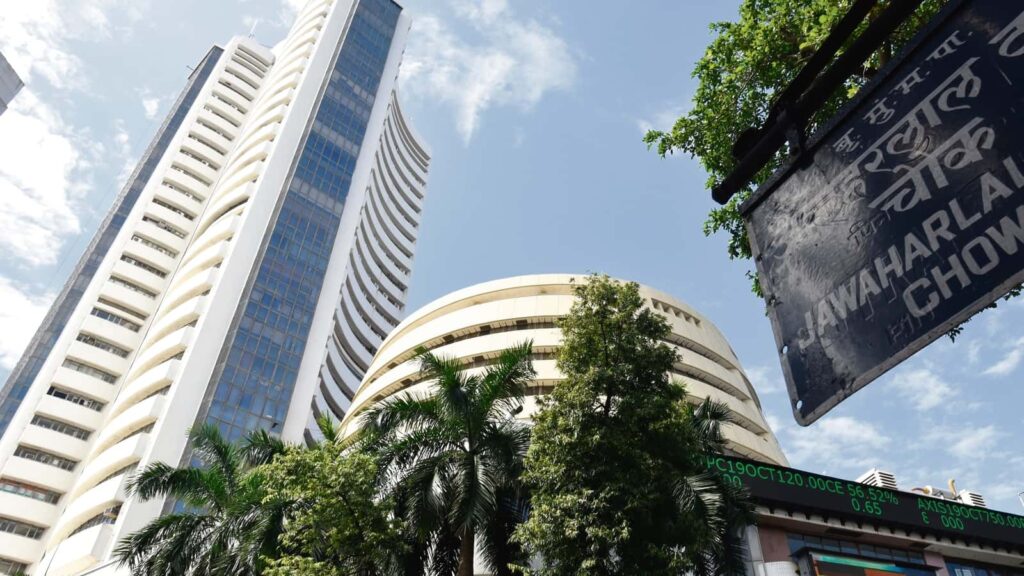

Benchmark Sensex pared early losses to shut 242 factors greater whereas Nifty settled above the 18,000-mark on Wednesday following good points in IT, oil and choose banking shares amid blended world tendencies.

Extending good points for a second day, the 30-share BSE Sensex superior 242.83 factors or 0.40 per cent to shut at 61,275.09 with 20 of its constituents ending within the inexperienced.

The index opened decrease at 60,990.05 however later regained foot to the touch a excessive of 61,352.55 in day commerce.

The broader Nifty of NSE rose by 86 factors or 0.48 per cent to settle above the 18,000-mark at 18,015.85, following good points in RIL, Tech Mahindra and Adani Enterprises.

Amongst Sensex shares, Tech Mahindra rose probably the most by 5.79 per cent. Index main Reliance Industries spurted 2.22 per cent, whereas Bajaj Finserv, Bharti Airtel, Tata Metal, M&M, Nestle Industries, HCL Tech, Kotak Financial institution, Tata Motors, ICICI Financial institution and Titan additionally superior.

Hindustan Unilever fell probably the most by 1.22 per cent. ITC, Solar Pharma, L&T, HDFC twins and IndusInd Financial institution had been among the many main losers.

Within the broader market, the BSE midcap index superior 0.69 per cent whereas the smallcap index rose by 0.36 per cent.

In the meantime, Asian and European shares had been blended after US inflation fell lower than anticipated, elevating expectations of aggressive fee hikes by the US Federal Reserve.

In Asia, the Shanghai Composite Index misplaced 0.4 per cent, the Nikkei 225 in Tokyo declined 0.4 per cent and The Dangle Seng in Hong Kong dropped 1.4 per cent.

In Europe, In early buying and selling, the FTSE 100 in London declined 0.1 per cent whereas the DAX in Frankfurt gained 0.4 per cent and the CAC 40 in Paris rose 0.7 per cent. Wall Avenue futures had been decrease as inflation slowed to six.4 per cent in January from the earlier month’s 6.5 per cent in opposition to the road estimate of 6.2 per cent.

Oil costs additionally dropped on considerations over weak demand with the Brent futures declining by 1.3 per cent to USD 84.45 per barrel.

International Portfolio Traders had been internet patrons, buying shares price ₹1,305.30 crore on Tuesday.