(Bloomberg) — Federal Reserve officers may make clear what number of policymakers noticed the case for a bigger interest-rate enhance at their final assembly and whether or not they anticipated the necessity to take charges greater than beforehand thought to tame persistently excessive inflation.

Most Learn from Bloomberg

US central bankers will publish minutes at 2 p.m. Wednesday of their Jan. 31-Feb. 1 gathering, at which they voted unanimously to lift charges by only a quarter proportion level. That was a moderation from their half-point hike in December after 4 consecutive jumbo-sized 75 basis-point will increase. The motion introduced the Fed’s benchmark coverage charge to a goal vary of 4.5% to 4.75%.

The Fed’s coverage assertion on Feb. 1 mentioned the “extent of future will increase” in charges will rely on quite a lot of components together with cumulative tightening of financial coverage, wording Fed watchers seen as a sign the central financial institution could persist with 25 basis-point strikes because it approaches the top of its tightening marketing campaign.

“We expect the minutes will specific the strategic rationale for shifting in 25s in phrases which can be just like our personal: to be taught from the 1H information to what extent the resilient information to this point mirrored coverage lags vs an financial system that’s extra resilient to greater charges,” Evercore ISI’s Krishna Guha and Peter Williams wrote in a word to shoppers.

However two hawkish policymakers, Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard, mentioned final week that they noticed the case for doing one other 50 basis-point hike on the assembly and that such bigger strikes ought to nonetheless be on the desk for upcoming choices.

The readout of the gathering may provide perception on whether or not these two officers, who don’t vote in financial coverage choices this yr, had been alone of their pondering or if others shared their view. That mentioned, Richmond Fed President Thomas Barkin pushed again in opposition to the opportunity of returning to greater hikes, saying on Friday that 25 basis-point will increase give officers extra flexibility.

Officers could set a excessive bar for returning to half-point charge will increase. But when extra policymakers supported preserving the choice for a bigger transfer, it may trace that the Fed could also be open to taking charges greater than beforehand anticipated to quell robust inflation, mentioned Omair Sharif, founding father of Inflation Insights.

“That at the very least offers us some sense of doubtless how rapidly the Fed would possibly shift if wanted,” mentioned Sharif. “Should you suppose 50 is clearly on the desk, then that in all probability means that the terminal charge goes to be greater as effectively.”

Projections issued on the Fed’s December assembly confirmed officers noticed charges rising barely above 5% this yr and staying there for some time to deliver inflation right down to the central financial institution’s 2% goal. Traders beforehand doubted that message, and had been pricing in charge cuts for the second half of this yr.

However on the heels of stronger financial information and hawkish messaging from some policymakers, markets now see the Fed extending its charge climbing marketing campaign for longer than beforehand anticipated. Quarter-point charge will increase are absolutely priced in for March and Might and the chances of one other such transfer in June are excessive. Traders see charges peaking at 5.37% this yr, in response to monetary futures contracts.

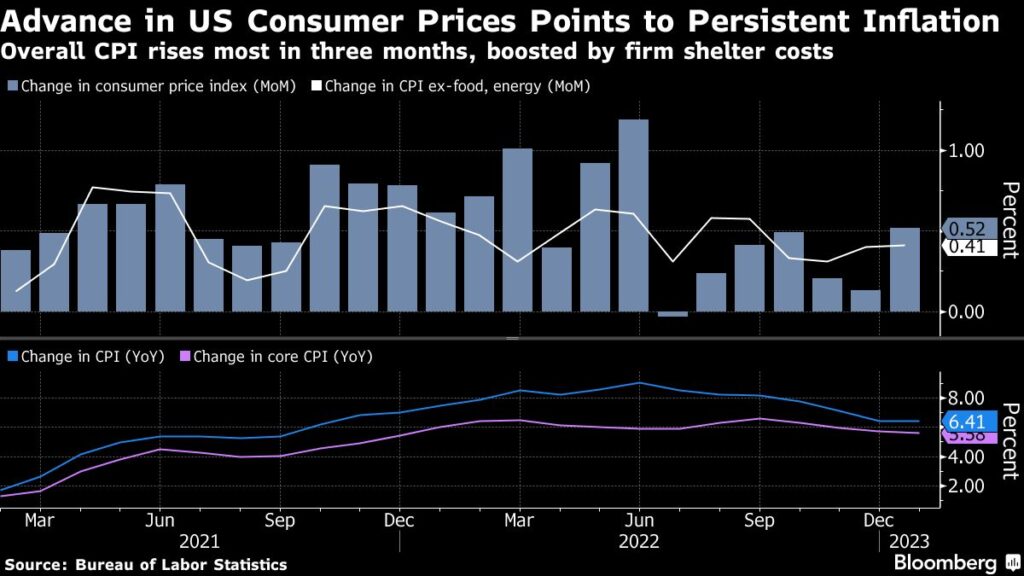

Latest financial reviews confirmed strong retail gross sales, a stronger-than-expected rebound in US producer costs and shopper costs that aren’t slowing by as a lot as forecast.

The minutes may additionally reveal how officers interpreted the information they’d available by the point of the assembly, providing clues on how they could be decoding the robust information that’s been launched for the reason that gathering, mentioned Sharif. A message that policymakers see the dangers of doing too little to halt inflation because the higher danger when in comparison with climbing an excessive amount of, may recommend that officers are ready to take charges greater, he mentioned.

Fed Chair Jerome Powell advised reporters after the assembly earlier this month that upcoming projections, which officers will pencil in for his or her March 21-22 assembly, will probably be decided by what occurs with inflation.

“It may actually be greater than we’re writing down proper now,” Powell mentioned. “On the identical time, if the information are available in, within the different route, then we’ll, you already know, we’ll make information dependent choices at coming conferences.”

–With help from Vince Golle.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.