(Bloomberg) — China’s annual Nationwide Folks’s Congress, the primary since Beijing introduced an abrupt finish to a few years of crippling Covid Zero restrictions, has begun with a modest goal for financial development and few hints of previous stimulus extravagance.

Most Learn from Bloomberg

Right here’s a rundown of what commodities and power markets have to know after the primary day of the assembly.

What are Beijing’s plans for the post-Covid financial system?

The federal government reiterated it needs to spice up development by elevating home consumption, alongside proactive fiscal insurance policies. However the 2023 targets underlying that stance will disappoint bulls hoping for extra formidable assist because the financial system reopens.

Though Beijing promised elevated state spending and a wider funds deficit, the headline GDP development determine of round 5% is on the low finish of expectations. The goal for native authorities bond gross sales — the spine of infrastructure funding that drives the majority of uncooked supplies demand — was modest too, suggesting the federal government is in search of to strike a steadiness between the necessity to assist the financial system and strained native realities, plus the necessity to stop runaway commodities inflation.

Not one of the official paperwork launched on Sunday instructed urge for food for the form of large enhance deployed to proper the financial system after the monetary disaster and even at first of the pandemic, when Beijing drove markets for supplies like copper and iron ore to report highs in 2021, forcing authorities to intervene.

There was some solace to be discovered within the rhetoric round China’s want to extend consumption — excellent news for commodities that profit from client spending, together with oil and agricultural merchandise — however there have been few concrete measures to level to. The central financial institution has additionally reiterated that it gained’t roll out extreme stimulus, relying as a substitute on client confidence and funding to enhance because the financial system strengthens.

What are the commodity market priorities?

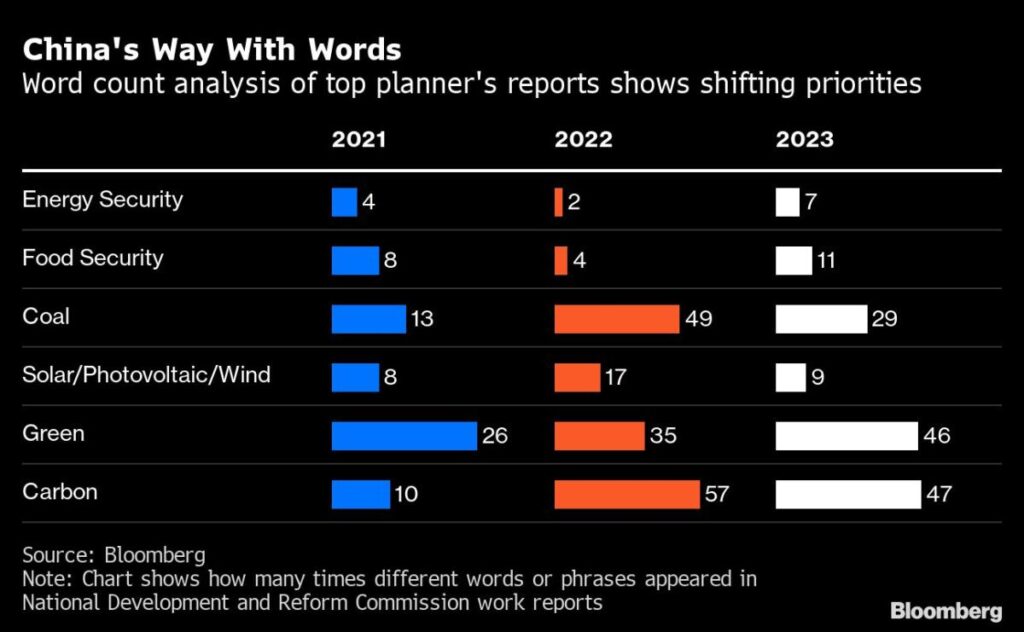

China’s anxieties over its reliance on abroad suppliers to feed its huge inhabitants and provide the uncooked supplies it wants are by no means removed from the forefront of presidency coverage, however the mixture of Covid disruptions and Russia’s invasion of Ukraine positioned each towards the highest of the record of this 12 months’s considerations.

A few of additional spending will probably be deployed on tasks to boost power and meals safety, together with a rise within the nation’s capability to supply grain. The federal government additionally needs to bolster the home provide of supplies like iron ore, for the metal business, and lithium, for electrical automobile batteries, that are deemed essential to selling self-sufficiency.

Elevating protection spending has additionally emerged as a prime precedence, and whereas procurement is more likely to be extremely secretive, it may raise demand for uncommon earths and different metals utilized in weaponry.

How did environmental and local weather insurance policies fare?

Environmental targets included a small drop in power depth for the 12 months — about 2% — and a pledge to regulate fossil gasoline consumption, though that message was muddied by the shout-out for the function performed by coal because the nation’s mainstay gasoline.

Stung by widespread energy outages lately, the federal government has pushed manufacturing of the dirtiest fossil gasoline to report ranges. Output rose 10% final 12 months to 4.5 billion tons, whereas pure gasoline additionally hit an all-time excessive and crude oil rose above 200 million tons for the primary time since 2015, serving to to chop China’s reliance on dear power imports.

Breakneck enlargement is testing miners’ limits and considerations over security are as soon as once more within the information after a lethal mine collapse in northern China final month solid a highlight on the risks inherent within the nation’s effort to prioritize power safety by boosting coal manufacturing.

The federal government will push forward with its plans for large photo voltaic and wind tasks based mostly inland, and with energy grids upgrades. Cracking down on carbon information fraud can even be a precedence because the authorities work to strengthen the nation’s ailing emissions buying and selling system forward of a deliberate enlargement.

What concerning the outlook for property and infrastructure?

Native governments will probably be allowed to promote 3.8 trillion yuan ($550 billion) of recent particular bonds, that are primarily used to fund infrastructure spending. That’s greater than the three.65 trillion yuan set ultimately 12 months’s assembly, however decrease than precise issuance of 4.04 trillion yuan in 2022. Bloomberg Economics calculates the federal government’s spending plans translate right into a broad funds deficit, together with native authorities bonds, of 5.9%, in comparison with 5.8% of GDP in 2022 — larger than it anticipated.

Infrastructure accounts for the most important chunk of China’s metal consumption, in order that sector specifically will profit from extra public works to buttress the financial system’s restoration and to alleviate the disaster in the actual property business.

However the kind of funding is altering as spending turns from the previous financial system to the brand new. Meaning extra photo voltaic farms, energy storage services and expansions of the grid, maybe utilizing much less metal and cement however requiring extra supplies like copper and aluminum which might be deemed important to the power transition.

The federal government’s assist for the embattled property market, for instance, which accounts for nearly one-third of Chinese language metal demand and as a lot as one-fifth of urge for food for base metals reminiscent of copper, aluminum, and zinc, was equivocal. Premier Li Keqiang mentioned China wants to forestall a disorderly enlargement of the sector, as coverage makers search to drag an important financial development lever with out piling on monetary dangers.

Sunday’s plans counsel Beijing isn’t fairly content material to let the financial system motor alongside beneath its personal steam after an unexpectedly strong revival in manufacturing unit exercise in February. Nevertheless it isn’t about to unleash previous exuberance.

The Week’s Diary

(All occasions Beijing until famous.)

Monday, March 6

Tuesday, March 7

-

China’s 1st batch of 2023 commerce information via February, together with metal, aluminum & uncommon earth exports; metal, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gasoline & coal imports; oil merchandise imports & exports. ~11:00

-

China international reserves for February, together with gold

-

BNEF China discussion board in Beijing, 14:30

-

EARNINGS: MMG Ltd.

Wednesday, March 8

-

CCTD’s weekly on-line briefing on China’s coal market, 15:00

-

China farm ministry’s month-to-month crop supply-demand report (CASDE)

Thursday, March 9

-

China inflation information for February, 09:30

-

China to launch February mixture financing & cash provide by March 15

-

Wilson Heart webinar on geopolitics of minerals important to the clear power transition

-

EARNINGS: CATL

Friday, March 10

-

China weekly iron ore port stockpiles

-

Shanghai change weekly commodities stock, ~15:30

-

Mysteel’s Indonesia Nickel Provide Chain Summit in Jakarta

–With help from Luz Ding, Dan Murtaugh, Hallie Gu and Kathy Chen.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.