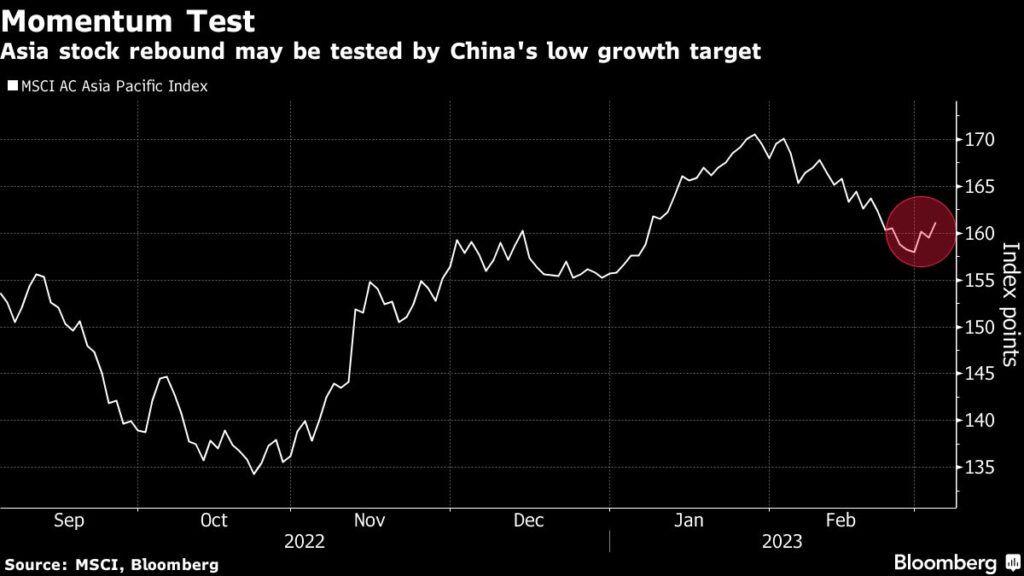

(Bloomberg) — A gauge of Asian shares superior together with US and European fairness futures whereas Chinese language shares fell, weighed down by a modest financial development goal that diminishes the prospect of extra stimulus from Beijing.

Most Learn from Bloomberg

Features within the area had been led by Japan and South Korea, the place benchmark indexes rose about 1%, following the lead from Wall Avenue on Friday. US shares ended the week on a excessive notice, pushed by hypothesis that the Federal Reserve received’t increase rates of interest past peak ranges already priced in.

Shares fluctuated in Hong Kong and dropped about 0.2% in Shanghai as traders digested the implications of China’s purpose of development round simply 5%. This set the tone for commodities from iron ore to copper, which slid along with oil on expectations that demand could also be softer than some traders had anticipated.

Authorities bond yields declined in Australia and New Zealand, monitoring strikes in Treasuries on Friday, when the speed on 10-year US debt closed again under the carefully watched 4% stage. Treasuries had been little modified Monday in Asia. A gauge of greenback energy fluctuated after a small rise earlier.

Traders will proceed to look at strikes in Chinese language equities carefully for indications on the resilience of the latest upward momentum seen within the nation and extra broadly throughout Asia. A gauge of Asia’s equities rallied 1.5% final week after a close to 6% hunch in February.

A rally within the S&P 500 Friday helped snap a three-week dropping streak whereas the Nasdaq 100 scored its finest day since early February. Sentiment remained upbeat regardless of a report exhibiting resilience within the service sector, as some traders wagered the affect of the Fed’s hikes on the economic system can be delayed. A measure of costs paid by service suppliers confirmed prices rising at a slower tempo, which was cheered by merchants.

“Charges are going to be larger for longer so we don’t assume the energy you’re seeing within the fairness market goes to be sustainable within the again half of the 12 months,” Nadia Lovell, UBS International Wealth Administration senior US fairness strategist, mentioned in an interview with Bloomberg Tv. “We do assume you’re going to see a drag on the economic system that has implications for company earnings.”

This week brings a slew of key financial knowledge and occasions for traders to think about. In Asia, eyes stay on the Nationwide Individuals’s Congress in Beijing for any additional coverage bulletins and particulars which will set the tone for the way market pleasant — or harsh — regulation shall be by way of 2023. Australia’s rate of interest resolution shall be in focus Tuesday and on Friday comes the final Financial institution of Japan coverage resolution beneath the present governor Haruhiko Kuroda.

Globally, merchants shall be watching the US non-farm payrolls report for clues on whether or not the economic system can deal with extra charge hikes. Knowledge final week confirmed continued labor-market resilience within the US, supporting the case for the Fed to stay to its tightening coverage, a theme that had pushed nearly each main asset into the pink in February. Traders may also be glued to their screens when Fed Chair Jerome Powell speaks earlier than Senate and Home committees this week.

Key occasions this week:

-

US manufacturing facility orders, sturdy items, Monday

-

US wholesale inventories, client credit score, Tuesday

-

Fed Powell’s semiannual Financial Coverage Report back to the Senate Banking Committee, Tuesday

-

Australia charge resolution, Tuesday

-

Euro space GDP, Wednesday

-

US MBA mortgage functions, ADP employment change, commerce steadiness, JOLTS job openings, Wednesday

-

Fed Chair Powell’s semiannual Financial Coverage Report back to the Home Monetary Companies Committee, Wednesday

-

Canada charge resolution, Wednesday

-

EIA crude oil inventories, Wednesday

-

China CPI, PPI, Thursday

-

US Challenger job cuts, preliminary jobless claims, family change in web price, Thursday

-

Financial institution of Japan coverage charge resolution, Friday

-

US nonfarm payrolls, unemployment charge, month-to-month price range assertion, Friday

A few of the fundamental strikes in markets:

Shares

-

S&P 500 futures rose 0.1% as of 1:43 p.m. Tokyo time. The S&P 500 rose 1.6% on Friday

-

Nasdaq 100 futures rose 0.3%. The Nasdaq 100 rose 2% on Friday

-

Japan’s Topix index rose 0.8%

-

Australia’s S&P/ASX 200 Index rose 0.6%

-

Hong Kong’s Hold Seng was little modified

-

The Shanghai Composite fell 0.2%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0645

-

The Japanese yen rose 0.2% to 135.58 per greenback

-

The offshore yuan fell 0.3% to six.9179 per greenback

-

The Australian greenback fell 0.2% to $0.6757

Cryptocurrencies

-

Bitcoin fell 0.6% to $22,357.44

-

Ether fell 0.7% to $1,561.23

Bonds

-

The yield on 10-year Treasuries declined one foundation level to three.94%

-

Japan’s 10-year yield was little modified at 0.50%

-

Australia’s 10-year yield declined 13 foundation factors to three.77%

Commodities

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.