Sluggish disinflation and a still-strong jobs market have sparked fears the Fed could also be readying to drag the set off on additional aggressive price hikes in an effort to chill off financial exercise and produce inflation down.

However, the general backdrop of continued development momentum isn’t essentially dangerous for shares, in keeping with Goldman Sachs strategist Kamakshya Trivedi.

“Our total view remains to be extra in keeping with sluggish disinflation amid some additional enchancment to world development. That blend ought to preserve the upward stress on yields however finally restrict the injury to equities,” Trivedi opined.

The banking large’s inventory analysts are taking that line ahead, and searching for out the equities that may do extra than simply ‘restrict damages.’ In reality, the analysts see a trio of lesser-known shares posting good points of not less than 60% and going previous 100%.

We ran them by the TipRanks database to see what makes them interesting funding selections proper now.

Sea, Ltd. (SE)

The primary Goldman decide is Sea, a Singaporean agency performing as a tech holding firm. Sea operates by its subsidiaries, which have constructed up a world attain in a number of on-line sectors, together with e-commerce, on-line monetary providers, and gaming. The corporate’s Shopee model handles the retail finish, the SeaMoney model, which is considered one of Southeast Asia’s main on-line finance suppliers, has the monetary providers, and Garena is the net recreation growth and publishing platform.

All of this boiled all the way down to a number of years of robust income development – on the expense of profitability. In 3Q22, its quarterly earnings report confirmed an adjusted internet lack of $357.7 million, a loss greater than double the $167.7 million 3Q21 determine. That stated, revenues for 3Q got here in at $3.2 billion, for an 18.5% year-over-year improve, whereas gross revenue was up 21% y/y to $1.2 billion. We’ll see if Sea’s efficiency has continued to assuage traders, when the corporate releases 4Q22 and full 12 months numbers on March 7.

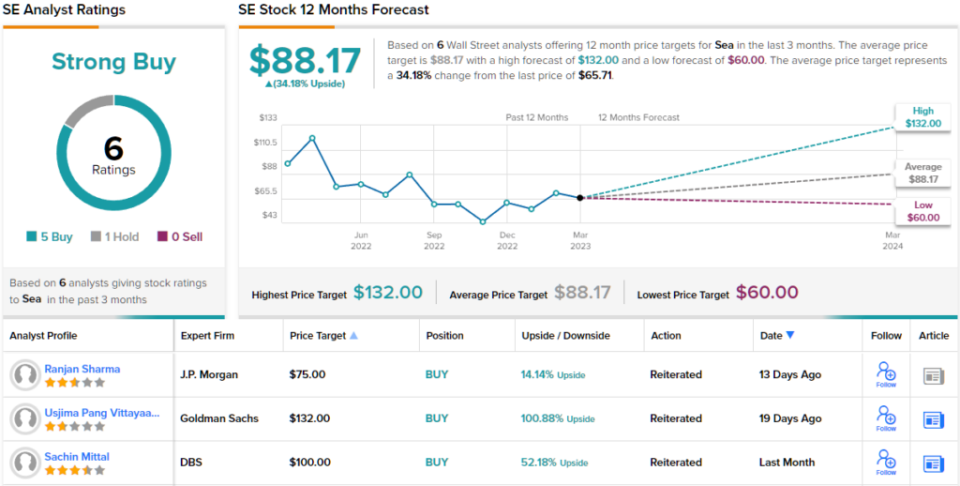

Masking Sea for Goldman Sachs, analyst Pang Vittayaamnuaykoon believes the inventory will outperform the market, as she sees accelerated path to profitability this 12 months.

“Within the mid to long run, we forecast mid-high teenagers % ecommerce development, reflecting our view that Shopee will begin reinvesting once more submit breakeven (whereas staying worthwhile) in development to defend its management place and broaden in development areas… On Gaming, we consider that the road has already priced in continuous EBITDA decline, which supplies draw back help; whereas SeaMoney, largely missed, is about to interrupt even in 1Q23E. With this, we now consider SE will generate EBITDA of US$1.1bn/US$4.1bn by FY23/25E,” Vittayaamnuaykoon opined.

With a risk-reward profile that “stays enticing,” Vittayaamnuaykoon added SE to Goldman’s Conviction Checklist. The analyst charges the inventory a Purchase and her $132 worth goal suggests an upside of ~101% in the middle of the approaching 12 months. (To look at Vittayaamnuaykoon’s monitor file, click on right here)

General, Sea shares have a Robust Purchase score from the analyst consensus, based mostly on 6 latest analyst opinions that embody 5 Buys and 1 Maintain. The shares are promoting for $65.71 and their $88.17 common worth goal implies room or a 12-month upside of ~34%. (See SE inventory forecast)

Krystal Biotech (KRYS)

The second Goldman selection is Krystal Biotech, a clinical-stage biopharma firm engaged on new gene therapies to handle severe, uncommon circumstances brought on by single-gene mutations or absences. Krystal’s distinctive twist on gene remedy is a concentrate on redosable therapeutic brokers, to offer best-in-class remedies. Among the many illness circumstances addressed by the brand new drug candidates in Krystal’s growth pipeline are Dystrophic epidermolysis bullosa (DEB), TGM1-deficient Autosomal Recessive Congenital Ichthyosis (TGM1-deficient ARCI), and cystic fibrosis (CF).

The corporate’s main drug candidate, B-VEC (branded as Vyjuvek), was the topic of a latest Section 3 research within the therapy of DEB. It is a uncommon, regularly deadly, blistering situation of the pores and skin brought on by an absence of a specific collagen protein. The B-VEC drug candidate goals to deal with each recessive and dominant types of this genetic illness. In December of final 12 months, the corporate revealed constructive outcomes from the Section 3 scientific trial, and has since acquired discover from the FDA that the PDUFA date for the Biologics License Utility – a key step in regulatory approval of a brand new drug – is about for Might 19, 2023. Labelling discussions between the corporate and the FDA will start no later than April 20.

Elsewhere within the scientific pipeline, Krystal expects to quickly begin dosing sufferers within the Section 2 portion within the research of KB105, a therapy for TGM1-deficient ARCI. The trial is enrolling each grownup and pediatric sufferers, and can deal with the security and efficacy profiles of the drug candidate.

The third drug candidate within the scientific stage is KB407, a possible therapy for CF. In August of final 12 months, Krystal introduced that the FDA had accredited the IND utility, clearing the best way for a scientific trial, and the Section 1 trial within the US is scheduled to begin throughout 1H23. The corporate is already conducting affected person screening for enrollment in an Australia-based Section 1 trial of KB407.

On a closing observe for the scientific program, Krystal is making ready an IND utility for KB101 to be submitted this 12 months. This drug candidate is being developed for the therapy of Netherton Syndrome, one other harmful, genetically-defined, pores and skin situation.

Whereas Krystal has loads of promising analysis tracks in its growth pipeline, the principle information revolves across the main program, B-VEC/Vyjuvek. Goldman’s 5-star analyst Madhu Kumar writes of this program: “The 5/19 PDUFA for Vyjuvek for dystrophic epidermolysis bullosa (DEB) stays the important thing NT occasion for KRYS shareholders. Our 90% POS and investor conversations point out potential approval and debates round Vyjuvek at the moment are primarily targeted on the launch… We have now revised our market mannequin to higher replicate Vyjuvek’s alternative in DEB (peak world unadjusted gross sales improve from $1.2B to $1.5B with an accelerated ramp in early years of the launch with 25% and 48% of peak penetration being reached in 2024 and 2025), which we consider might drive additional upside for KRYS shares.”

In Kumar’s view, this helps a Purchase score on KRYS shares and a $124 worth goal that means a 61% upside for the following 12 months. (To look at Kumar’s monitor file, click on right here)

General, this biotech inventory has picked up a unanimous Robust Purchase consensus score from the Road’s analysts, based mostly on 6 latest constructive opinions. The shares have a $76.91 buying and selling worth, and the typical worth goal, standing at $114.40, suggests a achieve of ~49% on the one-year time-frame. (See KRYS inventory forecast)

Inter & Firm (INTR)

The final Goldman decide we’re is Inter, a Brazilian-based monetary agency offering a variety of banking providers, together with asset administration, insurance coverage brokerage, and securities to particular person, retail, and industrial purchasers. The corporate’s banking section consists of checking and deposit accounts, credit score and debit playing cards, and varied mortgage providers. The Securities section aids within the buy, sale, and custody of varied safety belongings, in addition to portfolio administration, whereas the Insurance coverage section provides all the frequent insurance coverage merchandise, together with life, property, auto, monetary, and well being/dental insurance policies, in addition to journey and credit score safety.

Inter has rapidly change into a frontrunner in Brazil’s digital banking sector, and has seen its buyer base broaden from simply 1.5 million in 2018 to 24.7 million on the finish of 2022. Even higher, 66% of the corporate’s purchasers use 3 or extra of Inter’s monetary merchandise. As of the tip of final September, Inter boasted over 28 billion Brazilian reals (US$5.39 billion) in buyer deposits, and a mortgage portfolio totaling over 22 billion reals (US$4.23 billion) – up 47% year-over-year.

Whereas Inter received its begin in Brazil, the corporate will not be confining its operations to that nation. Inter boasted 501,000 world accounts on the finish of September 2022, and reported opening 5,500 new world account per day within the first 9 months of final 12 months.

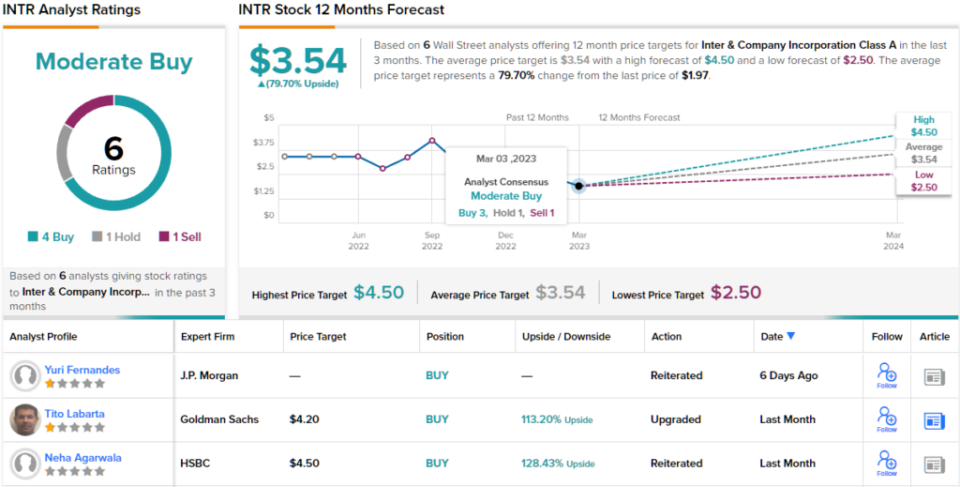

The Goldman view on this inventory, set out by analyst Tito Labarta, relies on strong prospects for additional development. Labarta notes three key factors driving the corporate’s success: “1) an elevated targeted on profitability with a extra prudent method to development and pricing, in addition to efforts to enhance effectivity… 2) sound digital platform/tremendous app — Inter has constructed one of the vital full digital platforms in Brazil, combining banking, investments, and e-commerce, amongst others; 3) credit score as a development lever — credit score is the most important revenue pool for Brazil banks and Inter nonetheless has modest market share in most of its operations, between 1-2%. Delivering on development and conserving asset high quality below manageable ranges can shut a lot of the hole to incumbents’ profitability…”

For Labarta, this comes out to a $4.20 worth goal, indicating room for sturdy share development of 113% within the coming 12 months, together with a Purchase score on the inventory. (To look at Labarta’s monitor file, click on right here)

Is the remainder of the Road in settlement? Nearly all of different analysts are. 4 Buys, 1 Maintain and 1 Promote have been issued within the final three months, so the phrase on the Road is that INTR is a Average Purchase. The shares are priced at $1.97 and have a mean goal of $3.54, implying a one-year upside of ~80%. (See INTR inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.