Whereas Tesla’s current Investor Day might need lacked the punch some buyers have been hoping for, CEO Elon Musk did double down on the necessity for a sustainable vitality economic system and pressured that it doesn’t have to come back on the expense of different requirements.

“There’s a clear path to a sustainable-energy Earth,” Musk mentioned. “It doesn’t require destroying pure habitats. It doesn’t require us to be austere and cease utilizing electrical energy and be within the chilly or something.”

“In truth,” Musk went on so as to add, “you can help a civilization a lot larger than Earth, far more than the 8 billion people might truly be supported sustainably on Earth.”

In fact, it’s not solely Musk who has such a forward-thinking agenda. There are numerous firms on the general public markets pursuing these objectives and so they additionally provide alternatives for buyers.

With this in thoughts, we dipped into the TipRanks database and pulled up the small print on two sustainable vitality shares which have acquired a stamp of approval from Wall Road analysts, and provide stable upside potential. Let’s take a better look.

Plug Energy (PLUG)

The primary inventory we’ll have a look at is a frontrunner in a sector Musk has traditionally not been too eager on. Nonetheless, whereas he was beforehand generally known as a giant hydrogen skeptic, on the current investor day, he conceded inexperienced hydrogen might but have a job to play in helping the world’s pivot to a sustainable vitality future.

That’s definitely the agenda of Plug Energy. The corporate is on the forefront of the burgeoning international inexperienced hydrogen economic system, for which it’s constructing an end-to-end inexperienced hydrogen ecosystem. Its actions vary from manufacturing, storage and supply to vitality technology — all designed to assist shoppers attain their targets while decarbonizing the economic system. The pursuit of that aim, nonetheless, has seen the corporate rack up the losses.

The issue in the latest quarterly report – for 4Q22 – was that Plug Energy additionally failed to satisfy expectations on the different finish of the size. The corporate delivered file gross sales of $220.7 million – amounting to a 36.3% year-over-year improve – but falling wanting consensus expectations by $48 million. And though gross margins bettered the unfavorable 54% on show in 4Q21, they nonetheless confirmed a unfavorable 36% with the corporate dialing in an a $680 million working loss over the course of 2022. On the plus aspect, the hydrogen specialist pressured it stays on track to ship revenues of $1.4 billion in FY2023, above the Road’s expectation of $1.36 billion. The corporate additionally expects it would generate a ten% gross margin.

Taking a sanguine view, J.P. Morgan analyst Invoice Peterson thinks the corporate can overcome “near-term challenges” though it must show it’s as much as the duty.

“We proceed to consider Plug has good backlog protection throughout its numerous companies, although changing backlog to gross sales will likely be extremely depending on centered execution,” the analyst defined. “Plug continues to see sturdy demand from clients throughout its enterprise segments regardless of near-term buyer readiness delays, and top-line development potential continues to impress, and particularly so for electrolyzers and stationary energy… we see room for continued gross margin enhancements all through 2023 coming from scale, effectivity, and subsidies, such that Plug might probably meet its 2023 profitability targets.”

To this finish, Peterson charges PLUG inventory an Obese (i.e. Purchase), whereas his $23 value goal makes room for 12-month beneficial properties of ~67%. (To observe Peterson’s observe file, click on right here)

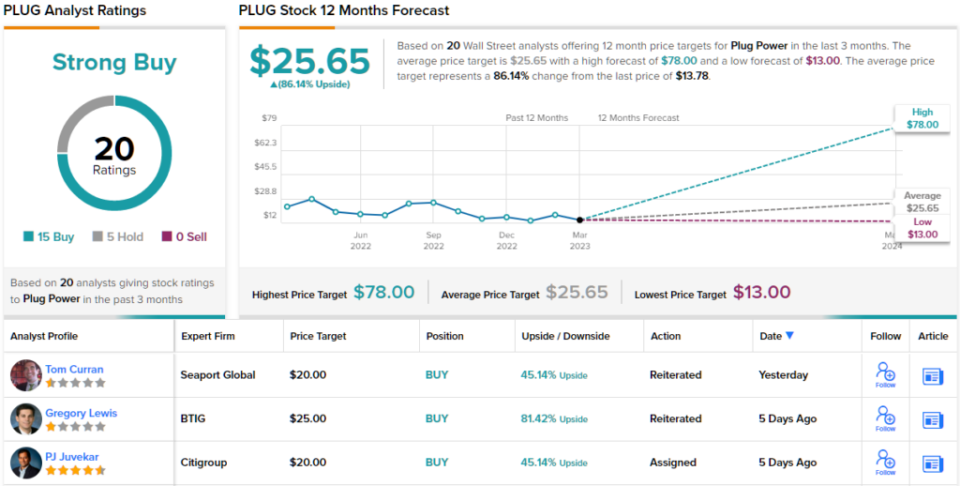

Most analysts agree with the J.P. Morgan view; based mostly on 15 Buys vs. 5 Holds, the inventory claims a Robust Purchase consensus score. There’s loads of upside projected right here; at $25.65, the typical goal suggests shares will climb 86% greater within the yr forward. (See PLUG inventory forecast)

Brookfield Renewable Companions (BEP)

Subsequent up, we now have clear vitality powerhouse, Brookfield Renewable, a giant participant in renewable energy and local weather transition options. The corporate owns and operates renewable vitality belongings throughout numerous segments together with hydroelectric, wind, utility-scale photo voltaic, distributed technology, and carbon seize, amongst different renewable applied sciences. Brookfield is a worldwide concern with its top-notch belongings situated on 4 continents which can be adopting extra sustainable and cleaner energy technology practices — North America, Europe, South America and Asia-Pacific (APAC).

After a number of quarters of sustained development got here to a halt in 3Q22, the corporate put that proper in the latest quarterly report – for 4Q22. Income rose by 9.2% from the identical interval a yr in the past to $1.19 billion, whereas edging forward of the Road’s forecast by $10 million. FFO (funds from operations) grew from $214 million, or $0.33/unit in 4Q21 to $225 million – amounting to $0.35/unit. Funds from operations for the total yr exceeded $1.0 billion ($1.56 per unit), for an 8% year-over-year uptick.

The corporate additionally pays a juicy dividend, which since 2011 has grown by a minimum of 5% annually. The corporate raised it once more in February – by 5.5% to a quarterly payout of $0.3375. This at present yields a good-looking 4.8%.

Assessing this renewable vitality participant’s prospects, Jones Analysis analyst Eduardo Seda highlights some great benefits of the corporate’s long-term contracted mannequin.

“We be aware that roughly 94% of BEPs 2022 technology output (on a proportionate foundation) is contracted to public energy authorities, load-serving utilities, industrial customers, and to Brookfield Company, and that BEP’s energy buy agreements (PPAs) have a weighted-average remaining length of 14 years on a proportionate foundation,” Seda defined. “Because of this, BEP is ready to get pleasure from each long-term visibility and stability of its diversified income and money movement technology, and furthermore, its distribution development which is predicated on long-term sustainability.”

These feedback underpin Seda’s Purchase score on BEP, which is backed by a $37 value goal. Ought to the analyst’s thesis go in response to plan, buyers will likely be sitting on one-year returns of ~32%. (To observe Seda’s observe file, click on right here)

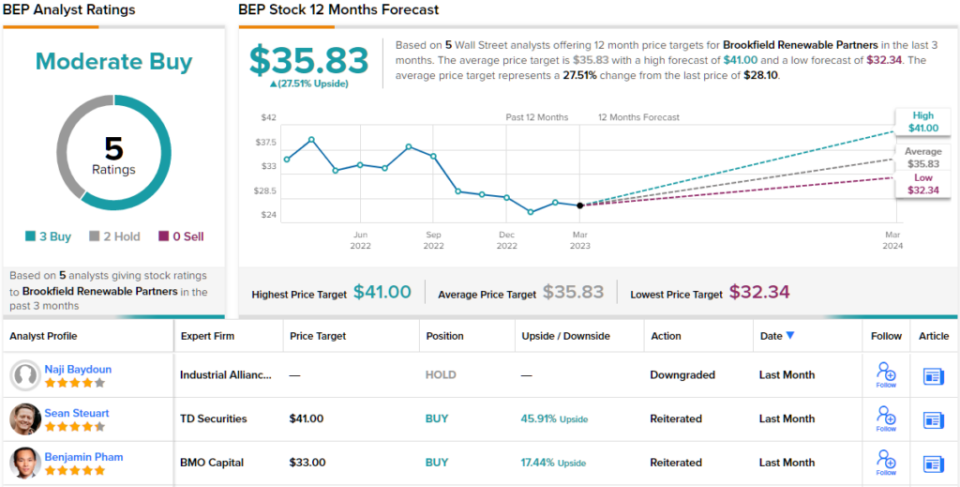

Elsewhere on the Road, the inventory receives a further 2 Buys and Holds, every, all culminating in a Reasonable Purchase consensus score. The shares are promoting for $28.10, and their $35.83 common value goal suggests room for 27.5% upside potential over the following 12 months. (See BEP inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.