Shares of SVB Monetary Group, generally known as Silicon Valley Financial institution, tumbled for a second day Friday earlier than the financial institution was shut down by regulators. The failure raised fears extra banks would incur heavy losses on their bond portfolios.

SVB’s CEO, Greg Becker, held a name with purchasers Thursday afternoon to calm their fears, CNBC realized, after a 60% tumble within the inventory that day. The shares have been down one other 62% in premarket buying and selling Friday earlier than they have been halted for pending information. They didn’t open for buying and selling with the market at 9:30 a.m. ET.

Noon Friday, regulators shut down the financial institution and mentioned the FDIC would defend insured deposits.

CNBC’s David Faber reported earlier the financial institution was in talks to promote itself after makes an attempt to lift capital failed, citing sources acquainted. Nonetheless, fast deposit outflows outpaced the sale course of, which made it tough for any purchaser to do a practical evaluation, Faber reported.

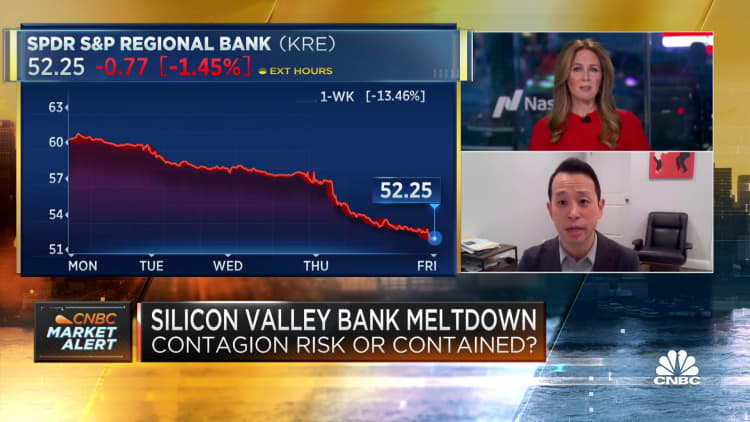

The SPDR S&P Regional Banking ETF, which tumbled 8% on Thursday, fell one other 4% on Friday as information of SVB’s failure hit. Signature Financial institution, which is understood to cater to the crypto sector, declined 22% following a 12% tumble Thursday. First Republic Financial institution fell 15% following a 17% slide Thursday. PacWest Bancorp misplaced 38%. Many of those financial institution shares have been halted repeatedly for volatility on Friday.

Main banks outperformed regional banks. Financial institution of America misplaced 0.9%. The Monetary Choose SPDR Fund dropped 1.8%, following a 4% decline Thursday.

“Present pressures going through SIVB are extremely idiosyncratic and shouldn’t be considered as a read-across to different banks,” wrote analysts Manan Gosalia and Betsy Graseck with Morgan Stanley in a observe Friday.

Unfavourable shock

Concern amongst founders and enterprise capital buyers spiked earlier this week after Silicon Valley Financial institution stunned the market by asserting late Wednesday it wanted to lift $2.25 billion in inventory. The financial institution had been compelled to promote all of its available-for-sale bonds at a $1.8 billion loss as its startup purchasers withdrew deposits, it mentioned.

That information, approaching the heels of the collapse of crypto-focused Silvergate financial institution, sparked one other wave of deposit withdrawals Thursday as VCs instructed their portfolio corporations to maneuver funds, in accordance with folks with information of the matter.

SVB clients mentioned they did not acquire confidence after Becker urged them to “keep calm” in a name Thursday afternoon, and the inventory’s collapse continued unabated, reaching 60% by the top of buying and selling.

The mounting pressures on SVB prompted hedge fund billionaire Invoice Ackman to invest that if non-public buyers can not help shore up confidence within the California lender, a authorities bailout may very well be subsequent.

Treasury Secretary Janet Yellen mentioned throughout testimony Friday on Capitol Hill mentioned there are a number of banks she is monitoring very fastidiously associated to the problems at SVB.

Idiosyncratic pressures’

SVB mentioned in a letter Wednesday that it bought “considerably all” of its available-for-sale securities made up of largely U.S. Treasurys.

The financial institution additionally beforehand reported greater than $90 billion in held-to-maturity securities, which would not essentially incur losses until it was compelled to promote them earlier than maturity to cowl fleeing deposits. Because the Federal Reserve persistently raises rates of interest, it’s decreasing the worth of Treasurys. For instance, the iShares 20+ Treasury Bond ETF, which is made up of longer maturity Treasurys, is down 24% within the final 12 months.

Buyers are additionally fearful about lack of assist from Silicon Valley Financial institution’s funding base of tech startups, an space hit arduous from the slumping inventory market and surging charges. Peter Thiel’s Founders Fund and different massive enterprise capital companies requested its corporations to tug their funds from SVB, Bloomberg Information reported.

“Falling VC funding exercise and elevated money burn are idiosyncratic pressures for SIVB’s purchasers, driving a decline in complete shopper funds and on-balance-sheet deposits for SIVB,” wrote the Morgan Stanley analysts. “That mentioned, we’ve got at all times believed that SIVB has greater than sufficient liquidity to fund deposit outflows associated to enterprise capital shopper money burn.”

SVB had a market worth of $16.8 billion to finish final week.

This can be a growing story. Verify again for updates.

Correction: The Monetary Choose SPDR Fund declined 4% on Thursday. An earlier model misstated the day.