March 22 (Reuters) – Pacific Western Financial institution (PACW.O) has raised $1.4 billion from funding agency Atlas SP Companions, the lender mentioned on Wednesday, because the crisis-hit sector scrambles to restrict the injury from the latest collapse of two mid-sized lenders.

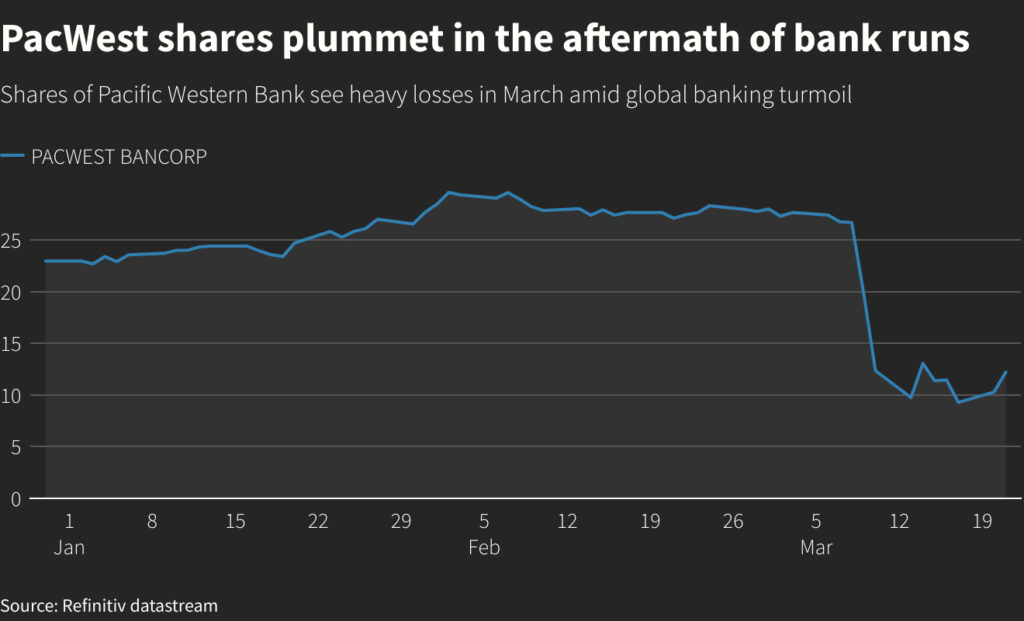

Shares of the financial institution have been down 10% in morning buying and selling, even because the lender tried to allay investor worries by saying it had greater than $11.4 billion in money as of March 20.

Los Angeles-based PacWest additionally mentioned it had explored the concept of elevating new capital, however determined in opposition to the transfer as a result of a rout in financial institution shares.

“Any time that you understand a financial institution talks about having thought-about a capital elevate, particularly on this surroundings the place there’s a lot skittishness from the markets, it is certain to have a unfavorable impression of the inventory,” mentioned Gary Tenner, analyst at brokerage D.A. Davidson & Co.

Reuters first reported final week that PacWest was in talks with funding corporations together with Atlas SP Companions for tactics to spice up its liquidity.

The financial institution mentioned deposits insured by the Federal Deposit Insurance coverage Corp, together with accounts eligible for pass-through insurance coverage, exceeded 65% of its whole deposits, as of March 20.

Complete deposits on the financial institution fell 20% to $27.1 billion from $33.9 billion as of Dec. 31.

“The replace that put out as we speak versus the replace that put out final Friday, the learn on it’s a little bit extra unfavorable,” Tenner mentioned.

Regional banks, whose shares have been battered for the reason that collapse of two mid-sized U.S. lenders this month, have tried to guarantee prospects their deposits are safe after the latest financial institution runs whipsawed the worldwide monetary ecosystem.

“We are going to proceed to see flows away from regionals and into systemically essential banks which are too large to fail,” mentioned Thomas Hayes, chairman and managing member of Nice Hill Capital.

Reporting by Jaiveer Shekhawat and Manya Saini in Bengaluru and David French in New York; Modifying by Pooja Desai and Anil D’Silva

: .