March 24 (Reuters) – It is an previous noticed: A credit score crunch is when your financial institution will not lend to you. A credit score disaster is when banks will not lend to one another.

Federal Reserve Chair Jerome Powell stated Wednesday Silicon Valley Financial institution’s collapse and the banking system upheaval it triggered “are more likely to end in tighter credit score situations for households and companies, which might in flip have an effect on financial outcomes.”

In different phrases: a credit score crunch is coming.

Credit score crunches usually are not new. They’re frequent fellow vacationers with recessions, however not all the time so. In addition they include various severity and durations, key elements Powell stated stay unknown on the present time. Some small and concentrated crunches can weigh on progress with out bringing the complete economic system to a standstill. Deeper lending clamp-downs can hobble the economic system for years.

This is a take a look at a few of the dynamics from previous credit score crunches compared with what has been noticed to now within the present episode.

CRUNCH VS CRISIS

Whole credit score from industrial banks – consisting of their bond holdings and the complete scope of loans to companies and shoppers, from routine enterprise credit score and industrial actual property loans to residential mortgages and bank cards – is simply off its file excessive from mid-February.

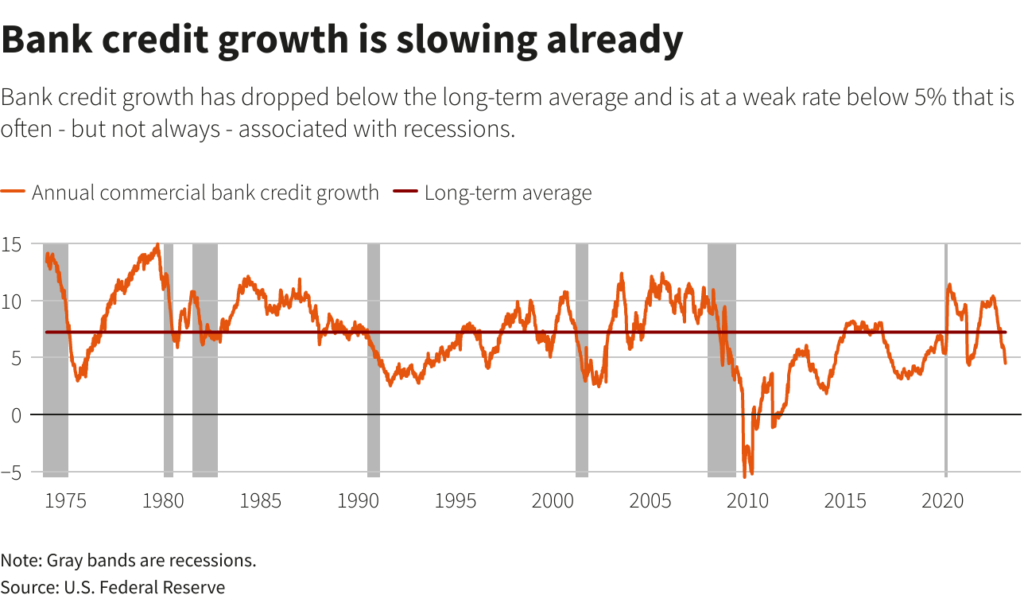

However the credit score progress charge has lately fallen beneath its historic common to a degree that has usually been related to a recession. General annual credit score progress not often turns unfavorable, however when it decelerates into the low single-digits because it has now, it reveals that the lending that helps gasoline general financial progress is beneath pressure.

Solely as soon as for the reason that early Nineteen Seventies has it really turned unfavorable, within the aftermath of the 2007-2009 monetary disaster. That was indicative of the lasting restraint that episode had on the restoration in credit score and financial progress general.

LESS RISK

When credit score situations tighten, among the many first classes of debtors to really feel the pinch are these with decrease means or with poorer credit score profiles as banks pull again from threat. One place to observe for that dynamic is within the issuance of subprime auto loans.

New York Federal Reserve knowledge reveals these volumes hit the very best in practically twenty years in the midst of final 12 months, however had slowed considerably by 12 months finish, although on steadiness have been on the higher finish of volumes seen earlier than the pandemic. Within the final huge credit score clamp-down, these mortgage volumes fell by two-thirds between 2005 and 2009.

CONSUMERS VS BUSINESS

When general credit score situations tighten, banks normally rein in loans to each shoppers and companies alike, although not all the time to the identical diploma and never all the time on the identical second.

And typically particular elements will create a pinch for one however not the opposite. That was the case 8-10 years in the past when low oil costs triggered a credit score crunch amongst U.S. oil fracking corporations, weighing closely for a interval on general industrial mortgage progress whereas client mortgage progress saved bettering.

Excluding the COVID-19 recession – when industrial mortgage volumes have been distorted by pandemic reduction efforts for companies – enterprise credit score has suffered the larger blow within the recessions to this point this century. Client credit score was significantly gradual to get well from the 2007-2009 meltdown due to the centrality of residential mortgages and the housing market to that disaster.

Annual progress within the two classes seems to have peaked across the center of final 12 months, although each stay at round 10% or extra – effectively above the historic common progress charge of about 6.5%.

BANKS IN NEED

When banks discover they can not get the funding they want from conventional sources – each other – they flip to the Fed, borrowing from its “low cost window,” lengthy dubbed the lender of final resort.

In 2008, the explosion of its use was a transparent sign that crunch had turned to disaster because it confirmed that banks, cautious of the stigma related to turning to the low cost window, had run out of different choices.

However the Fed has since taken steps to de-stigmatize the low cost window, together with decreasing the penalty rate of interest it historically charged. It noticed widespread use throughout the early months of the pandemic and utilization spiked once more within the final two weeks after Silicon Valley Financial institution’s collapse.

Reporting By Dan Burns, Ann Saphir and Howard Schneider; Enhancing by Andrea Ricci

: .