JOHANNESBURG, March 28 (Reuters) – China spent $240 billion bailing out 22 creating international locations between 2008 and 2021, with the quantity hovering in recent times as extra have struggled to repay loans spent constructing “Belt and Street” infrastructure, a examine revealed on Tuesday confirmed.

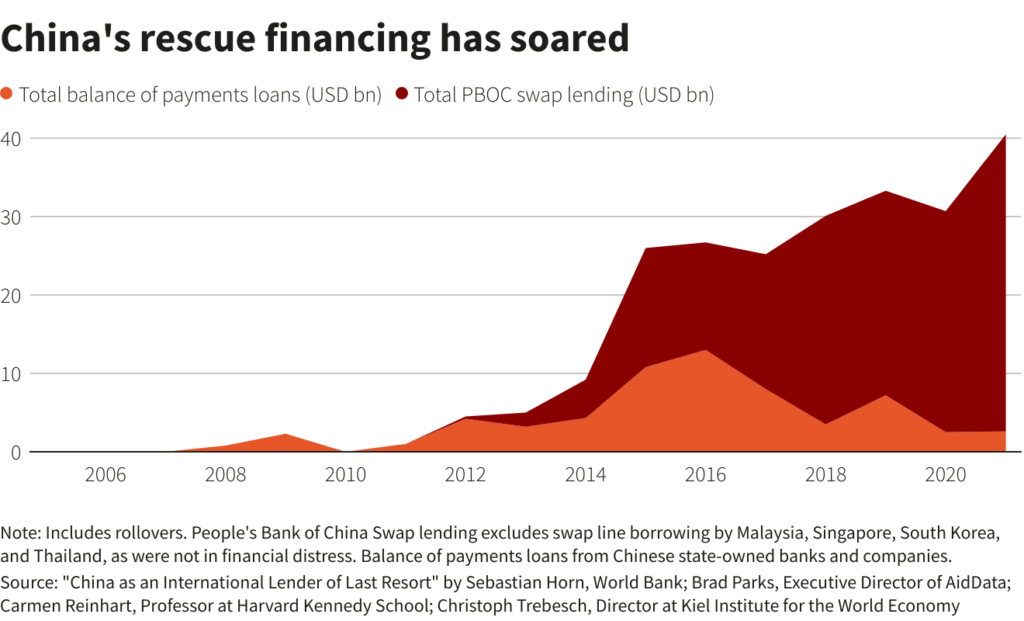

Virtually 80% of the lending was made between 2016 and 2021, primarily to middle-income international locations together with Argentina, Mongolia and Pakistan, in line with the report by researchers from the World Financial institution, Harvard Kennedy Faculty, AidData and the Kiel Institute for the World Financial system.

China has lent tons of of billions of {dollars} to construct infrastructure in creating international locations, however lending has tailed off since 2016 as many initiatives have did not pay the anticipated monetary dividends.

“Beijing is in the end making an attempt to rescue its personal banks. That is why it has gotten into the dangerous enterprise of worldwide bailout lending,” mentioned Carmen Reinhart, a former World Financial institution chief economist and one of many examine’s authors.

Chinese language loans to international locations in debt misery soared from lower than 5% of its abroad lending portfolio in 2010 to 60% in 2022, the examine discovered.

Argentina obtained probably the most, with $111.8 billion, adopted by Pakistan with $48.5 billion and Egypt with $15.6 billion. 9 international locations obtained lower than $1 billion.

The Folks’s Financial institution of China’s (PBOC) swap traces accounted for $170 billion of the financing, together with in Suriname, Sri Lanka and Egypt. Bridge loans or steadiness of funds help by Chinese language state-owned banks and firms was $70 billion. Rollovers of each sorts of loans had been $140 billion.

The examine was crucial of some central banks doubtlessly utilizing the PBOC swap traces to artifically pump up their international trade reserve figures.

China’s rescue lending is “opaque and uncoordinated,” mentioned Brad Parks, one of many report’s authors, and director of AidData, a analysis lab at The School of William & Mary in the USA.

China’s authorities hit again on the criticism, saying its abroad investments operated on “the precept of openness and transparency”.

“China acts in accordance with market legal guidelines and worldwide guidelines, respects the need of related international locations, has by no means pressured any celebration to borrow cash, has by no means pressured any nation to pay, won’t connect any political circumstances to mortgage agreements, and doesn’t search any political self-interest,” international ministry spokesperson Mao Ning mentioned at a information convention on Tuesday.

The bailout loans are primarily concentrated within the center revenue international locations that make up four-fifths of its lending, because of the danger they pose to Chinese language banks’ steadiness sheets, whereas low revenue international locations are provided grace intervals and maturity extensions, the report mentioned.

China is negotiating debt restructurings with international locations together with Zambia, Ghana and Sri Lanka and has been criticised for holding up the processes. In response, it has referred to as on the World Financial institution and Worldwide Financial Fund to additionally supply debt reduction.

Reporting by Rachel Savage; Extra reporting by Laurie Chen in Beijing; Modifying by Richard Chang and Jacqueline Wong

: .