Reminiscence-chip maker Micron Know-how (MU) late Tuesday missed Wall Avenue’s low expectations for its fiscal second quarter because it struggles by means of a cyclical business downturn in demand. Nonetheless, MU inventory rose in prolonged buying and selling on feedback that the worst may be over for Micron.

X

The Boise, Idaho-based firm misplaced an adjusted $1.91 a share on gross sales of $3.69 billion for the quarter ended March 2. Analysts polled by FactSet had anticipated Micron to lose 67 cents a share on gross sales of $3.71 billion. Within the year-earlier interval, Micron earned $2.14 a share on gross sales of $7.79 billion.

Micron took a cost of $1.43 billion for stock write-downs within the second quarter. That had a adverse affect on earnings of $1.34 a share.

For the present quarter, Micron predicted an adjusted lack of $1.58 a share on income of $3.7 billion. Wall Avenue was projecting a lack of 96 cents a share on gross sales of $3.72 billion for the fiscal third quarter. Within the year-earlier interval, Micron earned $2.59 a share on gross sales of $8.64 billion.

Micron’s steering consists of a listing write-down of about $500 million. That may negatively affect earnings by about 45 cents a share.

MU Inventory Rises On Outlook

In after-hours buying and selling on the inventory market right now, MU inventory rose 1.5% to 60.15. In the course of the common session Tuesday, MU inventory slid 0.9% to shut at 59.28.

In written feedback, Micron Chief Govt Sanjay Mehrotra mentioned he sees a “steadily bettering supply-demand stability within the months forward.” Buyer inventories have decreased in a number of finish markets, together with information facilities, he mentioned.

Nonetheless, the memory-chip section nonetheless faces “vital near-term challenges,” Mehrotra mentioned.

“The semiconductor reminiscence and storage business is dealing with its worst downturn within the final 13 years, with an exceptionally weak pricing surroundings that’s considerably impacting our monetary efficiency,” he mentioned.

However the long-term outlook is shiny, with investments in synthetic intelligence offering one other driver of demand for reminiscence chips, Mehrotra mentioned.

MU Inventory Has Subpar Composite Score

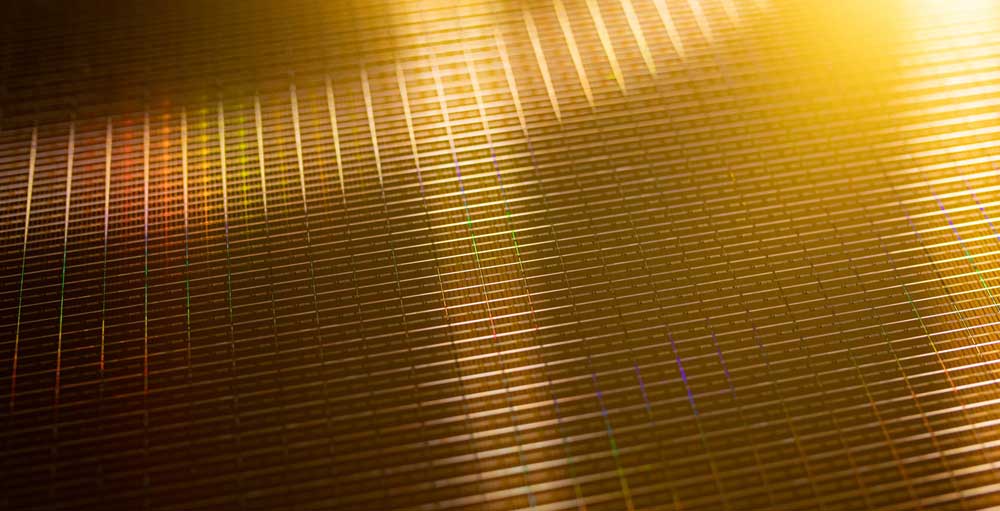

Micron makes two fundamental forms of reminiscence chips: DRAM and Nand. DRAM chips act as the primary reminiscence in PCs, servers and different gadgets, working intently with central processing models. Nand flash gives longer-term information storage.

Dynamic random-access reminiscence, or DRAM, accounted for 74% of Micron’s income in its fiscal second quarter. Nand flash reminiscence accounted for twenty-four% of its income in the course of the interval.

MU inventory ranks third out of 10 shares in IBD’s Pc-Information Storage business group, in response to IBD Inventory Checkup. But it surely has a subpar IBD Composite Score of 45 out of 99.

IBD’s Composite Score is a mix of key basic and technical metrics to assist buyers gauge a inventory’s strengths. The perfect development shares have a Composite Score of 90 or higher.

Comply with Patrick Seitz on Twitter at @IBD_PSeitz for extra tales on client expertise, software program and semiconductor shares.

YOU MAY ALSO LIKE:

Apple Promoting Enterprise Is Underappreciated, Analyst Says

This Prime Cybersecurity Inventory Is Nearing A Purchase Level

Is AMD Inventory A Purchase Earlier than Chipmaker’s March-Quarter Report?

See Shares On The Record Of Leaders Close to A Purchase Level

Discover Successful Shares With MarketSmith Sample Recognition & Customized Screens