NEW YORK, April 4 (Reuters) – Goldman Sachs Group Inc (GS.N) and JPMorgan Chase & Co (JPM.N) every received the accolade of prime mergers and acquisitions (M&A) monetary advisor within the first quarter of 2023 in separate deal league tables, highlighting discrepancies in how these are compiled.

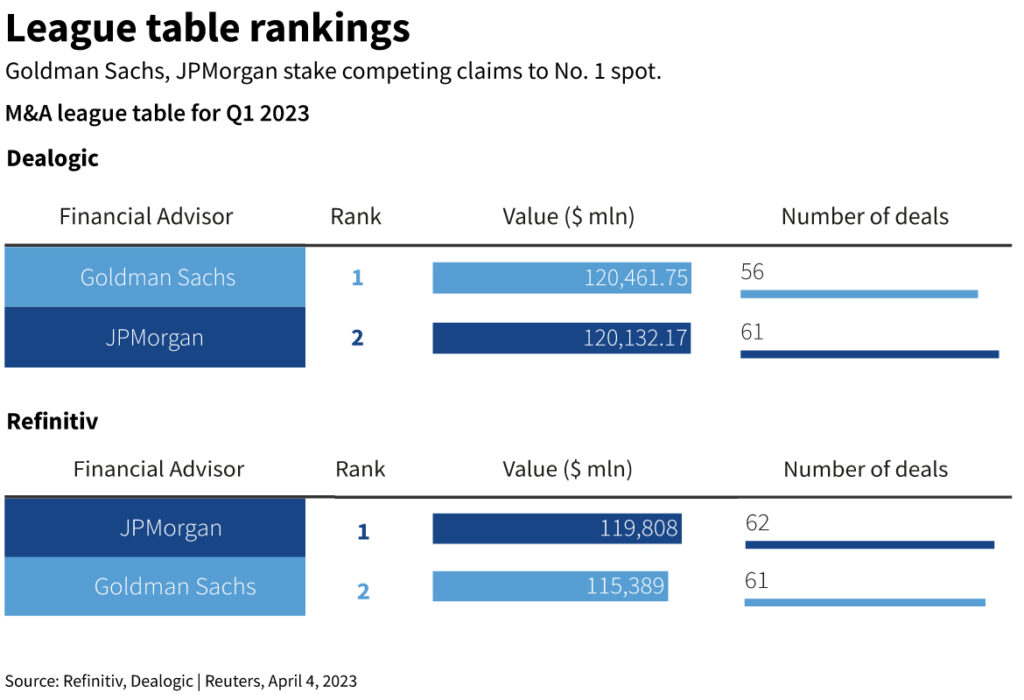

JPMorgan edged out Goldman to assert the highest spot in international league tables compiled by Refinitiv Offers Intelligence, having labored on $119.8 billion price of offers versus $115.4 billion for Goldman in second place. This was the primary time Goldman missed out on the highest spot for the reason that first quarter of 2019, in keeping with Refinitiv.

In Dealogic’s international league tables, nonetheless, Goldman claimed the highest spot within the first quarter with $120.5 billion price of offers. JPMorgan got here second with $120.1 billion price of offers.

Whereas the league desk numbers produced by Dealogic and Refinitiv have slight variations each quarter, it’s uncommon for them to supply completely different winners for the No. 1 spot.

Profitable the highest spot is a coveted prize for funding banks, which monitor league tables carefully and use them as a advertising and marketing instrument to draw purchasers and rent and retain expertise. The discrepancies led to Goldman asking Refinitiv and JPMorgan asking Dealogic for explanations, in keeping with individuals accustomed to the conversations.

A spokesperson for ION Analytics, the guardian firm of Dealogic, stated that its methodology is predicated on suggestions it receives from the market, and declined to touch upon the origin of the discrepancies.

“The methodology has been refined repeatedly over three many years of collaboration with market members,” the spokesperson stated.

Matt Toole, director of Refinitiv Offers Intelligence, a London Inventory Change Group Plc (LSEG.L) firm, stated that the info vendor took market suggestions onboard and was open to creating changes when it’s merited.

“There’s a course of in place there that may’t be unduly influenced as a result of in any other case that breaks the entire belief issue,” Toole stated.

Spokespeople for Goldman and JPMorgan declined to remark.

It isn’t clear what precipitated the discrepancies that led to Goldman and JPMorgan each claiming the No. 1 spot, although there are some identified variations in how the league tables of Refinitiv and Dealogic are compiled.

Refinitiv, for instance, counts the consolidation of two or extra courses of inventory as an M&A transaction, whereas Dealogic doesn’t. Dealogic registers a spin-off transaction on the time it’s introduced, whereas Refinitiv takes notice of it on the time when the spun-off firm begins buying and selling, which may be a number of quarters later.

Refinitiv and Dealogic agreed on who got here on prime of their authorized advisor deal league desk rankings within the first quarter of 2023 — M&A powerhouse Sullivan & Cromwell LLP.

Reporting by Anirban Sen in New York; Enhancing by Greg Roumeliotis and Andrea Ricci

: .