A have a look at the day forward in U.S. and international markets from Mike Dolan.

As U.S. banking giants calm the horses, international traders are actually targeting world development and earnings indicators greater than rate of interest rises for route – with an assumption the latter are close to an finish anyway.

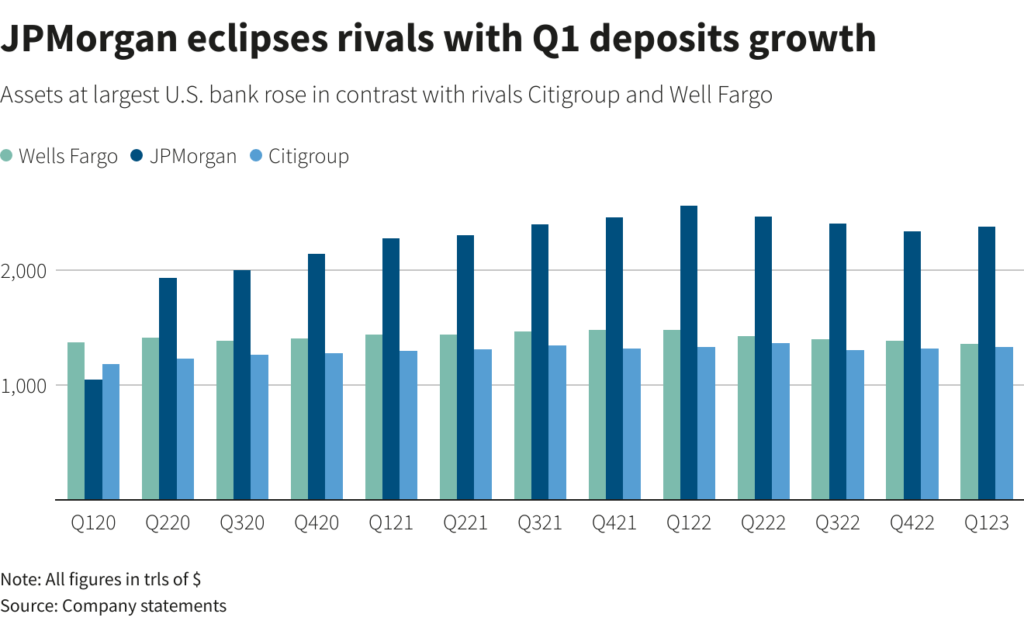

Sending its inventory worth surging 7.5% for its largest each day achieve in additional than two years and greatest results-day bounce in 20 years, JPMorgan (JPM.N) on Friday led different U.S. banking giants in disregarding the March regional financial institution disaster with first-quarter revenue beats that confirmed bigger banks successful out.

Considerably relieved analysts marginally brightened their dim outlook for first-quarter U.S. outcomes in contrast with per week in the past.

Though on mixture S&P500 earnings are nonetheless on target for his or her second straight quarterly contraction, consensus forecasts for Q1 had been pared again to a 4.8% decline from a 12 months in the past versus a 5.2% drop a 12 months earlier.

State Road and Charles Schwab on Monday kick off a busy earnings week for extra massive banking names in addition to readouts from the likes of Netflix, IBM and Tesla.

With the U.S. diary fairly skinny on Monday, consideration shifts to Tuesday’s month-to-month information dump in China – the place first quarter GDP is forecast to have accelerated to an annual 4.0% from 2.9% within the last three months of final 12 months and retail and industrial numbers are anticipated to have sped up in March too.

Given final week’s report of a blowout March for Chinese language exports and imports, the chance to these numbers might be to the upside.

And so with the banking stress ebbing and world development image holding up impressively to date – regardless of the combined image stateside – rate of interest markets appear assured in pricing one last hike from the Federal Reserve subsequent month.

Futures markets now see a greater than 80% likelihood the Fed will execute one last quarter level price rise subsequent month – reversing it by September. That price rise would carry the actual Fed coverage price – adjusted by headline client worth inflation – into constructive territory for the primary time in three years.

Two-year Treasury yield clung to 4% meantime.

However shares appear relaxed with the entire prospect, the VIX volatility gauge (.VIX) closing at its lowest on Friday since January 2022 and Treasury volatility (.MOVE) again all the way down to February ranges.

Asia bourses had been up well and Europe extra combined, Wall St futures had been larger going into the open. The greenback prolonged Friday’s rebound because the Might price rise pricing hardened.

With three-month Treasury invoice charges elevated attributable to simmering U.S. debt ceiling issues which can be attributable to come to a boil this summer season, there was background trepidation.

Geopolitical tensions between the US and China additionally rankle. The U.S. warship USS Milius sailed by the Taiwan Strait on Sunday, in what the U.S. Navy described on Monday as a “routine” transit, simply days after China ended its newest conflict video games across the island.

In an indication of how the deterioration in relations between the 2 superpowers is beginning to have an effect on company planning, there was curiosity in a Monetary Occasions report that mentioned one in all China’s largest water-heater producers Vanward New Electrical claimed its U.S. shoppers had demanded it transfer manufacturing out of China in response to the rising rigidity.

It was a a lot better weekend on the planet of mergers and acquisitions.

Merck (MRK.N) mentioned on Sunday it should purchase California-based biotechnology agency Prometheus Biosciences (RXDX.O) for about $10.8 billion, which at $200 per share represents a 75% premium to the $114.01 closing worth for Prometheus shares on Friday.

Merck’s transfer sees it decide up a promising experimental therapy for ulcerative colitis and Crohn’s illness and builds its presence in immunology.

Shares of Rovio (ROVIO.HE) rose 17.8% after Japan’s Sega (6460.T) agreed to launch a 706 million euro supply for Offended Birds maker.

Elsewhere in banking, the BOE is contemplating a serious overhaul of its deposit assure scheme, together with boosting the quantity lined for companies and forcing banks to pre-fund the system to a higher extent to make sure quicker entry to money when a lender collapses, the FT reported on Sunday.

Key developments which will present route to U.S. markets in a while Monday:

* U.S. April NAHB housing market index, NY Fed April manufacturing survey, Feb TIC information on Treasury holdings

* Richmond Federal Reserve President Thomas Barkin speaks, Financial institution of England Deputy Governor Jon Cunliffe speaks

* U.S. company earnings: State Road, Charles Schwab, M&T Financial institution, JB Hunt Transport

By Mike Dolan, <a href=”mailto:mike.dolan@thomsonreuters.com” goal=”_blank”>mike.dolan@thomsonreuters.com</a>. Twitter: @reutersMikeD. Modifying by Ed Osmond

: .

Opinions expressed are these of the creator. They don’t replicate the views of Reuters Information, which, below the Belief Ideas, is dedicated to integrity, independence, and freedom from bias.