Do you surprise the place the inventory market is headed? Properly, Wells Fargo’s senior international market strategist, Scott Wren, believes that the S&P 500 will stay range-bound, with a low finish round 3,600 and a high finish round 4,300, for the rest of the 12 months. Wren’s recommendation is to not chase the market when it nears that peak, however to utilize any pullbacks.

As for the perfect shares to load up on within the present local weather, Wren has an concept about these too. “We need to deal with U.S. over worldwide, large- and mid- cap shares over small, and favor sectors like Power, Well being Care, and Expertise that we imagine have the potential to climate the financial storm we may even see later this 12 months,” he defined.

The inventory analysts at Wells Fargo are placing that stance into motion. They’re naming shares from these beneficial segments as ‘Prime Picks’ and choosing those which have lately pulled again however are anticipated to rebound. We’ve used the TipRanks platform to search for the small print on two of these picks. Right here’s the lowdown.

Zscaler, Inc. (ZS)

The primary Wells Fargo decide we’ll take a look at is a tech agency within the networking safety area of interest, Zscaler. Zscaler’s distinctive promoting level is the Zero Belief Alternate, or as the corporate places it, ‘the world’s largest safety cloud.’ This platform securely connects apps, units, and customers on any community, and offers the enhancements to confidence, on-line navigation, and enterprise apps mandatory for improved productiveness. The Zero Belief Alternate works at a number of ranges, from machine-to-machine to app-to-user to app-to-app.

Since its founding in 2007, Zscaler has labored to leverage its community safety experience to show the web into the company world’s cloud. A take a look at some combination numbers makes it clear simply how huge Zscaler’s goal market truly is. The corporate boasts that its platform processes greater than 300 trillion day by day alerts, to generate a robust synthetic intelligence/machine studying impact. These embody over 280 billion day by day transactions, resulting in some 9 billion incident and coverage violations prevented per day.

Another quantity is essential to grasp Zscaler’s scale and success: $387.6 million. That was the corporate’s high line within the final reported quarter, Q2 of fiscal 12 months 2023 (January quarter). The income determine was up greater than 51% year-over-year, and beat the forecast by $22.8 million. The non-GAAP earnings determine got here in at 37 cents, which was greater than triple the year-ago determine and was a stable 8-cents above expectation.

Zscaler’s revenues have been rising steadily for the previous a number of years, and the earnings have registered 4 sequential quarterly will increase in a row. The corporate has managed that, whilst its inventory worth has been dropping; ZS shares are down 52% within the final 12 months. The share worth drop comes as the corporate’s progress – nonetheless blisteringly quick – seems to be slowing down. Q2’s total progress got here in at 45% y/y, however the prior 12 months noticed 62% progress.

The slowdown in total progress hasn’t dimmed Zscaler’s luster within the eyes of Wells Fargo’s 5-star analyst Andrew Nowinski, who writes, “We proceed to imagine Zscaler has an architectural benefit over the competitors, which ought to drive long-term progress and market share features. Regardless of a modest slowdown in Billings progress final quarter, we imagine administration has made enhancements of their go-to-market technique and has a powerful pipeline. As such, we’re reiterating ZS as our ‘Prime Choose.’”

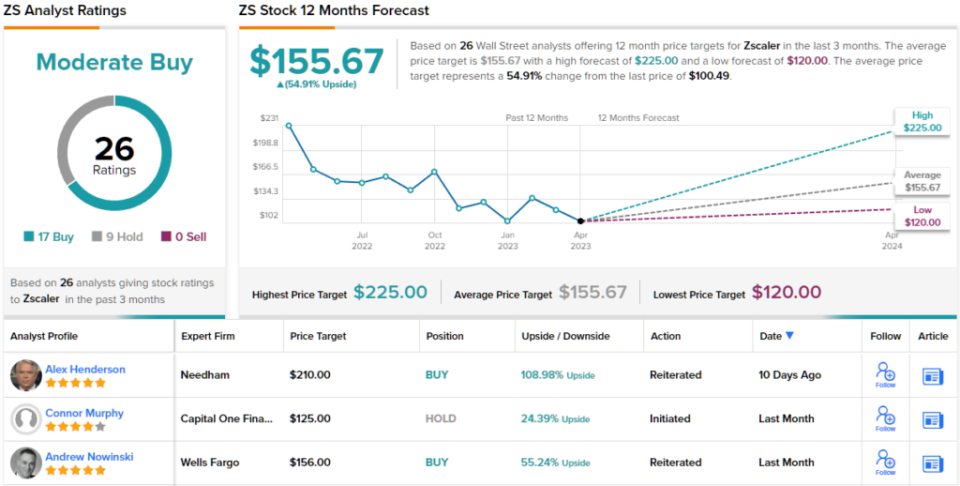

Wanting forward from that stance, Nowinski provides ZS an Chubby (i.e. Purchase) score – and a value goal of $156 that means one-year share progress of 55%. (To observe Nowinski’s monitor document, click on right here)

Backing up for a broader view, we discover that ZS will get a Average Purchase consensus score from the Avenue, primarily based on 26 opinions that embody 17 Buys and 9 Holds. The inventory is promoting for $100.49, and its $155.67 common value goal is sort of an identical to Nowinski’s goal. (See Zscaler inventory forecast)

Intellia Therapeutics (NTLA)

Now we’ll swap gears, and take a look at Intellia, a biotech firm whose work focuses on gene enhancing and the creation of latest therapeutic brokers for the therapy of genetic ailments. Intellia’s product line, primarily based on gene enhancing, assaults genetic ailments instantly on the causative genetic mutation. The gene treatment brokers are developed utilizing CRISPR expertise; Intellia usually follows a two-track method in its improvement actions, utilizing each in vivo and ex vivo strategies.

Intellia’s improvement pipeline contains pre-clinical tracks within the therapy of varied ailments, together with lymphomas, leukemia, and stable tumors, hemophilia, and liver and lung circumstances. On the scientific stage, the corporate’s pipeline options two drug candidates, NTLA 2001, a therapy for transthyretin (ATTR) amyloidosis, and NTLA 2002, designed to deal with hereditary angioedema (HAE). Every candidate has upcoming catalysts.

The primary, NTLA 2001, is present process a Part 1 scientific trial, and in November of final 12 months launched optimistic preliminary information. Developing, there are three predominant catalysts on this monitor, all anticipated to happen by mid-year or 12 months’s finish. First, Intellia plans to submit and IND to incorporate extra research websites for a pivotal trial of NTLA 2001 in sufferers with ATTR-CM. Second, the corporate will launch a further set of scientific information from the present trial. And eventually, the corporate plans to provoke the pivotal trial earlier than the tip of the 12 months.

On the second monitor, NTLA 2002, Intellia has initiated a Part 2 trial, evaluating the drug candidate as a CRISPR-based, potential single-dose therapy for hereditary angioedema (HAE). The corporate final month acquired IND clearance from the FDA to permit enrollment of sufferers at US websites for this research, and is on-track to launch information later this 12 months for the first-in-human trial.

Intellia’s share value, nonetheless, has not gotten a significant increase from the upbeat pipeline information. The inventory is down 50% from final August’s 52-week peak. Nonetheless, Wells Fargo analyst Yanan Zhu nonetheless considers Intellia as a ‘Prime-Choose’ and has a proof for the inventory’s lackluster efficiency.

The analyst writes, “We view the IND clearance as a key step ahead for the sphere and for NTLA worth inflection. We’d observe that whereas NTLA demonstrated best-case state of affairs scientific information final 12 months, the inventory has been depressed as a consequence of a priority of whether or not FDA would enable in vivo enhancing to go ahead (which we thought shouldn’t be a difficulty as a consequence of clear regulatory precedents). With the primary IND now cleared, we see vital room for worth creation as extra information are reported from the TTR and HAE research.”

These feedback again up Zhu’s Chubby (i.e. Purchase) score, whereas the analyst’s $100 value goal signifies the inventory might have room to develop a sturdy 180% over the following 12 months. (To observe Zhu’s monitor document, click on right here)

Most on the Avenue again Zhu’s take. NTLA shares have a Sturdy Purchase consensus score, primarily based on 17 current suggestions that embody 14 Buys in opposition to 3 Holds. The inventory’s $35.76 buying and selling value and $85.33 common goal value mix to offer ~139% upside on the one-year time-frame. (See NTLA inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your personal evaluation earlier than making any funding.