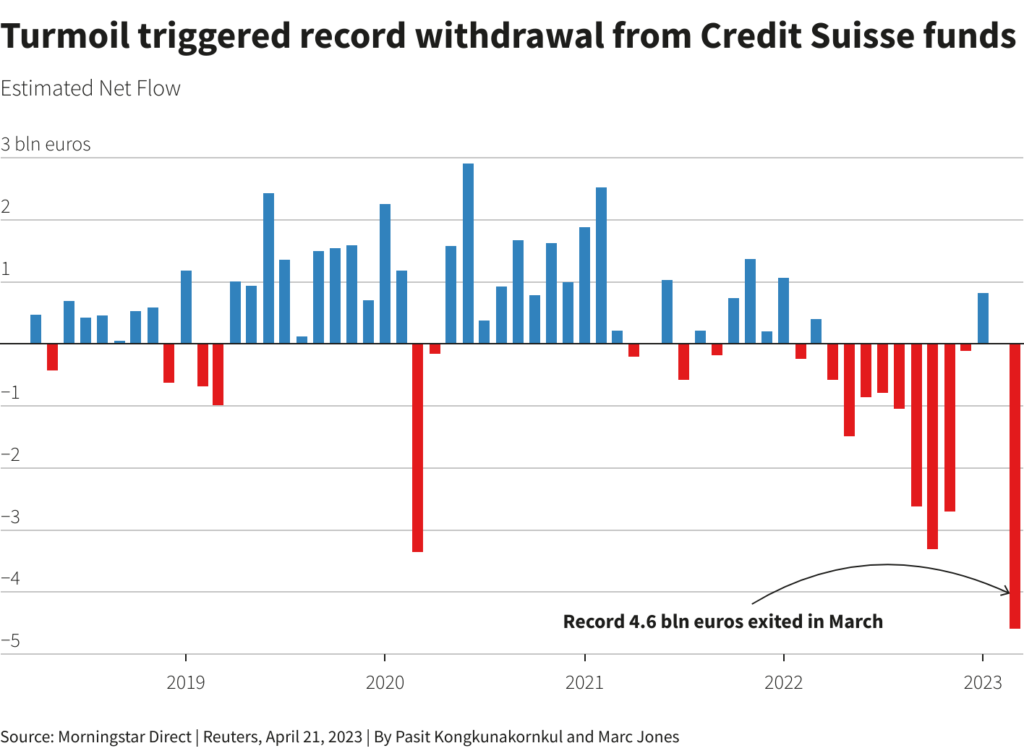

LONDON, April 21 (Reuters) – Credit score Suisse noticed traders pull a document 4.6 billion euros ($5.04 billion) out of its funds on the top of the financial institution’s troubles final month, knowledge printed on Friday confirmed.

The information from Morningstar lined the entire of March, when a possible collapse of Credit score Suisse noticed Switzerland’s monetary authorities orchestrate its emergency takeover by rival UBS (UBSG.S).

The information additionally confirmed that Swisscanto, one other Swiss asset supervisor, noticed the second-largest influx of funds after iShares in March, with an estimated 6.2 billion euros pouring in.

General, Europe-domiciled long-term funds skilled the primary mixed month-to-month outflow since November.

Going again during the last 12 months, the info additionally confirmed Credit score Suisse’s funds, which Morningstar counts as both open-ended fund and exchange-traded funds, had seen cash exiting each month aside from one.

($1 = 0.9127 euros)

Reporting by Marc Jones; Enhancing by Amanda Cooper

: .