April 28 (Reuters) – Funding financial institution Lazard Ltd (LAZ.N) on Friday reported a shock loss within the first quarter as dealmaking slumped, a development the corporate’s CEO mentioned would possible persist.

The corporate additionally warned of an unsure outlook for the 12 months and mentioned it could get rid of round 10% of its workforce in 2023, which may lead to further prices of round $95 million.

“The atmosphere has deteriorated for the reason that finish of final 12 months. We do not suppose there’s an imminent restoration within the M&A (mergers and acquisitions) market and positively completions are going to be muted by way of the tip of this 12 months,” CEO Kenneth Jacobs instructed Reuters in an interview.

Lazard has about 3,400 staff. Its workforce discount shall be broad-based and embody markets in Latin America and the Asia Pacific, which account for a smaller chunk of the charges the corporate brings in from arranging offers, Jacobs mentioned.

Main Wall Avenue funding banks together with Morgan Stanley (MS.N) and Goldman Sachs (GS.N) have felt the brunt of a barren atmosphere for M&A as rising rates of interest, excessive inflation and fears of a recession soured the urge for food for dealmaking.

M&A volumes almost halved within the first quarter from a 12 months earlier, in response to information from Dealogic.

The banking disaster in america after the collapse of two lenders has fueled financial uncertainty, Jacobs mentioned.

“This is likely one of the components that’s contributing to the uncertainty within the atmosphere, significantly within the U.S. proper now,” Jacobs mentioned. “Given the occasions of the primary quarter, there’s much more uncertainty within the banking sector than there was in a very long time.”

The stresses within the regional financial institution sector may result in a credit score crunch, though he mentioned it was too early to say how possible that may be or when it could happen.

The funding financial institution shall be cautious on inventory buybacks similtaneously in search of alternatives, he mentioned.

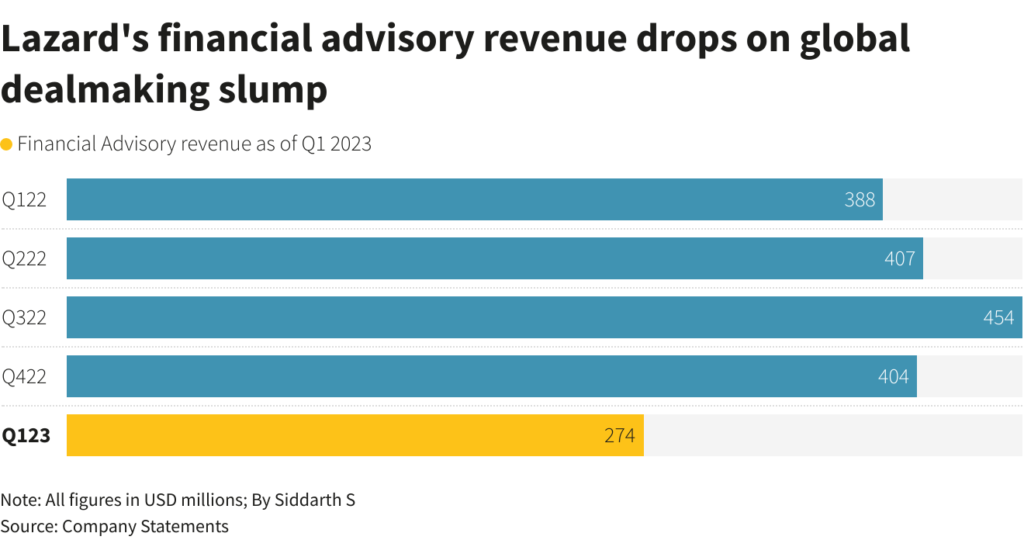

Lazard’s working income from its monetary advisory enterprise fell 29% to $274 million within the first quarter, when the corporate additionally recorded a $21 million cost from its cost-saving measures.

“Slower M&A exercise resulted in considerably decrease revenues within the quarter and the outlook for the 12 months stays unsure,” Jacobs mentioned in an announcement asserting the outcomes.

A banking disaster final month additionally weighed on investor sentiment, prompting an outflow of shopper property that has hit charges earned from asset administration.

Income from the phase, which is very targeted on equities and fixed-income property, dipped 15% to $265 million within the quarter ended March 31.

On an adjusted foundation, Lazard reported a lack of $23 million, or 26 cents per share, in contrast with a revenue of $115 million, or $1.05 per share, a 12 months earlier. Analysts had anticipated a revenue of 26 cents per share, in response to Refinitiv IBES information.

Reporting by Siddarth S in Bengaluru; Modifying by Shinjini Ganguli

: .