NEW YORK, Could 2 (Reuters) – On March 12, as a number of U.S. banks reeled from a disaster in confidence, JPMorgan Chase & Co (JPM.N) put its would possibly behind First Republic Financial institution, giving the troubled lender what two sources stated was a $10 billion financing.

The JPMorgan facility didn’t cease depositors from fleeing the lender. However it turned out to be the beginning of a collection of occasions – some particulars of that are reported right here for the primary time – that put JPMorgan and its chief government, Jamie Dimon, in a pivotal function in probably the most extraordinary U.S. financial institution rescues of latest years.

JPMorgan purchased First Republic on Monday in a authorities public sale, culminating weeks of failed rescue makes an attempt and aborted discussions involving among the strongest Wall Road executives and U.S. officers. The deal talks went all the way down to the wire, in keeping with two sources conversant in the scenario. 4 bidders, together with JPMorgan, made it to the ultimate rounds of the public sale on Sunday night time, one of many sources stated.

JPMorgan didn’t know until about 1.15 a.m. in New York that it had received, though closing bids had been initially due a number of hours prior. At one level late at night time, as Dimon and different senior executives waited for the end result of their bid, silence from Federal Deposit Insurance coverage Corp (FDIC) made them assume they’d misplaced, one of many sources stated.

The ultimate deal, introduced round 3:30 a.m., cements Dimon’s fame as one in all Wall Road’s strongest bankers.

However the deal additionally raised recent questions in regards to the risks of getting banks which can be too huge to fail, the standard of regulatory oversight of the banking trade and the Biden administration’s resolve to maintain firms from turning into too highly effective by way of offers.

Piper Sandler analysts stated greater than the funds, the deal was important for JPMorgan because it solidifies the financial institution “because the go-to trade chief in instances of turmoil.”

“The one fear we now have is the at-present unknowable. JPM was already a vastly important participant that has now managed to make itself much more so at a time when ‘too-big-to-fail’ continues to be a political concern,” they wrote.

Dimon pushed again towards any suggestion that his financial institution is getting too huge.

“We have now capabilities to serve our shoppers, who may be cities, colleges, hospitals, governments; we financial institution the IMF, the World Financial institution,” the banker stated in a convention name after the deal. “And anybody who thinks the USA shouldn’t have that may name me immediately.”

The FDIC stated earlier on Monday the decision concerned a “extremely aggressive bidding course of,” and was the least expensive various for its deposit insurance coverage fund.

BANKING CRISIS

First Republic was based in 1985 by James “Jim” Herbert, son of a group banker in Ohio. The financial institution was purchased by Merrill Lynch in 2007 proper earlier than the monetary disaster. It turned public once more in 2010, after Merrill Lynch itself was purchased by Financial institution of America Corp (BAC.N) and the brand new proprietor determined to eliminate it.

First Republic’s attraction was its wealthy shoppers, and it gave them preferential charges on mortgages and loans. Its reliance on the wealthy additionally made it extra weak – it had a excessive stage of uninsured deposits.

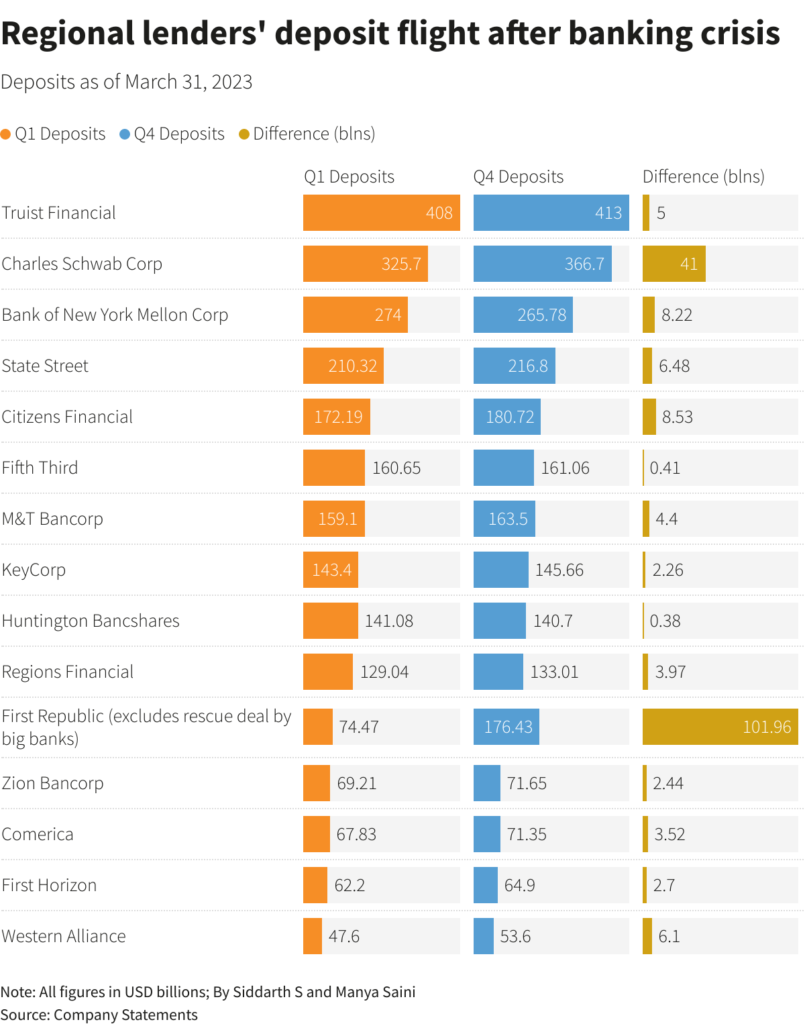

In early March, as a run on Silicon Valley Financial institution spooked depositors and traders, sending them into the arms of establishments they thought had been safer, First Republic shortly turned a goal. It noticed greater than $100 billion fleeing within the first quarter, leaving it scrambling to boost cash.

By the weekend of March 12, as regulators seized Silicon Valley Financial institution and Signature Financial institution and introduced a collection of emergency measures to shore up confidence within the system, First Republic stated it had taken further steps to entry a complete of $70 billion in funds, together with from JPMorgan.

The peace of mind, nevertheless, didn’t calm markets, and First Republic’s inventory fell once more the next day.

Reuters couldn’t decide when, however sooner or later JPMorgan’s curiosity in First Republic grew to change into greater than its function as an adviser serving to the financial institution bolster its funds. A part of its attraction: the lender’s roster of rich people which might add to JPMorgan’s personal non-public banking franchise.

Prevailing knowledge on the time, nevertheless, recommended that regulators wouldn’t permit JPMorgan to purchase one other financial institution. JPMorgan holds greater than 10% of the nation’s complete financial institution deposits, and federal regulation prevents a big financial institution from an acquisition that may put it above that threshold. Acquisitions of failed banks may be exempted from the rule.

JPMorgan began a course of internally, which checked out varied choices for First Republic, together with an acquisition, in keeping with a supply conversant in the matter. The deal was internally code-named “Forest”, the supply stated.

The financial institution stored the groups separate, the supply stated. First Republic additionally had Lazard Ltd (LAZ.N) as an adviser.

TOP BIDDER

In March, a collection of concepts had been floated to avoid wasting the financial institution. Dimon was among the many energy brokers that mentioned a package deal by giant banks to inject $30 billion in deposits. After that failed to enhance confidence within the lender, Dimon was amongst bankers that met in Washington at a discussion board, the place matters included aiming to work out particulars on what wanted to be finished. JPM proposed one other concept that was briefly thought of, of forming a consortium to purchase the financial institution, two sources beforehand stated.

A key hurdle to doing a personal sector deal, nevertheless, was that there have been billions of {dollars} of unrealized losses on First Republic’s books, and so they must be funded if anybody purchased the financial institution.

As weeks progressed, regulators got here shut a minimum of as soon as in late April to pulling the plug on the financial institution, one of many sources stated. The scenario turned worse final week after its shares went right into a free fall following earnings.

By Friday, the FDIC determined the financial institution had run out of time to discover a non-public answer, a supply beforehand informed Reuters. Suggested by Guggenheim Securities, the regulator reached out to numerous potential bidders, together with banks and personal fairness corporations, to solicit gives, two sources conversant in the scenario stated.

By late Sunday the race had narrowed to 4 bidders, one supply stated. Apart from JPMorgan, PNC Monetary Companies Group (PNC.N), Residents Monetary Group Inc (CFG.N) and Fifth Third Bancorp (FITB.O) had been additionally within the public sale, sources have stated.

The public sale dragged out by way of the night time because the FDIC’s advisors examined every bid on its deserves, a supply conversant in the matter stated.

Every bidder put in bids for the entire financial institution in addition to a part of its property, the supply stated, and the FDIC’s advisors had been searching for the one which might value the least to the depository insurance coverage fund.

JPMorgan deployed greater than 800 staff to do due diligence on the financial institution. Whereas the partial bids from the three different banks held some attraction to find an answer for First Republic, none may prime JPMorgan’s pitch to purchase the entire financial institution, one of many sources stated.

Reporting by Anirban Sen, Nupur Anand, Isla Binnie, David French, Saeed Azhar, Lananh Nguyen; Writing by Megan Davies; Modifying by Paritosh Bansal and Stephen Coates

: .