FRANKFURT, Might 4 (Reuters) – The European Central Financial institution will increase rates of interest for the seventh assembly in a row on Thursday as its lengthy battle in opposition to cussed inflation continues, with solely the dimensions of the transfer nonetheless open to debate.

The central financial institution for the 20-country euro zone has already lifted charges by a document 350 foundation factors since July within the hope of stopping runaway worth progress. However getting inflation right down to its 2% goal continues to be years away, leaving policymakers with little alternative however to tighten coverage once more this month and past.

A 25 foundation level transfer, slowing the tempo after three straight 50 foundation level hikes, seems the almost certainly final result, though a much bigger enhance continues to be a chance at what is nearly actually not the top of a historic tightening cycle.

The clincher might be a compromise amongst policymakers on what alerts to ship about future will increase.

Conservative “hawks”, who maintain a snug majority within the Governing Council, are leaning in the direction of a much bigger enhance.

However they’ve signalled they may reside with a smaller transfer so long as the ECB signifies that Might shouldn’t be the top of its hikes, even when some friends – notably the U.S. Federal Reserve – are on the verge of reaching their very own rate of interest peaks.

One other problem will likely be simply how massive a majority ECB President Christine Lagarde needs backing the choice.

Many hawks may reside with a smaller transfer given the correct steering however their dovish colleagues are more likely to voice loud dissent if the hike is greater, leaving the ECB as soon as extra talking with many voices, seen as a weak point for years.

A part of the compromise might be a deal to finish reinvestments from July of maturing debt purchased beneath the ECB’s 3.2 trillion euro Asset Buy Programme – a modest step that might shrink additional the financial institution’s bloated steadiness sheet, even when the inflation impression can be small.

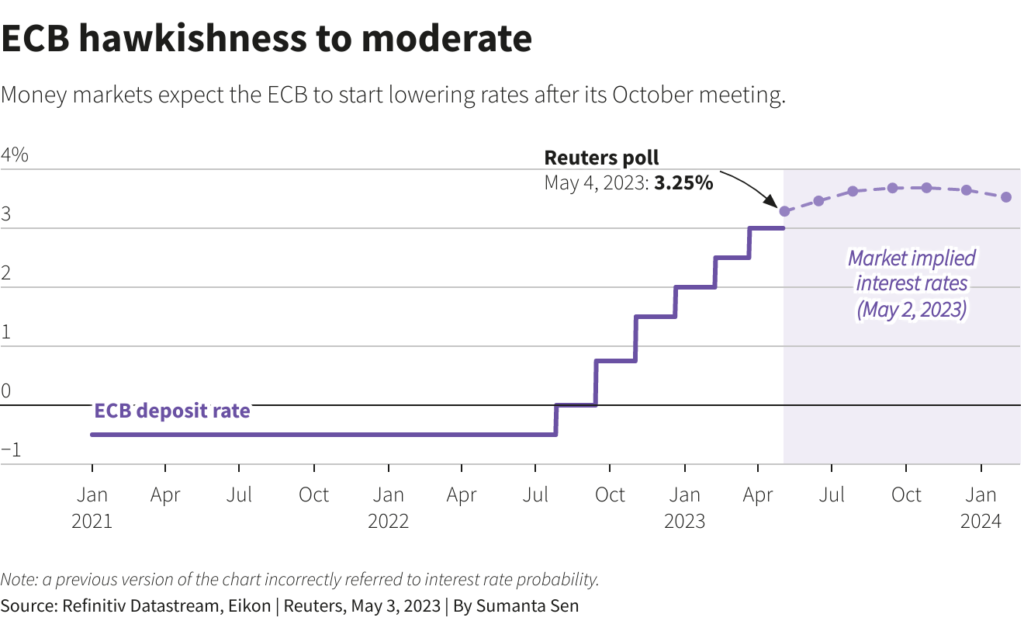

Markets see a 75% to 80% probability of a 25 foundation level transfer whereas the overwhelming majority of economists polled by Reuters had been additionally betting on the smaller hike. Charges are then seen peaking at round 3.75% in September.

Supporting a potential ECB downshift, the U.S. Federal Reserve lifted charges by 25 foundation factors on Wednesday and signalled it might pause additional will increase.

ALL ABOUT INFLATION

Financial fundamentals present loads of fodder for each side of the argument, even when the dovish arguments appear to multiplying.

Supporting the case for a smaller transfer, the euro zone economic system barely grew final quarter and lending figures confirmed the most important drop in credit score demand in over a decade, suggesting previous price hikes are beginning to work their manner by the economic system.

If squeezed onerous, this credit score downturn may morph right into a full-blown credit score crunch, weighing on progress which is barely in optimistic territory to start with.

At 3%, the ECB’s deposit price is already proscribing financial exercise, and underlying inflation has additionally stopped rising – at the least in the meanwhile.

“From a danger administration perspective, shifting to 25 bps would give the ECB the pliability to take care of each upside and draw back dangers to progress and inflation,” Davide Oneglia, at TS Lombard, mentioned. “So, a 25 bps hike shouldn’t be essentially ‘dovish’. For now, we keep our name for a 3.75% ECB terminal price.”

Hawks argue that underlying worth progress stays far too excessive and means that inflation may degree off above the ECB’s goal until the financial institution acts extra aggressively.

They are saying these dangers are exacerbated by a decent labour market, particularly since wage progress has been faster than predicted and the jobless price has fallen to an all-time-low regardless of the near-recessionary setting.

“We nonetheless anticipate the ECB to ship a 50 bp hike this week,” Financial institution of America mentioned. “This could include an emphasis on data-dependence, a sign that there’s nonetheless floor to cowl, and a transparent sign, once more, on the necessity for a sustained transfer decrease in core inflation for them to pause within the mountaineering cycle.”

The ECB will announce its coverage choice at 1215 GMT and Lagarde will maintain a press convention at 1245 GMT.

Modifying by Catherine Evans

: .