Could 8 (Reuters) – A take a look at the day forward in U.S. and world markets from Amanda Cooper.

U.S. Treasury Secretary Janet Yellen did not pull any punches on Sunday when she stated failure to resolve the deadlock over the debt ceiling in time may set off a “constitutional disaster”. And never simply that. The final time there was a significant showdown over the debt restrict in 2011, it price the US its prized triple-A credit standing. A repeat would name the federal authorities’s creditworthiness into query, Yellen says.

Scope Scores, which is seen because the main European credit standing company, on Friday stated it had positioned the US’ AA long-term issuer score below evaluate for a doable downgrade.

That is the final full week lawmakers in Washington need to hash out an settlement. In line with the legislative calendar, there are solely six days this month when the Home and the Senate are in session when President Joe Biden is in Washington.

Biden, who meets congressional leaders on Tuesday, final week sharply criticized “MAGA” Republicans for his or her refusal to vote in a better federal debt ceiling, signalling that there could be little compromise on Could 9.

“The very last thing this nation wants … is a manufactured disaster,” he stated.

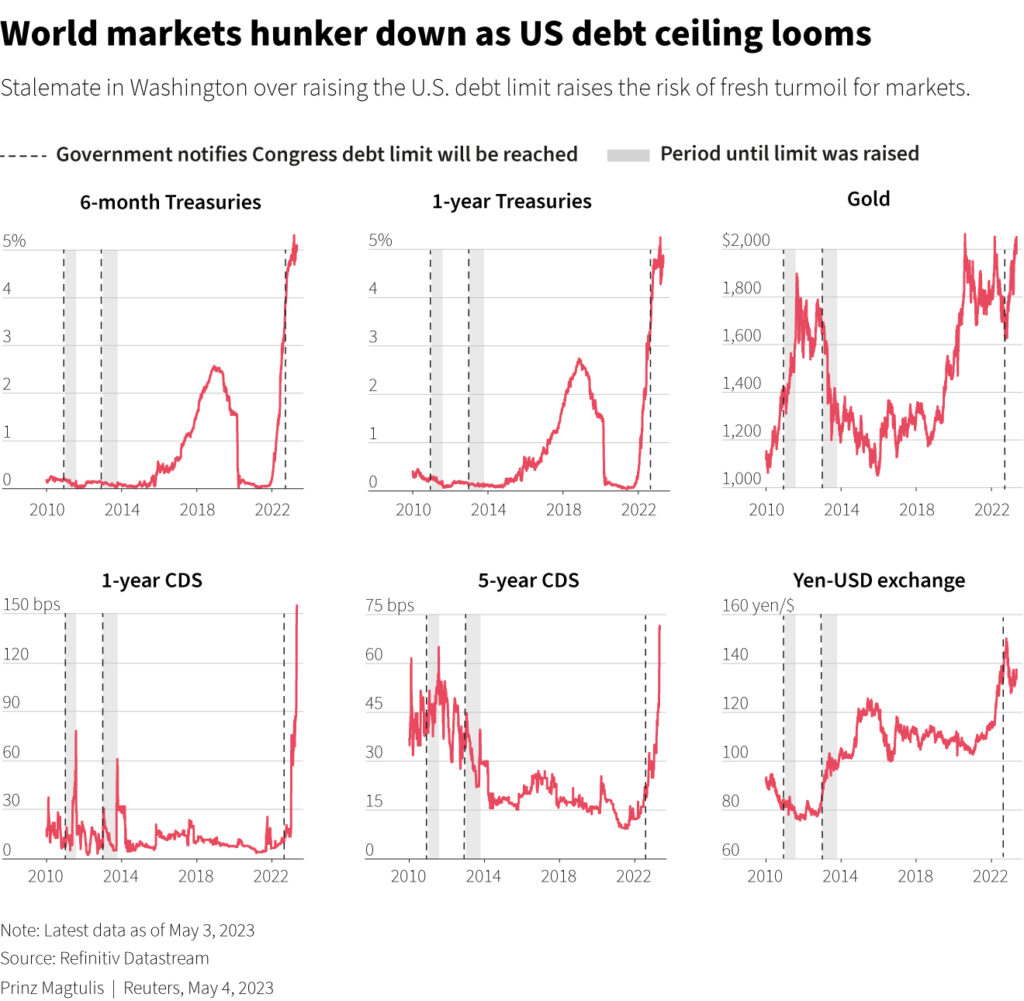

Most analysts consider there will probably be a decision to the disaster in time, however markets present buyers are usually not taking any possibilities. The price of insuring in opposition to the chance of a U.S. sovereign default has soared to its highest since a minimum of 2011 and is on a par with that of China, in line with information from S&P World Market Intelligence.

The yield on a one-month T-bill, which matures roughly across the time of the deadline, is now at its furthest above that on the benchmark 10-year Treasury word in a minimum of 20 years, displaying the premium that buyers now demand to carry very short-term U.S. debt.

Month-to-month payrolls information on Friday, which confirmed the U.S. financial system created way more jobs than anticipated final month, is including to the case for the Federal Reserve to maintain rates of interest increased for longer.

5 hundred foundation factors value of interest-rate rises in simply over a 12 months and the most popular inflation in many years have put the energy of the U.S. financial system, and its banking system specifically, to the check.

The collapse of three mid-tier lenders in just a few weeks has severely shaken shopper and investor religion. So Monday’s Federal Reserve’s Senior Mortgage Officer Opinion Survey is prone to entice much more consideration than standard.

The ‘SLOOS’, which incorporates as much as 80 massive home banks and 24 U.S. branches and companies of international banks, will present the extent to which lenders say credit score has tightened within the first quarter of the 12 months.

Goldman Sachs says it expects to see 60.2% of respondents reporting a tightening in lending requirements, which the financial institution says is “a stage tighter than the dot-com disaster however much less excessive than through the monetary disaster or the peak of the pandemic”.

Key developments that would present extra course to U.S. markets afterward Monday:

* March wholesale inventories

* Three and six-month Treasury invoice auctions

* KKR & Co. Q1 earnings

* PayPal Q1 earnings

Reporting by Amanda Cooper; Enhancing by Ed Osmond

: .

Opinions expressed are these of the creator. They don’t mirror the views of Reuters Information, which, below the Belief Rules, is dedicated to integrity, independence, and freedom from bias.