Swiss authorities brokered the controversial emergency rescue of Credit score Suisse by UBS for 3 billion Swiss francs ($3.37 billion) over the course of a weekend in March.

Fabrice Coffrini | AFP | Getty Photographs

UBS estimates a monetary hit of round $17 billion from its emergency takeover of Credit score Suisse, in line with a regulatory submitting, and mentioned the rushed deal could have affected its due diligence.

In a brand new submitting with the U.S. Securities and Change Fee (SEC) late Tuesday night time, the Swiss banking large flagged a complete adverse affect of round $13 billion in honest worth changes of the brand new mixed entity’s belongings and liabilities, together with a possible $4 billion hit from litigation and regulatory prices.

Nonetheless, UBS additionally expects to offset this by reserving a one-off $34.8 billion achieve from so-called “adverse goodwill,” which refers back to the acquisition of belongings at a a lot decrease value than their true price.

The financial institution’s emergency acquisition of its stricken home rival for 3 billion Swiss francs ($3.4 billion) was brokered by Swiss authorities over the course of a weekend in March, with Credit score Suisse teetering getting ready to collapse amid huge buyer deposit withdrawals and a plummeting share value.

Within the amended F-4 submitting, UBS additionally highlighted that the brief time-frame underneath which it was pressured to conduct due diligence could have affected its skill to “totally consider Credit score Suisse’s belongings and liabilities” previous to the takeover.

Swiss governmental authorities approached UBS on March 15 whereas contemplating whether or not to provoke a sale of Credit score Suisse with a view to “calm markets and keep away from the potential of contagion within the monetary system,” the submitting revealed. The financial institution had till March 19 to conduct its due diligence and return with a call.

“If the circumstances of the due diligence affected UBS Group AG’s skill to totally contemplate Credit score Suisse’s liabilities and weaknesses, it’s potential that UBS Group AG can have agreed to a rescue that’s significantly tougher and dangerous than it had contemplated,” UBS mentioned within the Danger Elements part of the submitting.

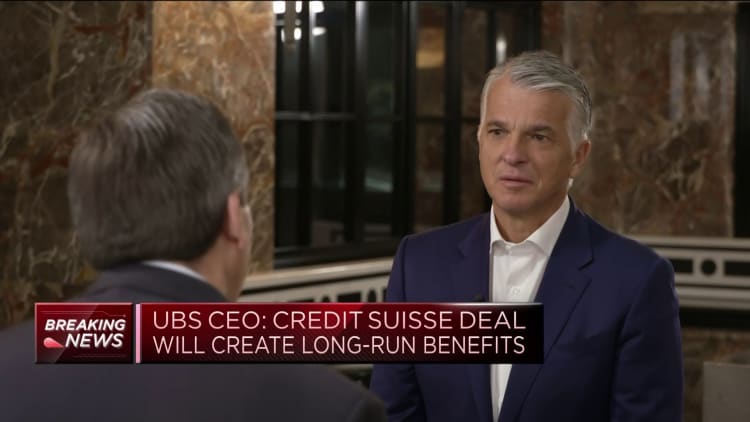

Although that is highlighted as a possible threat, UBS CEO Sergio Ermotti instructed CNBC final month that the Credit score Suisse deal was not dangerous and would create long-term advantages.

Essentially the most controversial facet of the deal was regulator FINMA’s choice to wipe out round $17 billion of Credit score Suisse’s further tier-one (AT1) bonds earlier than shareholdings, defying the traditional order of write downs and leading to authorized motion from AT1 bondholders.

Tuesday’s submitting confirmed the usStrategy Committee started evaluating Credit score Suisse in October 2022 as its rival’s monetary state of affairs worsened. The long-struggling lender skilled huge web asset outflows towards the top of 2022 on the again of liquidity considerations.

The united statesStrategy Committee concluded in February that an acquisition of Credit score Suisse was “not fascinating,” and the financial institution continued to conduct evaluation of the monetary and authorized implications of such a deal in case the state of affairs deteriorated to the purpose that Swiss authorities would ask UBS to step in.

UBS final week introduced that Credit score Suisse CEO Ulrich Koerner will be part of the chief board of the brand new mixed entity as soon as the deal legally closes, which is predicted inside the subsequent few weeks.

The group will function as an “built-in banking group” with Credit score Suisse retaining its model independence for the foreseeable future, as UBS pursues a phased integration.