“Legendary investor Peter Lynch has a simple perspective on company insiders and their actions within the inventory market. He put it merely: ‘Insiders would possibly promote their shares for any variety of causes, however they purchase them for just one motive—they assume the worth will rise.’

Certainly, top-of-the-line inventory alerts comes from company insiders, the corporate officers who maintain positions of excessive accountability – to their Boards, and to their friends, and to their shareholders and prospects – for bringing within the most returns. Their foremost focus is on maintaining the corporate wholesome, and their positions give them entry to data that most people simply hasn’t acquired. And that data will inform their buying and selling selections after they commerce their firm’s inventory.

With this in thoughts, we turned to TipRanks’ Insiders’ Scorching Shares instrument to determine two shares which might be flashing indicators of robust insider shopping for. What makes these shares notably interesting to traders is their beneficiant dividend yields, exceeding 9%. So, with out additional ado, let’s dive in.

Power Switch (ET)

The primary high-yield dividend inventory we’ll take a look at is Power Switch, a serious participant within the North American oil and fuel midstream sector. Every thing about Power Switch is massive: the corporate boasts a market cap close to $39 billion, operates over 120,000 miles of pipelines and different vitality transport infrastructure throughout the continental US, and final yr alone, ET spent roughly $740 million on sustaining and bettering that community. Whereas Power Switch’s operations primarily revolve round Texas, Louisiana, Arkansas, and Oklahoma, it additionally holds a robust presence within the northern Nice Plains, the Nice Lakes and Mid Atlantic areas, in addition to Florida.

Power Switch’s most up-to-date ‘massive information’ was the announcement of its settlement to amass the smaller agency Lotus Midstream. The acquisition will carry one other 3,000 miles’ value of crude oil gathering and transport pipelines into ET’s community, connecting property within the Texas-New Mexico border area with Oklahoma. The transaction, in each money and inventory, is valued at roughly $1.45 billion and was accomplished earlier this month.

The Lotus acquisition demonstrates ET’s confidence in its place, regardless of the corporate lacking its 1Q23 income targets. The whole prime line amounted to $19 billion, a 7% year-over-year lower, falling in need of the forecast by almost $2.49 billion. ET reported earnings per share of 32 cents, each fundamental and diluted. Nevertheless, the GAAP fundamental determine fell 3 cents beneath expectations, whereas the non-GAAP diluted determine exceeded the forecast by 2 cents.

Drilling down, we discover that Power Switch reported an adjusted EBITDA of $3.43 billion for 1Q23, which compares favorably to the $3.34 billion posted within the prior-year interval. Of specific curiosity to dividend traders, ET had $2.01 billion in distributable money circulate for Q1. Though this determine is decrease than the $2.08 billion from the year-ago quarter, it was nonetheless enough for administration to extend its dividend distribution for the sixth consecutive quarter.

That dividend is now set at $0.3075 cents per widespread share, or $1.23 annualized. At that charge, the dividend provides a formidable ahead yield of 9.8%.

Turning to the insider trades, the foremost insider trades in ET shares had been made by Kelcy Warren, the corporate’s government chairman. Warren made two massive purchases this month, for 1 million shares and 500,000 shares. These purchases value a complete of $18.62 million.

Wall Road likes this midstream large, and 5-star analyst Justin Jenkins, masking the corporate for Raymond James, lays out a strong bull case.

“Frequently amongst our most-debated shares, the narrative is shifting (with good motive) for Power Switch (ET) – look no additional than one of many higher YTD/TTM efficiency profiles within the group. With long-standing overhangs dissipating, the apparent investor push-backs are much less frequent — and earnings outcomes proceed for instance bettering fundamentals. Although tone in direction of development spending stays aggressive, FCF technology remains to be strong in our mannequin. The main target in 2023+ ought to be on attractively deploying extra FCF (e.g., serving to reduce the affect of decrease commodity costs). We wouldn’t wager in opposition to considered one of our most built-in names, notably not at ~7x 2024E EV/EBITDA,” Jenkins opined.

It ought to be unsurprising, then, that Jenkins charges ET shares a Robust Purchase. To not point out his $17 value goal places the upside potential at 35.5%. Primarily based on the present dividend yield and the anticipated value appreciation, the inventory has ~45% potential whole return profile. (To look at Jenkins’ monitor document, click on right here)

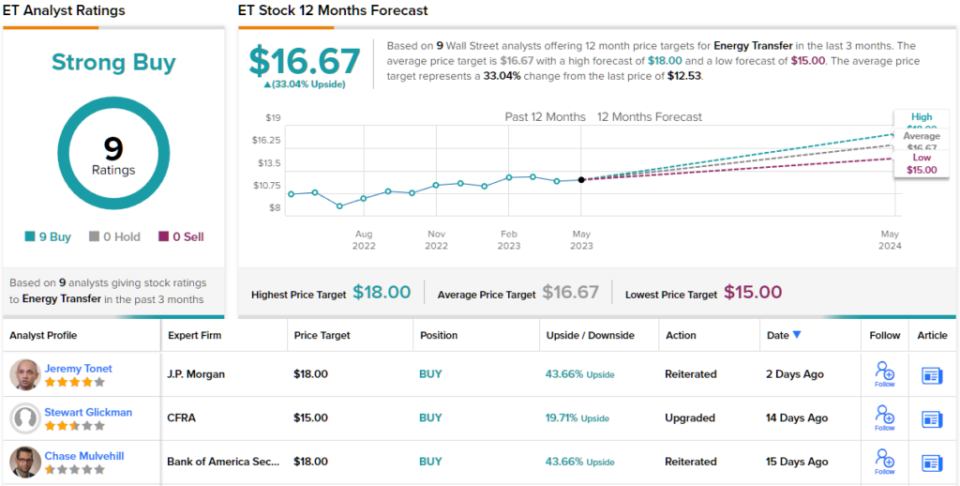

Jenkins is hardly the one one giving ET shares a Robust Purchase ranking; the inventory has 9 optimistic analyst evaluations on document, for a Robust Purchase consensus ranking. With the shares presently buying and selling for $12.53, the typical value goal of $16.67 signifies potential for a 33% improve over the subsequent 12 months. (See ET inventory forecast)

AFC Gamma (AFCG)

Shifting our focus from the vitality sector, let’s discover AFC Gamma, one of many many firms which have emerged to capitalize on the comfort of rules on marijuana and hashish merchandise, in addition to the rising adoption of authorized hashish on the state stage.

AFC Gamma operates as an actual property funding belief, offering actual property loans to companies within the hashish business. Along with actual property monetary companies, AFC Gamma affords mortgage underwriting and numerous financing options, concentrating on each direct lending and bridge loans starting from $5 million to $100 million.

Working throughout the hashish business, AFC Gamma finds it advantageous to ascertain its base in Florida, one of many main states within the authorized hashish sector. From this steady location, AFC Gamma is ready to present its monetary companies to an business going through challenges from a patchwork authorized framework on the state stage, sophisticated additional by federal illegality. The corporate goals to leverage its monetary flexibility to generate strong returns for shareholders.

The corporate generates these returns by means of its dividend, which was paid out in April for 1Q23 at a charge of 56 cents per widespread share. This cost was absolutely lined by the distributable earnings per share, which had been reported as 57 cents for Q1. With an annualized ahead cost of $2.24 per share, the dividend affords a sky-high yield of almost 21%. Only a few firms, no matter kind, can match such a considerable dividend yield. AFC Gamma has maintained its dividend on the present cost stage for the previous 4 quarters.

AFC Gamma was capable of sustain the excessive dividend yield, and to pay out 98% of its distributable earnings, despite the fact that it missed the income and earnings expectations within the first quarter of this yr. The whole income confirmed a prime line of $16.83 million, $1.48 million beneath the Road’s forecast, whereas the non-GAAP normalized earnings determine of 49 cents per share missed that forecast by 7 cents.

Regardless of lacking on earnings, two insiders didn’t hesitate to purchase massive blocks of AFCG inventory. Up to now week, Firm President Robyn Tannenbaum made two purchases, considered one of 125,000 shares and one other of 116,372 shares. In whole, Tannenbaum purchased 241,372 shares of AFCG for nearly $2.47 million. In a separate set of insider transactions, AFC Gamma CEO Leo Tannenbaum made 4 purchases this month, totaling 243,372 shares. The whole value of those purchases was $2.488 million.

AFC Gamma shares additionally caught the attention of TD Cowen analyst Michael Elias, who writes: “Whereas we’re inspired by mgmt. commentary round bettering pricing in hashish and proceed to consider non-cannabis CRE affords enticing lending alternatives given the pullback of conventional lenders within the house, we additionally acknowledge that the dividend is a key focus level for traders. For AFC Gamma to maintain present dividend ranges, the corporate might want to improve its variety of commitments and although we do consider there may be sufficient lending alternative available in the market for the corporate to take action, we’re skeptical that the corporate will improve its dividend within the NT and is extra more likely to elect to maintain the dividend flat till its dividend is <85% of Distributable Earnings.”

Taking all of this into consideration, Elias stays with the bulls. Alongside along with his Outperform (i.e. Purchase) name, the analyst provides AFCG inventory a $16 value goal, which means 48% upside from present ranges. (To look at Elias’ monitor document, click on right here)

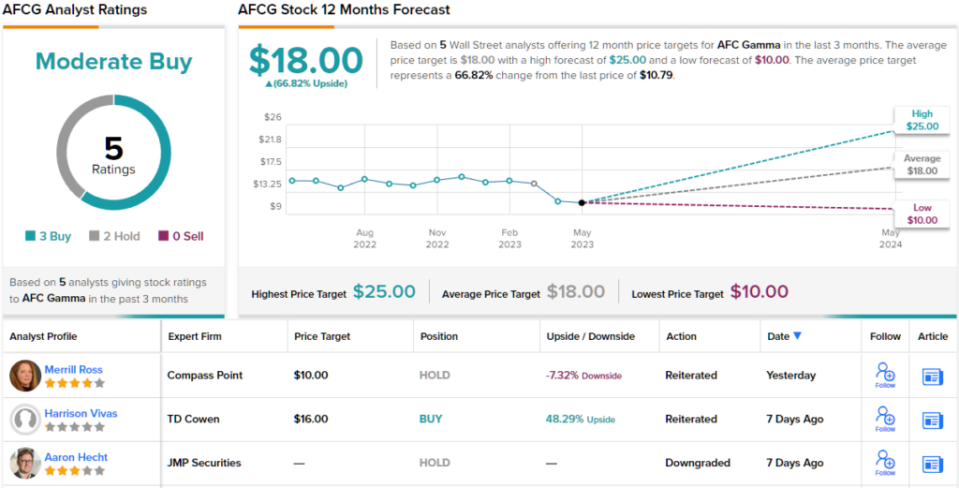

General, this cannabis-related REIT will get a Average Purchase from the analyst consensus, primarily based on 5 analyst evaluations that embody 3 Buys and a pair of Holds. The inventory’s $10.79 buying and selling value and $18 common value goal collectively point out a formidable 67% potential acquire for the yr forward. (See AFCG inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your individual evaluation earlier than making any funding.