After the bear market of 2022, the markets have made a restoration in 2023, with each the S&P 500 and, specifically, the NASDAQ displaying wholesome year-to-date good points. Subsequently, it is perhaps a pure intuition for traders who’ve nursed heavy losses to be eyeing the exit gate now that the market is rebalancing and the preliminary funding is again to breaking even. Nevertheless, legendary investor Ken Fisher says that form of considering is an enormous mistake.

“As preliminary bull market rallies construct, traders — uncooked from the prior drop — promote. It feels good,” says Fisher. Nevertheless it’s the mistaken transfer.

Whereas There is perhaps many bears prowling Wall Road proper now, in line with Fisher, the pendulum has already swung the opposite approach and we’re within the early innings of a bull market. The important thing, now, is to remain within the sport. “Whereas many will undergo breakevenitis, you may keep away from it — by conserving long-term targets high of thoughts,” says the billionaire.

Placing his cash the place his mouth is, Griffin is staying totally invested. We’ve opened the TipRanks database to see what the Road’s inventory consultants make of a pair of equities that kind a part of his portfolio. It appears to be like like they agree these are sound decisions; each are rated ‘Sturdy Buys’ by the analyst consensus. Let’s see why they’re value leaning into proper now.

Thermo Fisher (TMO)

The primary Griffin-backed identify we’ll take a look at is a big in its subject. Boasting a market capitalization of over $203 billion, Thermo Fisher is likely one of the world’s most outstanding healthcare suppliers. The corporate supplies a variety of scientific options, together with analytical devices, consumables, reagents, software program, and providers. It caters to a various buyer base that features pharmaceutical and biotech corporations, tutorial and analysis establishments, hospitals and scientific diagnostic labs, in addition to authorities companies

Regardless of being a serious international concern, TMO shouldn’t be resistant to the modifications taking place round it. The corporate’s latest Q1 report displays the affect of Covid-19, with testing income falling from $1.7 billion in the identical interval a yr in the past to $140 million. In consequence, income dropped by 9.4% year-over-year to $10.71 billion, though it exceeded the Road’s forecast by $40 million. Alternatively, the adjusted EPS of $5.03 met the analysts’ expectations. TMO additionally maintained its steerage for 2023, anticipating income of $45.3 billion and EPS of $23.70.

Fisher is evidently eager on this healthcare big. He holds an enormous TMO place, proudly owning 2,395,840 shares. These are at present value over $1.26 billion.

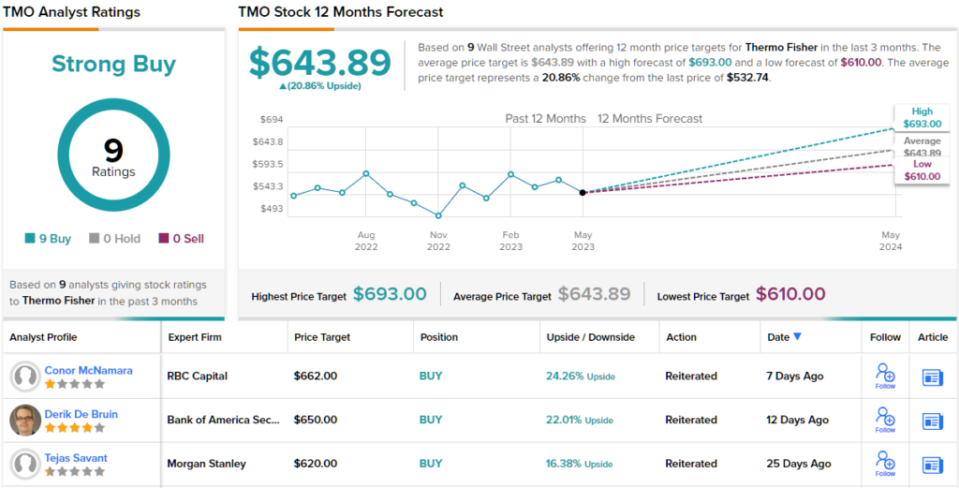

It’s an act that almost definitely will get the approval of Stifel analyst Daniel Arias. Assessing the Q1 print and outlook, Arias wrote, “We anticipate the controversy on demand threat to proceed going ahead, however for us TMO is differentiating itself in a approach that advertises the corporate’s strengths (portfolio variety, execution high quality, share acquire alternative). So whereas some traders appear poised to keep away from bioprocess associated names (or Instruments corporations basically) for a bit till the temperature within the room cools, we proceed to imagine that TMO at 20x is extremely engaging for these with a considerably increased threat tolerance.”

These feedback underpin Arias’ Purchase ranking whereas his Road-high $700 value goal suggests the shares will climb 33% increased over the approaching months. (To look at Arias’ monitor document, click on right here)

None of Arias’ colleagues seem to have a problem with that take. All 9 latest opinions are constructive, naturally making the consensus view right here a Sturdy Purchase. Going by the $643.89 common goal, the shares will ship returns of ~21% within the yr forward. (See TMO inventory forecast)

Taiwan Semiconductor (TSM)

For our subsequent Griffin-endorsed identify, we are going to shift our focus from one business big to a different phase chief. Taiwan Semiconductor is a number one international semiconductor producer. Since its founding in 1987, the corporate has emerged as a key participant within the semiconductor business, specializing within the manufacturing of superior built-in circuits (ICs) and system-on-chip (SoC) options. Because the world’s largest devoted semiconductor foundry, Taiwan Semiconductor is contracted by companies equivalent to Apple, AMD, Nvidia, and Qualcomm to fabricate chips. With such outstanding purchasers, it’s no shock that this mega-cap firm boasts a market capitalization of $450 billion.

That stated, as has been evident at different large tech corporations, the worldwide financial slowdown has affected TSM too. In the newest quarterly report, the corporate delivered a blended assertion. Citing “softening end-market demand,” income dropped by 4.8% year-over-year to $16.72 billion, in flip lacking the consensus estimate by $170 million. Nevertheless, earnings of $1.31 per share trumped the $1.20 forecast.

For the second quarter, income is anticipated within the vary between $15.2 and $16 billion, a way off the $18.16 billion generated in the identical interval a yr in the past, though the corporate stated that by Q3, it expects inventories to return to a “extra wholesome stage.”

In the meantime, Griffin goes nowhere. The billionaire holds a sizeable TSM place, with the possession of 25,228,676 shares. These at present command a market worth of $2.33 billion.

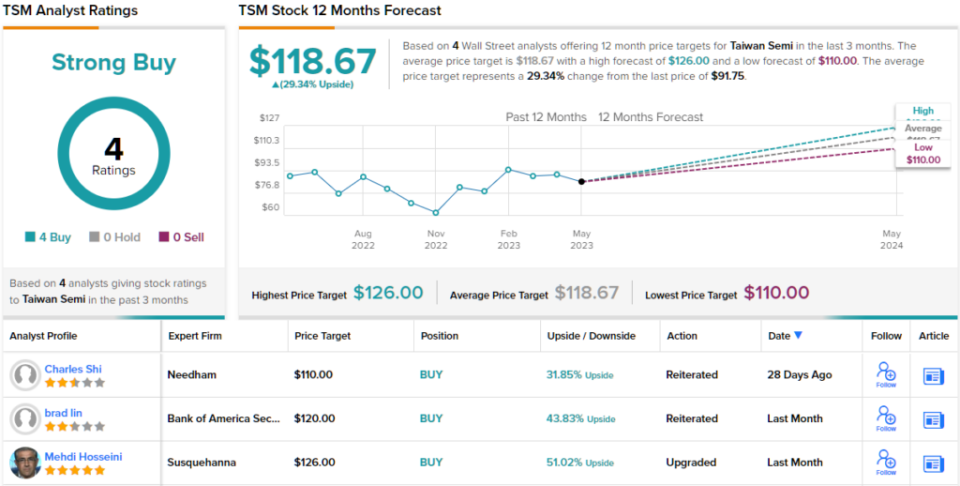

For Susquehanna analyst Mehdi Hosseini, it’s clear the place TSM’s worth proposition lies. “TSM, in our view, stays the popular foundry selection for modern nodes as Samsung Foundry has but to reveal a steady vanguard course of expertise, all whereas IFS is years away from providing a aggressive resolution,” the 5-star analyst defined. “It’s no marvel giant prospects depend on TSM as a sole-source foundry accomplice. Given… the inherent leverage in TSM’s enterprise mannequin, we argue the danger/ reward profile is favorable as quarterly EPS bottoms in 2Q23, adopted by a rebound into 2H23 and gaining momentum in 2024.”

Accordingly, Hosseini charges TSM shares as Optimistic (i.e., Purchase) and backs the ranking up with a $126 value goal. The implication for traders? Potetnial upside of 36% from present ranges. (To look at Hosseini’s monitor document, click on right here)

Three different analysts have waded in with TSM opinions just lately, and they’re all singing the corporate’s praises, offering the inventory with a Sturdy Purchase consensus ranking. The forecast requires one-year good points of 29%, contemplating the common goal stands at $118.67. (See TSM inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.