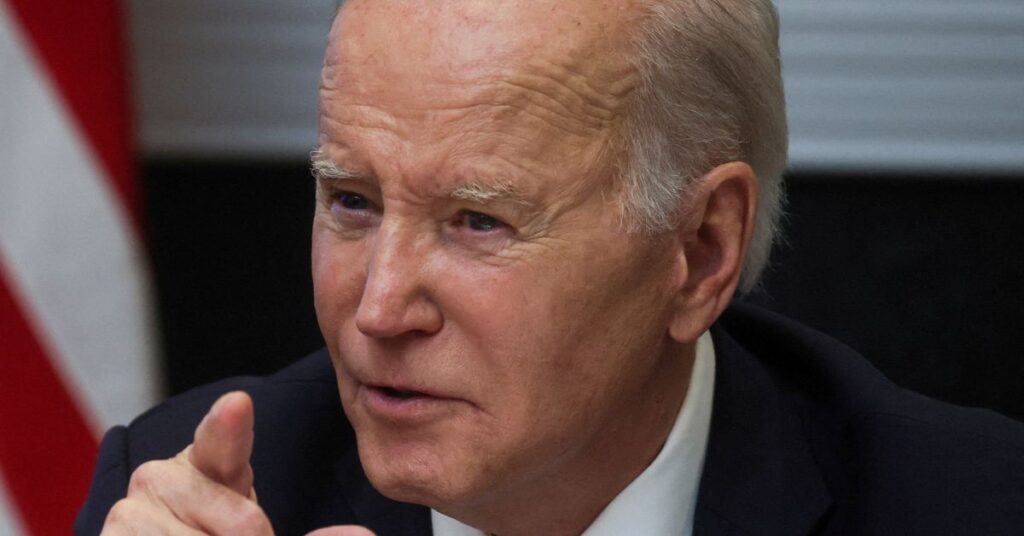

[1/2] U.S. President Joe Biden speaks with members of his “Investing in America Cupboard” within the Roosevelt Room on the White Home in Washington, U.S., Could 5, 2023. REUTERS/Leah Millis/

WASHINGTON, Could 29 (Reuters) – The U.S. is quickly approaching the deadline for Congress to go a deal, reached over the weekend by Democratic President Joe Biden and prime congressional Republican Kevin McCarthy, to droop the federal government’s $31.4 trillion debt ceiling or threat a catastrophic default.

WHEN WAS THE DEBT CEILING REACHED?

Washington usually units a restrict on federal borrowing. At present, the ceiling is roughly equal to 120% of the nation’s annual financial output. The debt reached that ceiling in January and the Treasury Division has saved obligations simply inside the restrict by suspending investments in some federal pension funds whereas persevering with to borrow from traders.

The Treasury on Friday warned that it might run out of room below the restrict as quickly as June 5, a couple of days later than its earlier June 1 forecast.

As a result of the Treasury borrows shut to twenty cents for each greenback it spends, Washington at that time would begin lacking funds owed to lenders, residents or each.

IS THE DEBT CEILING GOOD FOR ANYTHING?

Few counties on this planet have debt ceiling legal guidelines and Washington’s periodic lifting of the borrowing restrict merely permits it to pay for spending Congress has already approved.

Treasury Secretary Janet Yellen and different coverage specialists have known as on Washington to remove the restrict, as a result of it quantities to a bureaucratic stamp on choices already made.

Some analysts have proposed that the Treasury can bypass the disaster by minting a multitrillion-dollar platinum coin and placing it within the authorities’s account, an thought extensively seen as an outlandish gimmick. Others argue the debt ceiling itself violates the U.S. Structure. But when the Biden administration invoked that argument, which entails the 14th Modification, a authorized problem would comply with.

The White Home has dismissed each concepts as impracticable at this stage.

WHAT HAPPENS WHEN WASHINGTON CAN NO LONGER BORROW MONEY?

Shockwaves would ripple by international monetary markets as traders questioned the worth of U.S. bonds, that are seen as among the many most secure investments and function constructing blocks for the world’s monetary system.

The U.S. economic system would nearly definitely fall right into a recession if the federal government was pressured to overlook funds on issues like troopers’ salaries or Social Safety advantages for the aged. Economists anticipate that tens of millions of Individuals would lose their jobs. Rankings companies have warned they might downgrade the U.S.’s sovereign credit standing — as occurred in a previous 2011 showdown — and traders have shunned some U.S. debt securities that come due within the coming weeks as they attempt to keep away from payments maturing when the danger of a debt default is highest.

HOW DID WE GET HERE?

Republicans, who maintain a slender 222-213 majority within the Home of Representatives, in late April handed a invoice that may increase the debt restrict but additionally set in place sweeping spending cuts over the following decade.

The invoice has no likelihood of approval within the Democratic-controlled U.S. Senate. McCarthy and Biden over the weekend agreed on a tentative deal to droop the borrowing restrict for 2 years and cap spending, however they face objections from probably the most partisan lawmakers in every social gathering.

HAVEN’T WE HEARD THIS SONG BEFORE?

This sort of brinkmanship has been a part of U.S. politics for many years however worsened considerably after fiscal hawks within the Republican Occasion grew in energy since 2010.

In a 2011 showdown, Home Republicans efficiently used the debt ceiling to extract sharp limits on discretionary spending from Democratic President Barack Obama.

Spending caps stayed in place for many of the remainder of the last decade, however the episode rattled traders and led to a historic downgrade of the U.S. credit standing.

Reporting by Jason Lange; Modifying by Scott Malone, Jonathan Oatis and Andrea Ricci

: .