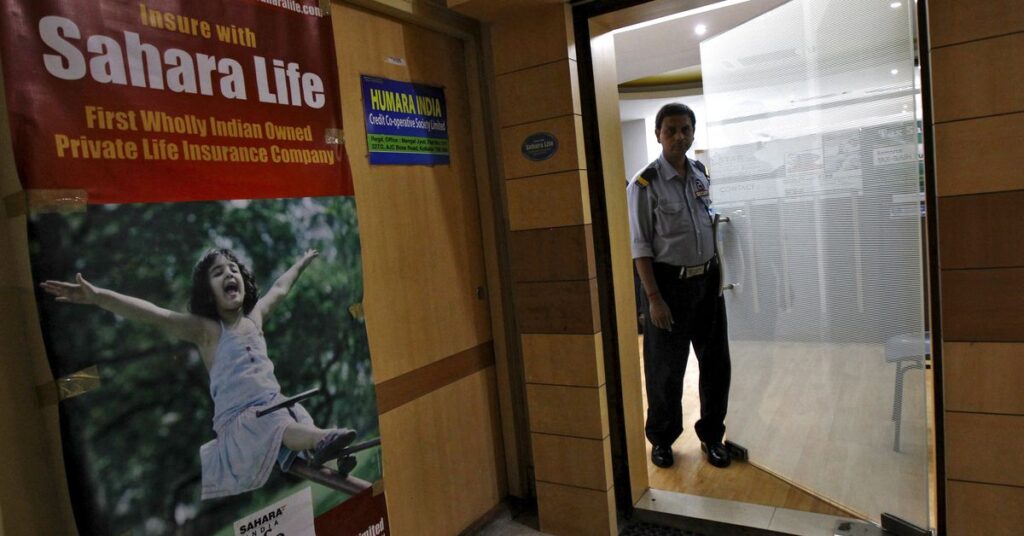

NEW DELHI, June 2 (Reuters) – India’s insurance coverage regulator on Friday ordered the takeover of a unit of Sahara India Life Insurance coverage by SBI Life Insurance coverage (SBIL.NS), following the corporate’s “steady deterioration of monetary place”.

The Insurance coverage Regulatory and Improvement Authority of India (IRDAI) on Friday mentioned the life insurance coverage enterprise of Sahara India Life shall be transferred to SBI Life with rapid impact.

SBI Life clarified that there shall be a switch of Sahara India Life’s policyholder belongings and liabilities, however no merger between the 2 entities.

A press release issued by Sahara India Life mentioned the matter is at the moment into consideration with the Securities Appellate Tribunal and the subsequent listening to is scheduled for June 6.

Sahara India Life has been beneath the regulator’s scrutiny since 2017 for allegedly appearing towards policyholders’ pursuits. IRDAI had appointed an administrator to run the insurer the identical yr.

The administrator had discovered that Sahara India Life’s promoters have been not match to run the corporate and had allegedly diverted funds.

“If the development is allowed to proceed, the state of affairs will worsen and result in erosion of capital and Sahara India Life Insurance coverage Co might not be capable of discharge its liabilities in direction of policyholders,” IRDAI mentioned on Friday.

As per the regulator’s order, SBI Life will take over the liabilities of about 200,000 insurance policies and belongings of Sahara India Life.

SBI Life should combine the programs for its life insurance coverage enterprise with that of Sahara India Life inside one yr, the IRDAI order mentioned.

The insurance coverage regulator has shaped an inner committee to supervise the acquisition in a “time sure” and “easy” method.

“IRDAI will proceed to watch the state of affairs and likewise concern needed instructions as required within the curiosity of the policyholders of Sahara Life,” the regulator’s assertion mentioned.

Reporting by Nikunj Ohri in New Delhi; Further Reporting by Rishabh Jaiswal in Bengaluru; Enhancing by Pooja Desai

: .