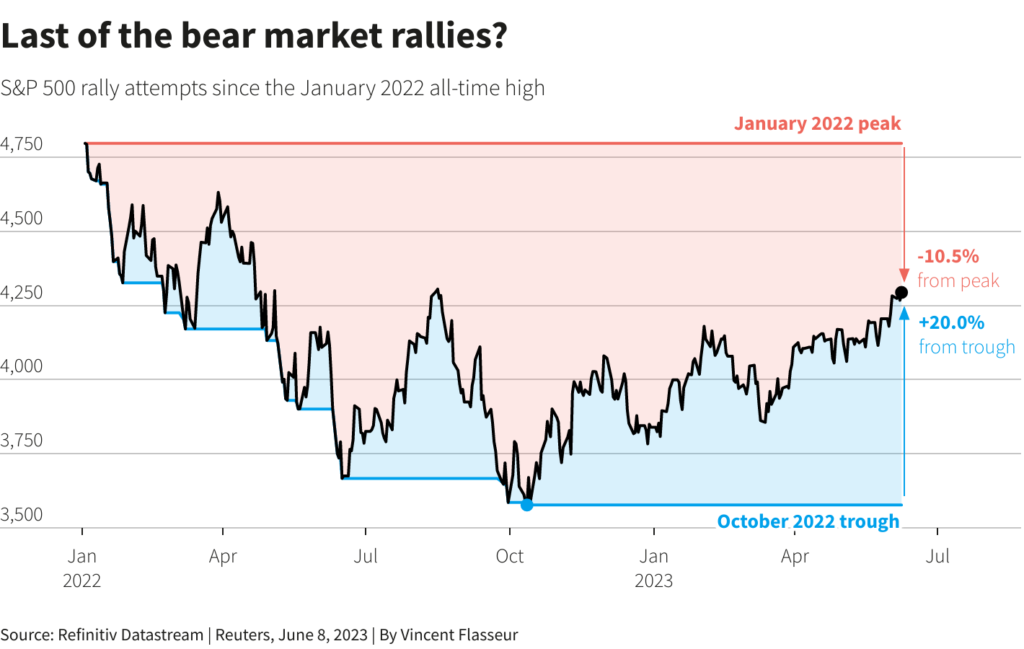

NEW YORK, June 8 (Reuters) – S&P 500 (.SPX) superior on Thursday, placing the benchmark index up 20% from its Oct. 12 closing low and heralding the beginning of a brand new bull market, no less than by the definition of some market members.

A part of the uncertainty is that there isn’t a set definition of a bull or bear market, or any kind of regulatory physique that declares one, such because the Nationwide Bureau of Financial Analysis (NBER) does with recessions.

The S&P 500 rose 0.6% in Thursday’s session, lifted by expertise shares, whereas volatility dropped to document lows forward of an eventful financial and coverage calendar subsequent week.

The Nasdaq (.IXIC) added 1%, and it’s now up practically 30% from its closing low final December.

Essentially the most generally accepted definition is a 20% rise off a low for a bull market and a 20% decline from a excessive for a bear market, however even that’s open to interpretation.

“The issue is there isn’t a authority of guidelines or laws on there, 20% got here again from the actually olden days, like throughout the First World Battle, it was the primary time we see it,” stated Howard Silverblatt, senior index analyst at S&P Dow Jones Indices in New York.

In response to Silverblatt, there have been 15 bear markets for the benchmark S&P index, starting in September 1929, on the finish of the Roaring Twenties growth, to the present one which started on Jan 3, 2022.

Sam Stovall, chief funding strategist at CFRA in New York, provides a time ingredient to his bear market standards, requiring a low to stay intact for a length of no less than seven months, which he believes removes the chance of a fast reversal decrease after a rally of 20% or extra, corresponding to what occurred throughout the Nice Monetary Disaster.

“In 2008, the S&P hit its low on Nov 20, we then superior by greater than 20% into early January solely to turnaround and set a good decrease low, by March 9,” stated Stovall. “I simply suppose it was a blip inside a longer-term bear market.”

In a be aware on Monday, Dan Suzuki, deputy chief funding officer at Richard Bernstein Advisors in New York, took an much more layered method since “it’s actually potential for this rally to evolve right into a full-fledged bull market, historic precedent suggests it’s removed from a foregone conclusion.”

One commonality Suzuki present in bull markets is a broad participation throughout sectors, one thing missing within the present rally as many of the greater than 11% achieve within the S&P 500 this yr has been concentrated amongst a small quantity of very massive shares corresponding to Nvidia (NVDA.O), Meta Platforms (META.O) and Amazon (AMZN.O).

“Definitely it is a bull market in big-cap expertise. I would not name it a bull market in a broad market sense, as a result of there are solely sure shares which can be actually in what we’d name bull market territory, and it is simply not a broad sufficient transfer to name it a sustainable bull market,” stated Tim Ghriskey, senior portfolio strategist Ingalls & Snyder in New York.

Taking a special view altogether is Ned Davis Analysis, which the Inventory Dealer’s Almanac depends on for outlining bull and bear markets. It says {that a} cyclical bull market requires a 30% rise after 50 calendar days or a 13 p.c rise after 155 calendar days for the Dow Jones Industrial Common (.DJI) or the Worth Line Geometric index (.VALUG), an equal-weighted index of practically 1,700 shares.

However whereas the S&P 500 has simply cleared the 20% hurdle, for some, a brand new bull market is not going to start till the index clears its prior excessive from January 2022, based on Silverblatt, and till then, “it’s a bull run in a bear market.”

Reporting by Chuck Mikolajczak, further reporting by Noel Randewich and Lewis Kruaskopf; Modifying by Alden Bentley

: .