A model of this publish first appeared on TKer.com

Shares closed increased final week with the S&P 500 leaping 2.6%. The index is now up 14.8% 12 months so far, up 23.3% from its October 12 closing low of three,577.03, and down 8.1% from its January 3, 2022 file closing excessive of 4,796.56.

Again in February, I wrote: “Attitudes are on the cusp of shifting in 3 main methods.”

I believe we at the moment are previous that cusp, and so it’s price an replace on these three themes.

1. The Fed has change into much less hawkish 🦅

Final spring, the Federal Reserve went into disaster mode over inflation. In Could 2022, Fed Chair Jerome Powell first mentioned financial “ache” could also be essential to get inflation down. In June, the Fed hiked charges by an eye-popping 75 foundation factors. On the time, it was the largest single charge hike since 1994.

After months of cooling inflation, the Fed’s tone grew to become a lot much less hawkish on February 1, when Powell acknowledged that “for the primary time that the disinflationary course of has began.” And on March 22, the Fed signaled that the tip of rate of interest hikes was close to.

On Wednesday, the Fed saved its goal vary for the federal funds charge at 5% to five.25%. This pause got here after 10 consecutive rate of interest hikes for the reason that starting of the speed hike cycle in March 2022.

The information got here after Tuesday’s Could Shopper Value Index report, which was the bottom annual studying on inflation since March 2021. It was additionally a file 11th straight month of decline.

To be clear, Wednesday was not essentially the tip of this charge hike cycle. In its up to date abstract of financial projections, the Fed’s estimated median federal funds charge for the tip of 2023 was revised up from 5.1% to five.6%, implying that the central financial institution sees a necessity for 2 extra charge hikes by the tip of the 12 months.

A “key takeaway from the June assembly is that FOMC contributors see a extra reasonable tempo of tightening as acceptable now that the funds charge is nearer to its doubtless peak,” Goldman Sachs’ David Mericle wrote on Wednesday.

The underside line is the Fed is shifting away from emergency-mode. This bodes nicely for monetary markets if it means efforts to additional tighten monetary circumstances are coming to an finish.

2. The economic system has change into much less doubtless to enter recession 💪

Coming into 2023, most economists had been fairly satisfied the U.S. economic system would go into recession a while through the 12 months.

TKer readers have lengthy understood the economic system has been bolstered by large tailwinds. These persistent causes for optimism have saved recession at bay and proceed to take action. Month after month, we’ve gotten affirmation job progress stays sizzling and shopper spending stays sturdy.

And an increasing number of, economists have adopted an more and more bullish tone. A June 8 piece on GoldmanSachs.com headlined “Why a US recession has change into much less doubtless” captures this sentiment.

Many economists who’ve been forecasting a recession have both withdrawn their name or delayed it.

“The chance backdrop has improved, and labor provide has rebounded,” BofA economist Michael Gapen wrote on Wednesday. “Each are contributing to resiliency within the US restoration… We revise in favor of a later, and extra reasonable, downturn in 2024. Inflation now falls, and unemployment rises, extra slowly.”

Certainly, simply because we get a recession doesn’t essentially imply the economic system might be in horrible form.

The underside line is that the case for an financial recession stays very weak as large tailwinds proceed to assist progress.

3. The inventory market will not be doomed to crater 📉

The ‘hottest prediction’ coming into 2023 was that shares would tumble through the first half of the 12 months earlier than rallying within the second half.

That prediction has been very unsuitable. The truth is, the inventory market formally entered a bull market earlier this month whereas spending nearly no time this 12 months within the crimson.

In latest weeks, the consensus has shifted with strategists throughout Wall Avenue revising up their year-end worth targets for the S&P 500, together with Goldman Sachs’ David Kostin (to 4,500 from 4,000), BMO Capital Markets’ Brian Belski (to 4,550 from 4,300), BofA’s Savita Subramanian (to 4,300 from 4,000), and RBC Capital Markets’ Lori Calvasina (to 4,250 from 4,100). Elsewhere, Evercore ISI’s Julian Emanuel, Stifel’s Barry Bannister, and Truist’s Keith Lerner moved their targets increased.

“With earnings estimates getting much less dangerous and the Fed nearing the tip of the speed cycle, it is smart that equities are discovering themselves on a greater footing,” Constancy’s Jurrien Timmer tweeted on Thursday.

Certainly, whereas the bettering outlook for earnings is the best clarification for increased inventory costs, it’s a welcome growth to see that the Fed-sponsored market-beatings could not go on for for much longer.

Who is aware of for positive what inventory costs will do within the second half?

The underside line is that market circumstances seem like bettering, and inventory costs have been shifting up (as they often do).

Zooming out 🔭

There’s numerous good issues taking place proper now. The economic system is robust, the outlook for earnings is bettering, and inventory costs are shifting increased.

Importantly, all of that is taking place as inflation continues to chill, which suggests we might be nearing the tip of the Fed’s market-unfriendly insurance policies.

Instinctually, it’s possible you’ll be pondering that it’s throughout occasions like this that issues go unsuitable. Perhaps so. Historical past is riddled with unfavourable shocks that set again the economic system and the markets.

However historical past additionally says the economic system tends to develop, earnings pattern increased, and shares often go up.

Whereas it’s by no means smart to get complacent, there’s additionally nothing unsuitable with having fun with issues whereas issues are good.

Reviewing the macro crosscurrents 🔀

There have been a number of notable information factors and macroeconomic developments from final week to contemplate:

🏛️ A hawkish pause. The massive occasion of the week was arguably the Fed announcement, which we mentioned above.

🛍️ Shopper spending is holding up. In accordance with Census Bureau information (by way of Notes), retail gross sales in Could climbed 0.3% to $686.6 billion. Whereas the tempo of gross sales is off its file excessive, it continues to pattern nicely above pre-pandemic ranges.

Excluding autos and fuel, gross sales had been up 0.4% with beneficial properties throughout most classes, led by constructing materials and backyard tools, automobiles and elements, furnishings, and eating places and bars.

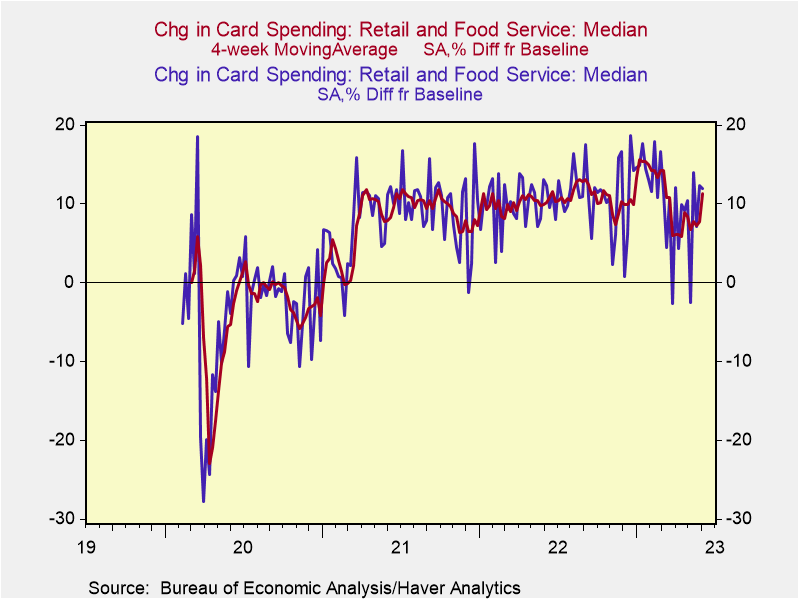

💳 Spending in June seems sturdy. From Renaissance Macro Research: “Consumption seems prefer it began off the month of June on a powerful observe. In accordance with cost card transactions information from the Bureau of Financial Evaluation, spending is up 12.0% towards a pre-pandemic baseline; the four-week common is 11.4%, [a] notable enchancment from early Could.”

⛽️ Shoppers are hitting the highway. Weekly EIA information by way of June 9 present gasoline demand is up from a 12 months in the past.

💵 Shoppers have money within the financial institution. From BofA: “…median family financial savings and checking balances stay nicely above their 2019 ranges for all generations.”

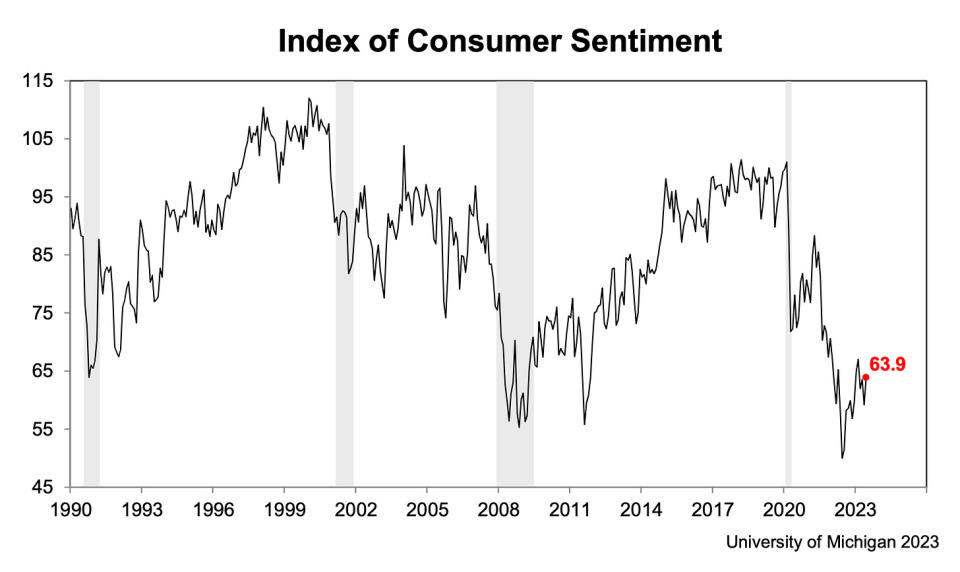

👍 Shopper sentiment is up. From the College of Michigan’s June Survey of Shoppers: “Shopper sentiment lifted 8% in June, reaching its highest stage in 4 months, reflecting higher optimism as inflation eased and policymakers resolved the debt ceiling disaster. The outlook over the economic system surged 28% over the quick run and 14% over the long term. Sentiment is now 28% above the historic low from a 12 months in the past and could also be resuming its upward trajectory since then.”

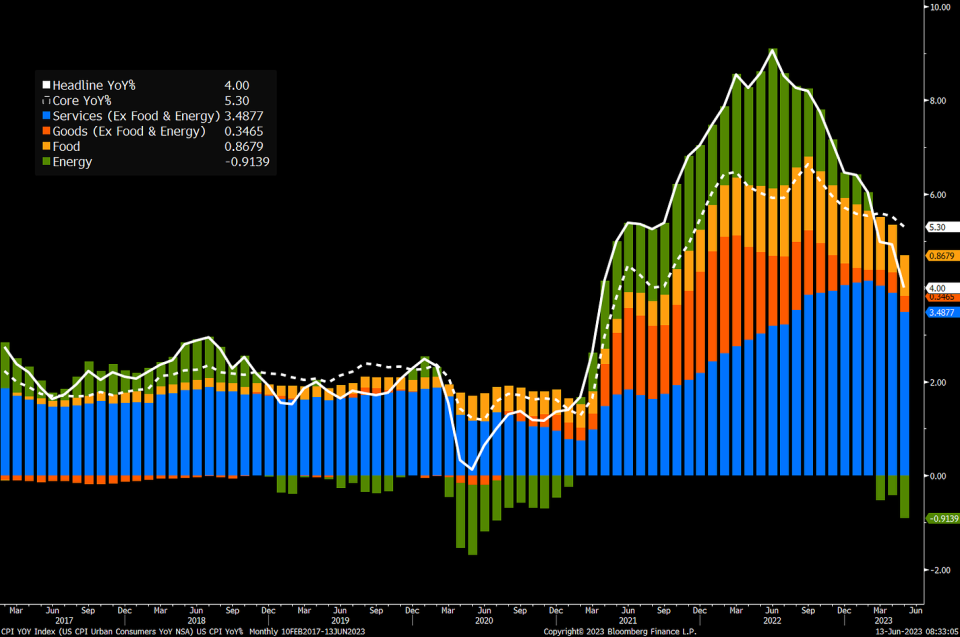

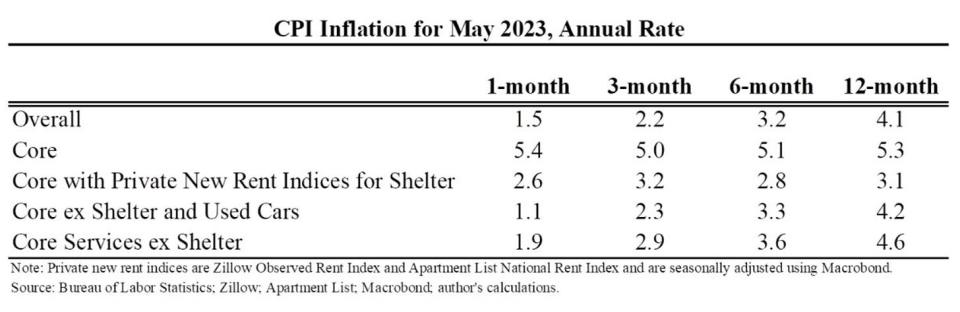

🎈 Inflation continues to chill. The Shopper Value Index (CPI) in Could was up 4.0% from a 12 months in the past, down from 4.9% in April. It was a file 11th straight month of decline, and it was the bottom studying since March 2021. Excluding meals and power costs, core CPI was up 5.3% from a 12 months in the past, down from 5.1% in April.

On a month-over-month foundation, CPI was up 0.1%, down from 0.4% the month prior as power costs tumbled. Core CPI was up 0.4%, unchanged from the month prior.

If you happen to annualize the three-month trend within the month-to-month figures, CPI is rising at a 2.2% charge and core CPI is climbing at a 5.0% charge.

Whereas inflation charges have usually been trending decrease, core measures of inflation proceed to be above the Federal Reserve’s goal charge of two%.

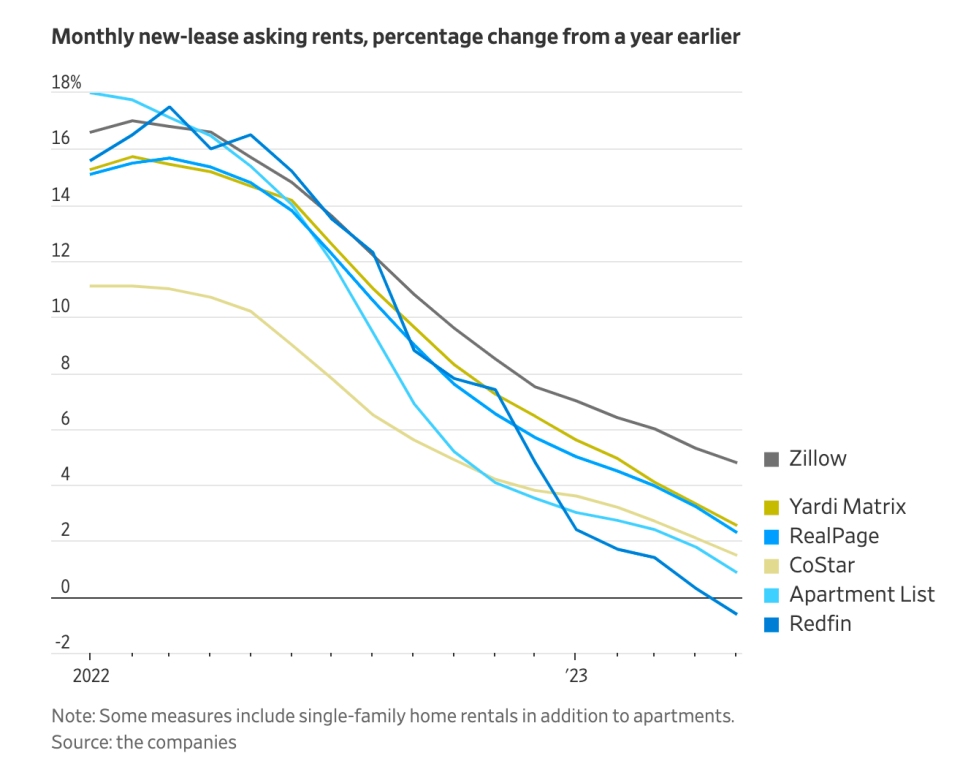

🏢 Rents are cooling. From the WSJ: “The common of six nationwide rental-price measures from rental-listing and property information corporations reveals new-lease asking rents rose just below 2% over the 12 months ending in Could. That’s down from the double-digit will increase of a 12 months in the past and represents the most important deceleration over any 12 months in latest historical past, in response to information agency CoStar Group and rental software program firm RealPage.”

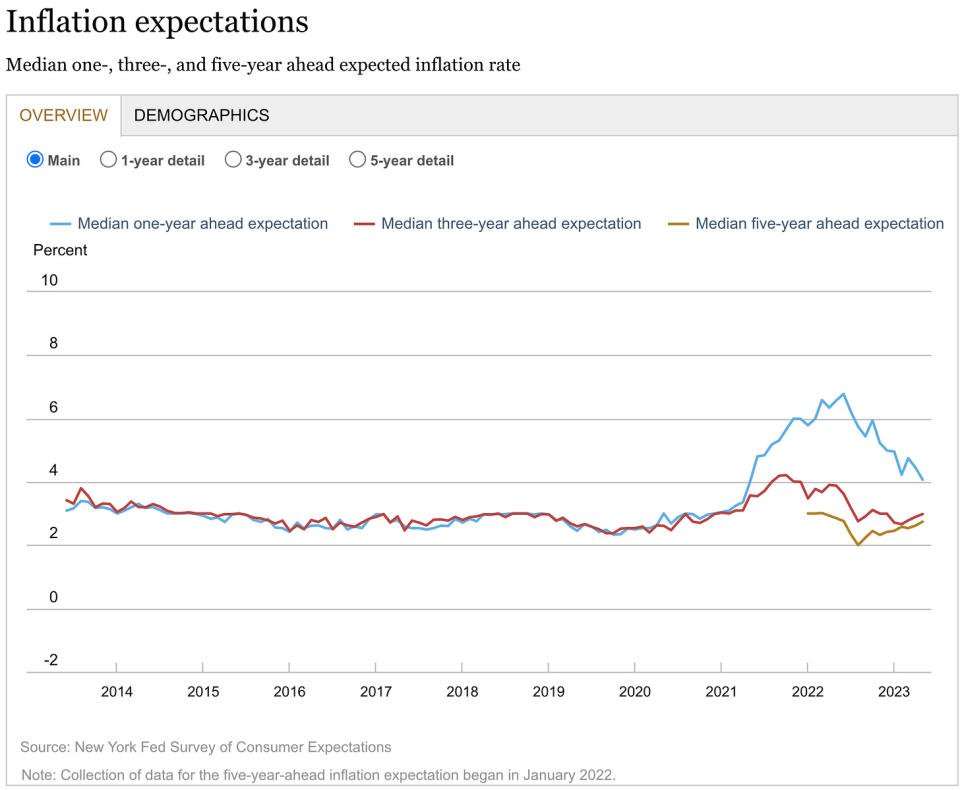

🤷🏻♂️ Shoppers’ outlook for inflation is combined. From the New York Fed’s Could Survey of Shopper Expectations: “Median inflation expectations declined by 0.3 share level on the one-year-ahead horizon to 4.1%, the bottom studying since Could 2021. In distinction, median inflation expectations elevated by 0.1 share level on the three- and five-year-ahead horizons to three.0% and a couple of.7%, respectively.”

From the College of Michigan’s June Survey of Shoppers: “Yr-ahead inflation expectations receded for the second consecutive month, falling to three.3% in June from 4.2% in Could. The present studying is the bottom since March 2021. In distinction, long-run inflation expectations had been little modified from Could at 3.0%, once more staying throughout the slender 2.9-3.1% vary for 22 of the final 23 months. Lengthy-run inflation expectations remained elevated relative to the two.2-2.6% vary seen within the two years pre-pandemic.”

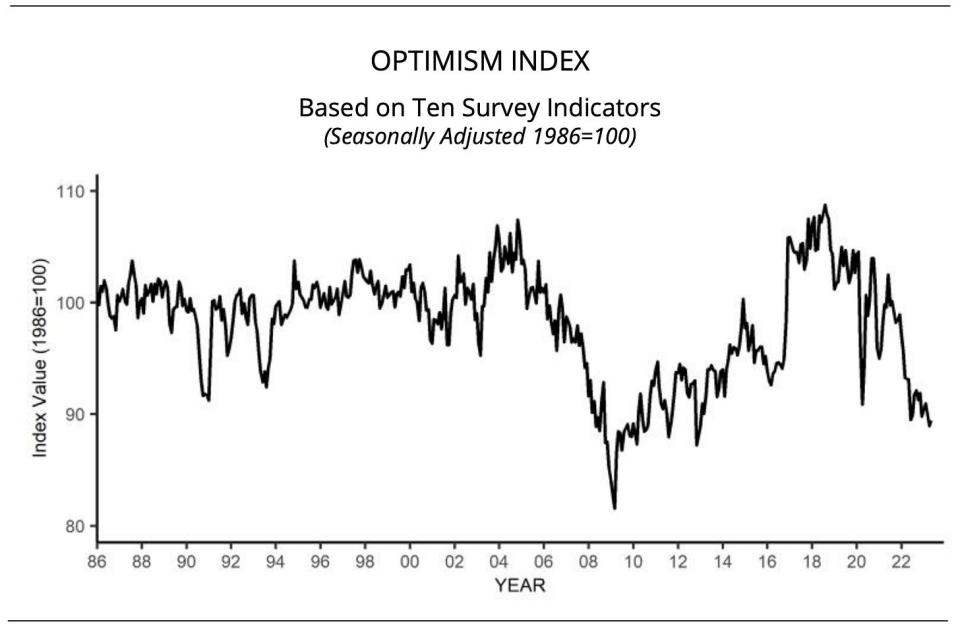

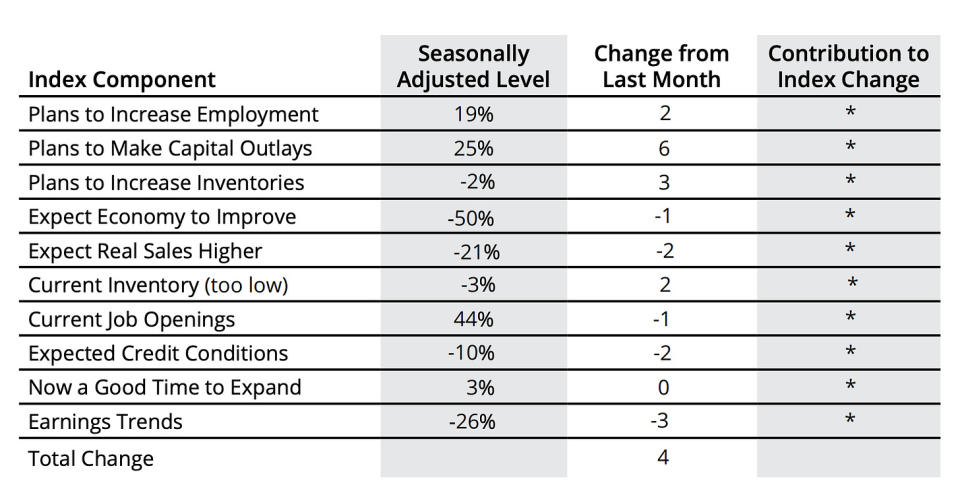

👍 Small enterprise sentiment ticks up. The NFIB’s Small Enterprise Optimism Index (by way of Notes) improved from depressed ranges in Could.

Strikes within the underlying parts of the index had been encouraging: Plans to extend employment improved, plans to make capital outlays jumped, and plans to extend inventories ticked increased.

Because the NFIB reveals, the extra tangible “exhausting” parts of the index have held up a lot better than the extra sentiment-oriented “gentle” parts.

Remember the fact that throughout occasions of stress, gentle information tends to be extra exaggerated than precise exhausting information.

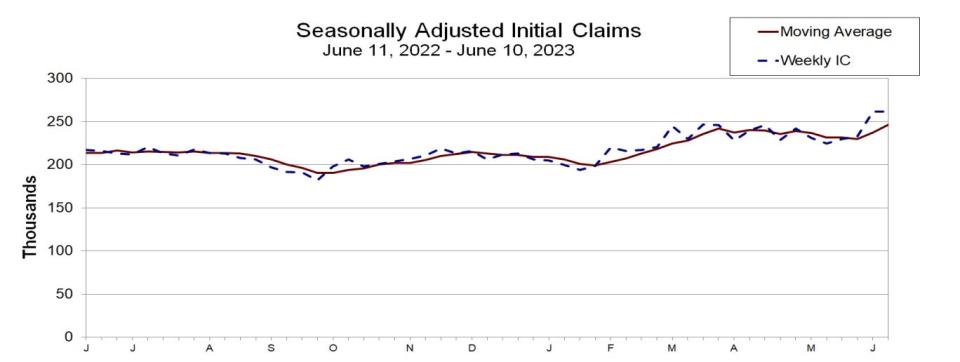

💼 Unemployment claims tick up. Preliminary claims for unemployment advantages stood at 262,000 through the week ending June 10, unchanged from the week prior. Whereas that is up from the September low of 182,000, it continues to pattern at ranges related to financial progress.

Relating to the rise, preliminary claims in Minnesota jumped by an outsized 3,664 through the interval. Right here’s Upjohn Institute economist Aaron Sojourner: “Minnesota had an unusually giant enhance into the prior week & a fairly large one this week, could also be partially attributable to a brand new regulation that expanded UI system to incorporate many college workers experiencing summer season layoff.”

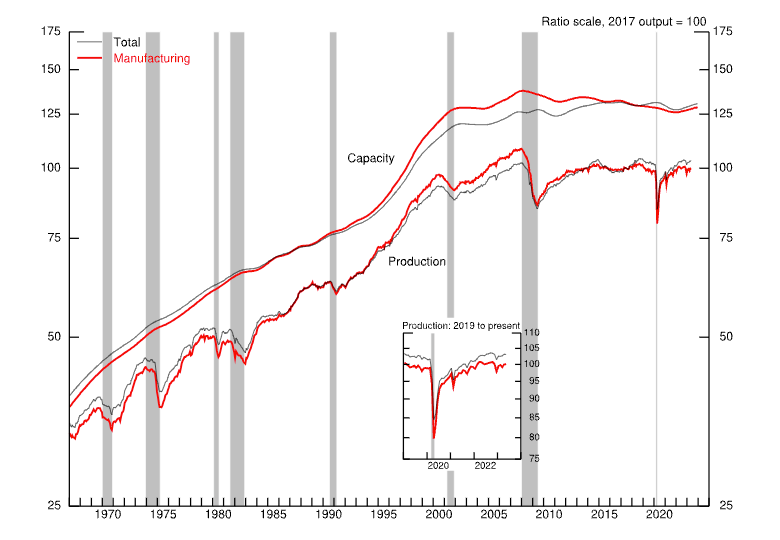

🛠️ Manufacturing output rises. Industrial manufacturing declined by 0.2% in Could. The carefully watched manufacturing output measure rose by 0.1%.

From Capital Economics: “Manufacturing output elevated by 0.1% m/m, which isn’t a lot, nevertheless it’s higher than we had been anticipating given the extreme weak spot evident within the survey-based exercise indicators.”

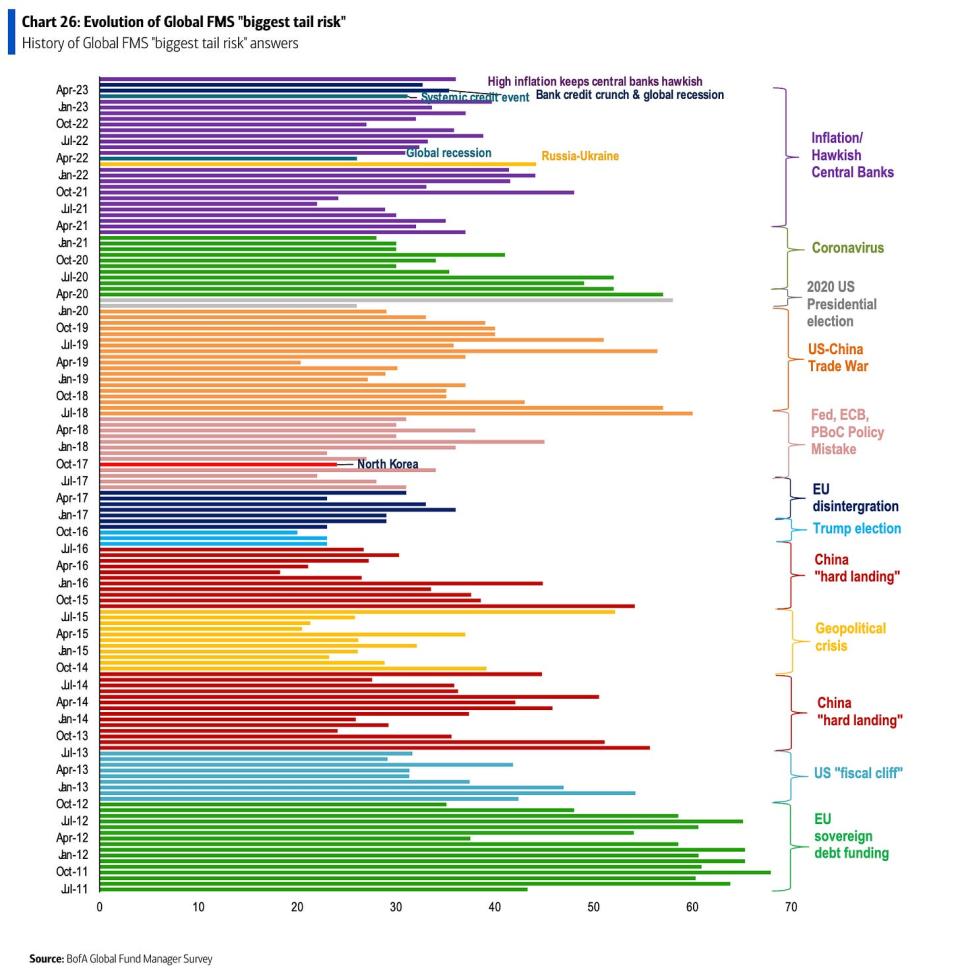

😬 The professionals are frightened about stuff. In accordance with BofA’s Could World Fund Supervisor Survey (by way of Notes), fund managers recognized central financial institution worries because the “largest tail threat.”

The reality is we’re all the time frightened about one thing. That’s simply the character of investing.

📈 Close to-term GDP progress estimates stay rosy. The Atlanta Fed’s GDPNow mannequin sees actual GDP progress climbing at a 1.8% charge in Q2. Whereas the mannequin’s estimate is off its excessive, it’s however very optimistic and up from its preliminary estimate of 1.7% progress as of April 28.

Placing all of it collectively 🤔

We proceed to get proof that we may see a bullish “Goldilocks” gentle touchdown state of affairs the place inflation cools to manageable ranges with out the economic system having to sink into recession.

The Federal Reserve lately adopted a much less hawkish tone, acknowledging on February 1 that “for the primary time that the disinflationary course of has began.” On Could 3, the Fed signaled that the tip of rate of interest hikes could also be right here. And at its June 14 coverage assembly, it saved charges unchanged, ending a streak of 10 consecutive charge hikes.

In any case, inflation nonetheless has to return down extra earlier than the Fed is snug with worth ranges. So we should always anticipate the central financial institution to maintain financial coverage tight, which suggests we needs to be ready for tight monetary circumstances (e.g. increased rates of interest, tighter lending requirements, and decrease inventory valuations) to linger.

All of this implies financial coverage might be unfriendly to markets in the interim, and the danger the economic system sinks right into a recession might be comparatively elevated.

BUT, we additionally know that shares are discounting mechanisms, that means that costs can have bottomed earlier than the Fed alerts a serious pivot in financial coverage.

Additionally, it’s essential to keep in mind that whereas recession dangers are elevated, customers are coming from a really sturdy monetary place. Unemployed individuals are getting jobs. These with jobs are getting raises. And lots of nonetheless have extra financial savings to faucet into. Certainly, sturdy spending information confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to show into financial calamity on condition that the monetary well being of customers and companies stays very sturdy.

And as all the time, long-term traders ought to keep in mind that recessions and bear markets are simply a part of the deal if you enter the inventory market with the purpose of producing long-term returns. Whereas markets have had a fairly tough couple of years, the long-run outlook for shares stays optimistic.

A model of this publish first appeared on TKer.com