With decades-long success on Wall Road, and private wealth valued at ~$6.5 billion, legendary inventory picker Ken Fisher clearly is aware of a factor or two about investing and what segments at the moment symbolize one of the best alternatives.

The Fisher Investments founder not too long ago shared his insightful advice for savvy traders, suggesting that investing in luxurious items shares may very well be a sensible and worthwhile transfer. Fisher believes that luxurious items corporations have a singular skill to thrive even throughout difficult financial instances. These corporations, identified for his or her premium manufacturers and top-notch craftsmanship, have a tendency to draw a devoted buyer base that values exclusivity and high quality.

“Occasions are good for world luxurious items,” Fisher mentioned. “Heated inflation didn’t dent their sturdy gross revenue margins, which have remained above 55 per cent since 2021.”

There are different optimistic developments occurring too. Regardless of issues of a stalling financial restoration, huge French and Swiss corporations have been racking up sturdy gross sales in China, and as wealth in India spreads wider, huge world names at the moment are penetrating there too, inflicting a “luxurious items spending increase.”

“Go searching you within the Center East and North Africa,” he goes on so as to add. “The large world manufacturers are increasing all over the place, notably within the UAE.”

With that in thoughts, then, we opened the TipRanks database and bought the lowdown on two luxurious items names well liked by sure Wall Road analysts, who see each having loads of room to run within the coming months. Let’s see what makes them interesting funding selections proper now.

Tapestry, Inc. (TPR)

The primary identify we’ll have a look at is Tapestry, a famend luxurious model that has cemented to position as a worldwide chief within the vogue and equipment business. Tapestry operates three distinct labels: Coach, Kate Spade New York, and Stuart Weitzman. Every model brings its personal factor to the market, catering to completely different segments of its luxurious shopper base.

Flagship model Coach combines traditional parts with fashionable touches, interesting to each women and men in search of out elegant and purposeful items. Kate Spade New York, however, is understood for its playful and vibrant method, whereas Stuart Weitzman is acknowledged for its high-quality footwear.

Regardless of a slowdown of luxurious purchases within the US, boosted by gross sales in China rising by 20%, the corporate delivered a robust top-line in its newest quarterly report, for the fiscal third quarter of 2023 (March quarter). In whole, income climbed by 5% year-over-year to $1.51 billion, while beating the Road’s forecast by $70 million. Likewise on the profitability profile, EPS of $0.78 trumped the analysts’ $0.60 forecast.

The corporate additionally elevated its outlook for the fiscal 12 months. The corporate now expects income progress of three% in comparison with 2% to three% beforehand and anticipates delivering a revenue of $3.85 to $3.90 a share, vs. the prior $3.75. Moreover, Tapestry stays on track to repurchase round $700 million in widespread inventory within the present fiscal 12 months.

All the above posits Tapestry as his “Business Child,” says Guggenheim analyst Robert Drbul.

“We imagine excessive profitability, skilled administration, robust steadiness sheet, and wholesome model fairness of the Coach model deserves a seat on the luxurious and accessible luxurious desk,” the analyst defined. “We anticipate this administration crew to proceed to execute in opposition to its FY25 $5.00+ EPS goal and imagine there’s vital potential share worth upside from present ranges. We stay assured in administration’s skill to execute its technique, which we might anticipate to drive vital a number of enlargement. Whereas we’re conscious of recessionary issues, we imagine this administration crew and portfolio of manufacturers has the flexibility to climate the downturns.”

Placing these ideas into gradings and numbers, Drbul charges Tapestry shares a Purchase, backed by a $60 worth goal. This means the shares will climb 38% larger over the approaching months. (To observe Drbul’s observe document, click on right here)

Most analysts agree with Drbul’s take. The inventory claims a Robust Purchase consensus ranking, based mostly on 10 Buys vs. 3 Holds. At $51.27, the typical goal makes room for one-year features of ~18%. As an added bonus, Tapestry additionally pays out a dividend. The present quarterly payout stands at $0.30 and yields 2.65%. (See Tapestry inventory forecast)

Capri Holdings (CPRI)

We’ll keep in the identical neighborhood for our subsequent luxurious model identify. Capri Holdings is a number one world vogue luxurious group with three iconic manufacturers working below its umbrella: Michael Kors, Versace, and Jimmy Choo. This firm has additionally established a robust presence within the luxurious vogue business and is well-known for its craftsmanship, glamour and innovation. Every model within the portfolio has its distinct identification and affords a variety of merchandise, together with attire, equipment, footwear, and fragrances.

That mentioned, revenues fell throughout the board within the newest quarterly readout, for the fiscal fourth quarter of 2023 (March quarter). With its manufacturers seeing year-over-year declines, whole income dropped by 10.1% to $1.34 billion. Nonetheless, the drop was anticipated on the Road and the determine truly managed to beat expectations by $60 million. On the different finish of the spectrum, adjusted earnings per share of $0.97 met the prognosticators’ forecast.

Shifting ahead, Capri sees full-year F2024 income of ~$5.7 billion, a contact beneath consensus at $5.73 billion. Then again, the estimated EPS of $6.40 is larger than the Road’s $6.28 forecast.

Regardless of the luxurious model section’s success this 12 months, Capri inventory has been excluded from the rally and is down by 36%. However, following talks with administration, BMO analyst Simeon Siegel thinks the shares’ valuation is means too low, and he believes they provide good worth at present ranges.

“Our latest administration conferences addressed matters together with steerage puts-and-takes, pricing/GM, brand-strategy, stock and capital allocation,” Siegel mentioned. “Administration expressed confidence in steerage given self-help (staffing/product initiatives and so on) and easing compares. CPRI’s one among our greatest ‘guide-beaters’ however, to be truthful, their ‘reiterated’ guides have additionally seen subsequent cuts. Nonetheless, we imagine it shouldn’t matter as shares are already pricing significant cuts/miss. We commend administration’s concentrate on sustaining model fairness, imagine shares cheap and reiterate our Outperform ranking given intrinsic worth mismatch.”

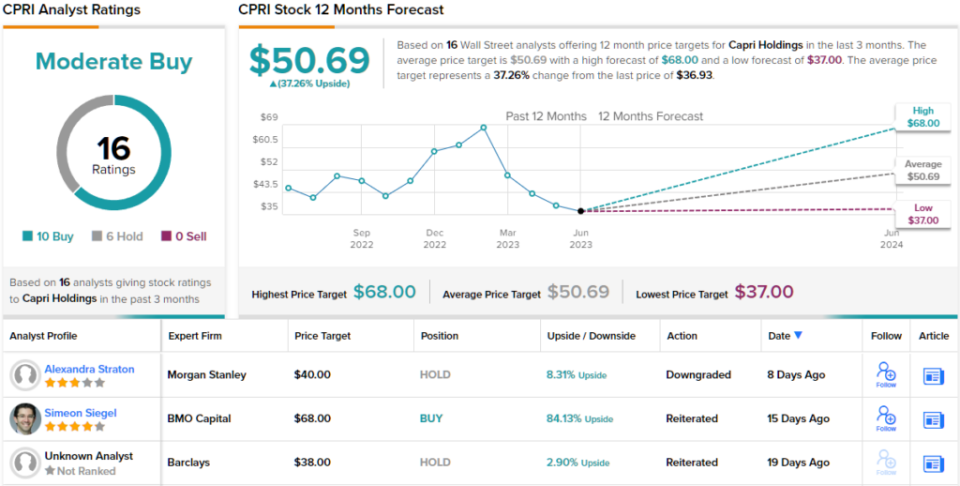

That Outperform (i.e., Purchase) ranking comes alongside a $68 worth goal, which means shares will put up progress of 84% over the one-year timeframe. (To observe Siegel’s observe document, click on right here)

Elsewhere on the Road, the inventory garners a further 9 Buys and 6 Holds for a Average Purchase consensus ranking. Going by the $50.69 common goal, a 12 months from now, traders will probably be pocketing returns of 37%. (See CPRI inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your personal evaluation earlier than making any funding.