-

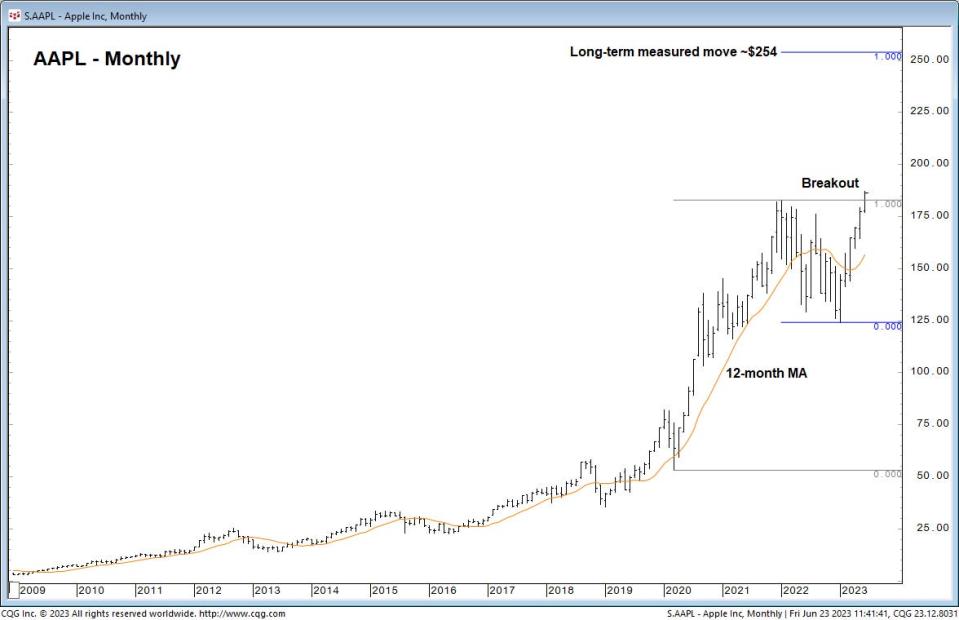

Apple inventory may see huge upside forward after it confirmed its breakout above the prior report excessive of $183, in accordance with Fairlead Methods.

-

Shares may bounce 37% from present ranges to $254 by the top of 2024.

-

“The uptrend [in Apple] reveals no counter-trend indicators but,” Fairlead Methods stated.

Apple inventory decisively confirmed its breakout to new report highs on Friday, and that would pave the best way for extra upside into 2024, in accordance with a Friday notice from Fairlead Methods.

The agency highlighted that with Apple inventory buying and selling at $187 Friday afternoon, the inventory is poised to shut above its prior resistance stage of $183 for the second week in a row, confirming a decisive breakout.

This “bullish long-term growth” generates a brand new value goal of $254 per share for Apple, representing potential upside of 37% from present ranges. An increase to that stage would give the iPhone maker a market valuation of about $4 trillion based mostly on at this time’s present shares excellent of 15.79 billion.

“The breakout yields a measured transfer goal of about $254 utilizing the Covid/2020 corrective low as a degree of reference,” Fairlead Methods’ founder Katie Stockton instructed Insider on Friday. “The ‘measured transfer’ assumes that the uptrend that preceded the 2021-2022 buying and selling vary has resumed.”

Stockton recognized the top of 2024 because the timeframe for the technical value goal to be reached, and famous that the inventory’s uptrend appears to be like poised to proceed within the brief time period.

“The uptrend reveals no counter-trend indicators but. When a pullback develops, preliminary help is on the rising 20-day shifting common… though a pullback doesn’t seem imminent,” she stated. The 20-day shifting common for Apple inventory is presently round $181 per share.

Apple inventory has surged 44% up to now in 2023 and has pushed the majority of the S&P 500’s year-to-date acquire of about 14%. The corporate not too long ago introduced its first product within the AR/VR market, the Apple Imaginative and prescient headset, which is able to promote for $3,499 when it’s launched early subsequent 12 months.

Apple’s present valuation is about $2.96 trillion, and it is set to cross the $3 trillion threshold if the inventory value hits $190.73, which is simply over $3 away from present ranges.

Learn the unique article on Enterprise Insider