Power shares ended the week on a optimistic observe, with the power sector ETF, the XLE, closing out Friday’s buying and selling up by over 2%, its largest one-day uptick in a month. In latest instances there have been uncertainties relating to international demand, however there could also be purpose to consider that the oil market is beginning to present indicators of tightening.

Shares of power companies pushed larger within the session, however the query is, which shares are set for additional positive factors? A dive into the info will assist us type out the most probably winners on this sector – and that brings us to the Good Rating.

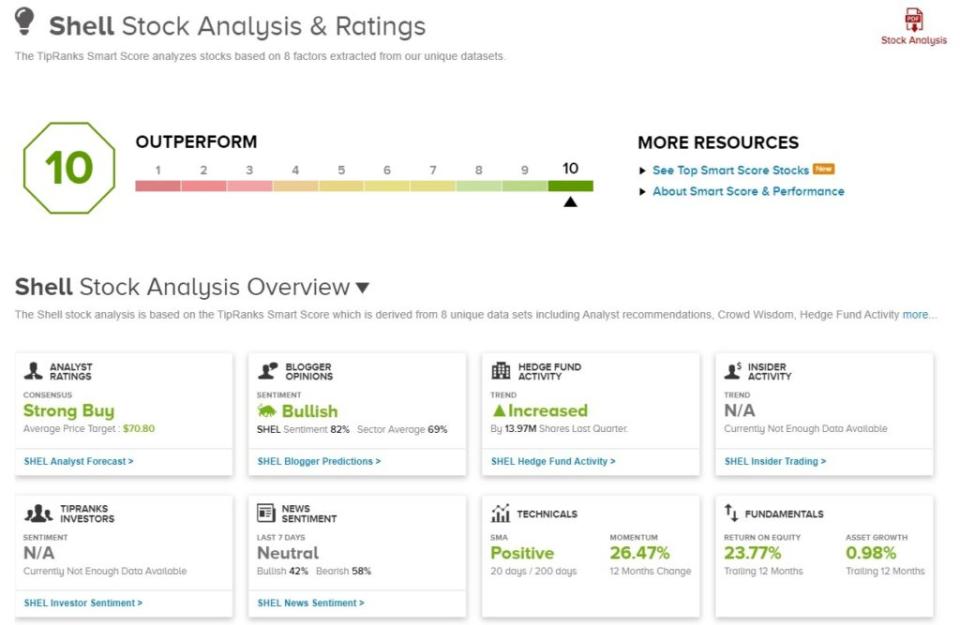

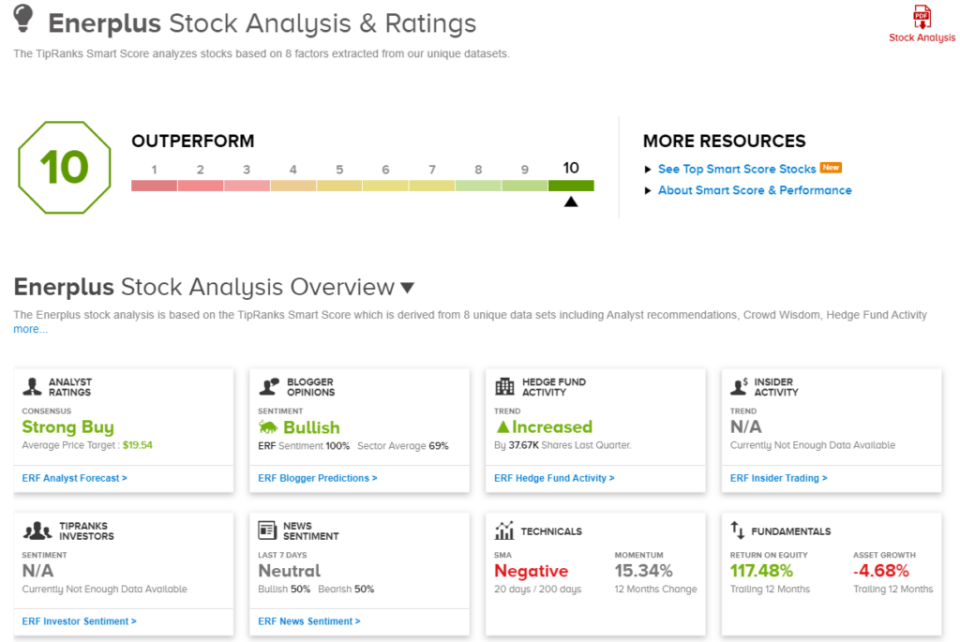

The Good Rating makes use of refined AI information algorithms to measure each publicly traded inventory in accordance a set of things recognized to contribute to ahead outperformance, after which it collates these measurements and provides every inventory a single-digit rating, on a scale of 1 to 10, indicating the shares’ doubtless path for the near-term. It feels like a mouthful, however what it comes all the way down to is straightforward: a inventory that ticks all of the containers with a ‘Excellent 10’ on the Good Rating deserves a more in-depth look.

So we’ve taken a more in-depth have a look at two power shares which have earned that ‘Excellent 10.’ Listed here are their particulars, together with feedback from the Road’s analysts.

Shell (SHEL)

We’ll get began with a large of the power trade, Shell Oil. This British-based oil and gasoline manufacturing firm is likely one of the world’s largest, when counted by complete income or by property – Shell completed final 12 months with $443 billion in complete property, and greater than $380 billion annual revenues. The corporate has significantly robust positions within the liquified pure gasoline sector, the deep water exploration and extraction enterprise, and the shale oil and gasoline extraction phase. The primary of those is a serious enterprise, particularly within the international commerce for pure gasoline; the latter two are vital operations within the extraction of fossil gas power from less-accessible sources and formations.

Shell’s general enterprise is split into 4 segments, upstream, built-in gasoline, renewables & power options, and downstream. On the B2C finish, Shell gives direct power supply, together with fuels, to greater than 32 million prospects. As well as, the corporate has a initiatives & expertise division engaged on progressive new initiatives in power expertise, in addition to enhancements within the technical capabilities that underpin the corporate’s operations.

For the final reported quarter, 1Q23, Shell noticed a prime line of $86.96 billion. Whereas down from $101.3 billion within the earlier quarter, the Q1 prime line was up 3.27% year-over-year. The corporate’s bottom-line adjusted earnings got here to $9.65 billion, or an adjusted non-GAAP EPS of $1.39. The EPS determine was flat quarter-over-quarter, and was up 19 cents year-over-year.

Whereas Shell’s money era was down year-over-year, the corporate nonetheless generated robust money leads to Q1. The money circulate from operations was reported at $14.16 billion, for a 4.4% y/y decline, whereas the free money circulate was listed as $9.9 billion, down 6% from the prior 12 months. The corporate’s money circulate supported the dividend fee, of 57.5 cents per American depositary share. This gives a 3.67% yield.

Shell’s ‘Excellent 10’ from the Good Rating is predicated on optimistic metrics nearly all throughout the board. Of explicit observe, we’ll level out the blogger sentiment, which is 82% optimistic, the gang knowledge, which is optimistic and based mostly on a 2.2% improve in personal holdings over the previous 30 days, some sound technical and basic components: a 26% 12-months-change momentum, and a 23% trailing-12-month return on fairness.

Masking this inventory for Goldman, analyst Michele Della Vigna lays out the explanations for his bullish stance on this power large. He writes, “Ongoing capital self-discipline has aided the repositioning of Shell’s upstream portfolio larger on the profitability value curve. We count on this optimistic pattern to proceed, pushed by materials upside to operational efficiency in each deepwater (Brazil and GoM) and LNG asset uptime. Leveraging our Prime Initiatives evaluation, robust pipeline of oil & gasoline initiatives may also help maintain excessive money flows for plenty of European Large Oils, with Shell screening amongst the most effective on manufacturing and money circulate uplift over the following 4 years.”

Wanting ahead, Della Vigna charges SHEL inventory as a Purchase, with a worth goal of $83 per American depositary share suggesting a 39% one-year upside potential. (To look at Della Vigna’s monitor document, click on right here.)

The ten latest analyst critiques on SHEL, with a 9 to 1 breakdown favoring Purchase over Maintain and a Sturdy Purchase consensus score, present that the Road is bullish right here. The inventory’s common worth goal of $71.18 implies a 19% one-year achieve from the present buying and selling worth of $59.65. (See Shell’s inventory forecast.)

Enerplus (ERF)

Enerplus, the second inventory we’re taking a look at, began out as Canada’s first oil and gasoline royalty belief, and at the moment holds a powerful place as an unbiased exploration and manufacturing firm working within the Bakken-Three Forks mild oil shale play of North Dakota. This formation has, within the final 15 years, develop into one of many richest manufacturing areas in North America, and has powered robust financial development in each North and South Dakota.

The corporate holds roughly 235,600 internet acres within the North Dakota reaches of the Bakken, making this the most important of the corporate’s holdings. As well as, Enerplus has 32,500 internet acres within the Marcellus shale, the key Appalachian dry gasoline manufacturing area of Pennsylvania. Final 12 months, Enerplus noticed 65,370 barrels of oil equal every day manufacturing from the Bakken place, and 169 MMcf per day of dry gasoline manufacturing from the Marcellus. Whole 2022 manufacturing got here to 100,326 barrels of oil equal per day, of which 39% was pure gasoline and 61% was crude oil and pure gasoline liquids.

Manufacturing on that scale will generate stable monetary outcomes, and Enerplus noticed revenues of $441 million within the first quarter of this 12 months. This was up from $306 million in 1Q22, for a 44% y/y improve. On the backside line, Enerplus had a internet earnings of $137.5 million for Q1, or 63 cents per share. This was a powerful enchancment from the year-ago quarter’s 14-cent EPS determine. As well as, 1Q23’s EPS got here in 2 cents forward of the forecasts.

Enerplus additionally has taken a number one place within the ESG area. That is basically a measure of ‘good company citizenship,’ and Enerplus has initiatives to advertise well being and security at work, together with good environmental stewardship. The corporate has developed a Social and Governance Coverage to make sure these initiatives whereas sustaining regulatory compliance and stakeholder earnings.

On that ‘Excellent 10’ Good Rating, ERF shares profit from solidly bullish – 100% optimistic – sentiment from the monetary bloggers. As well as, the inventory’s trailing 12-month return on fairness was over 117%, and the hedges tracked by TipRanks elevated their holdings in ERF by 37,700 shares final quarter.

Within the eyes of Mike Murphy, 5-star analyst from BMO, Enerplus has a lot to supply buyers. Murphy is especially impressed by the corporate’s capital returns, in addition to its potential to develop its place within the Bakken. Murphy writes, “We proceed to view Enerplus as effectively positioned to ship on its return of capital initiatives, with Bakken-focused M&A optionality within the close to to medium time period… We view Enerplus as an outperformer relative to the remainder of the Canadian E&P names from an ESG perspective. The corporate ranks favorably from an emissions depth perspective and in variety metrics.”

Murphy enhances his feedback with an Outperform (Purchase) score, and a $19 worth goal that means a possible achieve of 29% on the one-year time horizon. (To look at Murphy’s monitor document, click on right here.)

There are 5 latest analyst critiques of Enerplus shares, together with 4 to Purchase and 1 to Maintain – giving the inventory a Sturdy Purchase consensus score. The shares are promoting for $14.72, and their $19.54 common worth goal is considerably extra bullish than Murphy’s, suggesting a 33% one-year upside. (See Enerplus’s inventory forecast.)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your individual evaluation earlier than making any funding.