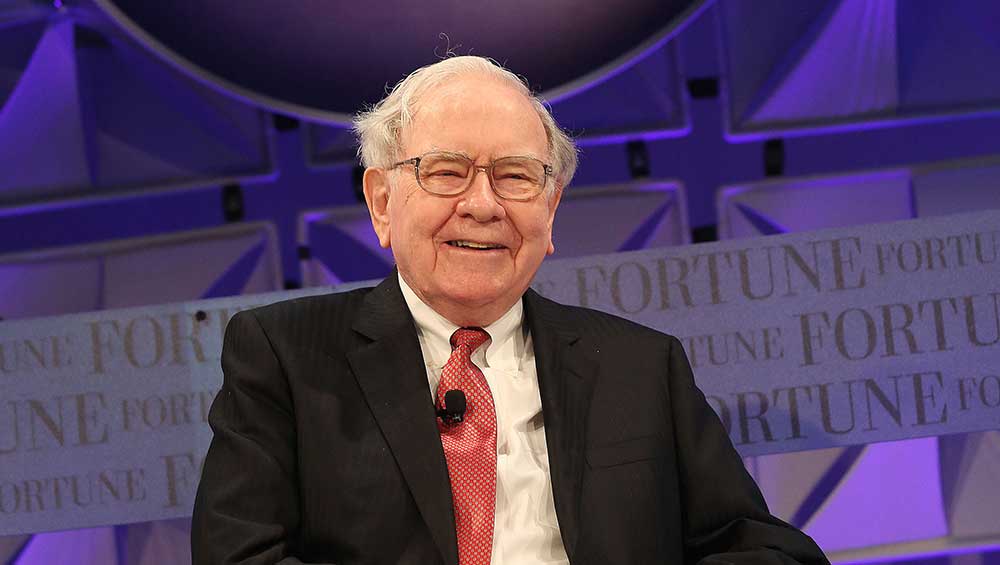

Warren Buffett added to his wager on liquefied pure fuel late Monday, with Berkshire Hathaway (BKRA) agreeing to purchase Dominion Power‘s (D) share of the Maryland-based Cove Level LNG export plant in a $3.3 billion deal.

X

Buffett’s Berkshire Hathaway Power introduced Monday it’s buying Dominion Power’s 50% stake within the Cove Level LNG terminal. The greater than $3 billion deal will deliver Buffett’s share within the LNG export facility to 75%. Brookfield Asset Administration (BAM) owns the opposite 25%.

The sale is topic to clearance beneath the Hart-Scott-Rodino Act and a submitting with the U.S. Division of Power, with anticipated closing by the top of the 12 months.

Morgan Stanley analyst David Arcaro wrote Tuesday the deal was round $1 billion lower than the agency anticipated.

Dominion Power inventory gained 0.8% to 51.99 Tuesday throughout market commerce. On Monday, D shares fell 1.3% to 51.58.

Warren Buffett Provides LNG Asset

The choice by Warren Buffett’s firm to up its possession in one in all seven operational U.S. LNG export terminals comes as U.S. pure fuel costs have dropped significantly in comparison with final 12 months.

U.S. pure fuel futures gained round 1.7% Tuesday to $2.70 per million British thermal models. Costs are down round 60% from the identical time final 12 months when futures spiked to 14-year highs as Russia’s invasion of Ukraine sparked fears of an power disaster in Europe.

The U.S. Power Info Administration reported final week common front-month futures costs for LNG cargoes in East Asia have been $12.14 per million British thermal models, down 68% in comparison with final 12 months. In the meantime, pure fuel futures for supply on the Title Switch Facility (TTF) within the Netherlands averaged $11.22 per million British thermal models, a 76% drop vs. 2022.

The Cove Level LNG terminal has a storage capability of 14.6 billion cubic toes (bcf/d). Its every day export capability is 1.8 bcf/d, a bit lower than 14% of whole U.S. LNG export capability.

“We’re happy with our operations at Cove Level and are excited for this chance to extend our possession in these world-class services,” Berkshire Hathaway Power Gasoline Transmission and Storage President Paul Ruppert mentioned in a press release.

In the meantime, Dominion Power mentioned in a press release the corporate will use the $3 billion from the deal to repay debt.

“This funding is noncore to Dominion Power as we deal with our state-regulated utility operations,” Dominion Power Chief Govt Robert Blue mentioned in a press launch. “This sale offers us the chance to cut back variable price debt per our purpose of strengthening our steadiness sheet.”

Buffett Making Oil And Gasoline Investments

Warren Buffett has continued so as to add oil and pure fuel investments to Berkshire’s holdings in 2023.

On June 28, Buffett introduced Berkshire bought a further 2.14 million shares of Occidental Petroleum (OXY) in three days. Berkshire purchased OXY at costs between 57.01-57.17.

The OXY purchases introduced Berkshire’s whole stake within the Houston-based power firm to 25%.

On Might 30, Buffett disclosed he bought 4.66 million OXY shares for about $275 million over Might 25-30.

Berkshire additionally holds a stake in Dow Jones power large Chevron (CVX). Buffett offered round $6 billion value of Chevron inventory within the first quarter, in response to Berkshire’s Q1 monetary report. Buffett’s outfit reported lowering CVX holdings to $21.6 billion as of March 31.

Warren Buffett started shopping for the Dow Jones inventory in 2020. Previous to Buffett’s Q1 choice to promote, Berkshire Hathaway amassed a stake totaling 167 million CVX shares, value round $29 billion.

OXY jumped 3.1% Tuesday as oil costs rebounded towards the highest of their current buying and selling vary. CVX added 1.8% Tuesday.

Please comply with Equipment Norton on Twitter @KitNorton for extra protection.

YOU MAY ALSO LIKE:

Get An Edge In The Inventory Market With IBD Digital

Tesla Inventory In 2023: The EV Big Faces Totally different Challenges In Its Two Megamarkets

Tesla Is Shifting Greater, However Is It A Purchase?

Labor Unions Preserve The Warmth On Starbucks And Amazon

Futures: Market Reveals Broad Energy; 11 Shares Flash Purchase Indicators