(Bloomberg) — In all places you flip, the most important gamers within the $23.7 trillion US Treasuries market are in retreat.

Most Learn from Bloomberg

From Japanese pensions and life insurers to overseas governments and US industrial banks, the place as soon as they had been lining as much as get their fingers on US authorities debt, most have now stepped away. After which there’s the Federal Reserve, which a couple of weeks in the past upped the tempo that it plans to dump Treasuries from its stability sheet to $60 billion a month.

If one or two of those often steadfast sources of demand had been bailing, the impression, whereas noticeable, would probably be little trigger for alarm. However for each one in every of them to tug again is an simple supply of concern, particularly approaching the heels of the unprecedented volatility, deteriorating liquidity and weak auctions of latest months.

The upshot, in accordance with market watchers, is that even with Treasuries tumbling probably the most since a minimum of the early Nineteen Seventies this yr, extra ache could also be in retailer till new, constant sources of demand emerge. It’s additionally unhealthy information for US taxpayers, who will finally need to foot the invoice for greater borrowing prices.

“We have to discover a new marginal purchaser of Treasuries as central banks and banks total are exiting stage left,” mentioned Glen Capelo, who spent greater than three many years on Wall Avenue bond-trading desks and is now a managing director at Mischler Monetary. “It’s nonetheless not clear but who that might be, however we all know they’re going to be much more worth delicate.”

Treasuries dropped once more on Tuesday in Asia. The yield on 30-year US bonds jumped 9 foundation factors to three.94%, the best since 2014, whereas that on 10-year notes climbed seven foundation factors to three.95%.

To make certain, many have predicted Treasury-market routs over the previous decade, just for patrons (and central bankers) to swoop in and help the market. Certainly, ought to the Fed pivot away from its hawkish coverage tilt as some are wagering, the temporary rally in Treasuries final week could also be only the start.

Analysts and buyers say that with the quickest inflation in many years hamstringing the flexibility of officers to loosen coverage within the close to time period, this time is prone to be a lot totally different.

‘Large Premium’

The Fed, unsurprisingly, represents the most important lack of demand. The central financial institution greater than doubled it’s debt portfolio within the two years by early 2022, to in extra of $8 trillion.

The sum, which incorporates mortgage-backed securities, could fall to $5.9 trillion by mid-2025 if officers keep on with their present roll-off plans, Fed estimates present.

Whereas most would agree that lessening the central financial institution’s market-distorting affect is wholesome in the long term, it nonetheless is a stark reversal for buyers who’ve grown accustomed to the Fed’s outsized presence.

“For the reason that yr 2000, there has at all times been a giant central financial institution on the margin shopping for loads of Treasuries,” Credit score Suisse Group AG’s Zoltan Pozsar mentioned throughout a latest dwell episode of Bloomberg’s Odd Heaps podcast.

Now “we’re principally anticipating the non-public sector to step in as an alternative of the general public sector, in a interval the place inflation is as unsure because it has ever been,” Pozsar mentioned. “We’re asking the non-public sector to take down all these Treasuries that we’re going to push again into the system, with out a glitch, and with out a large premium.”

Nonetheless, if it was simply the Fed — with its long-telegraphed balance-sheet runoff — reversing course, market angst can be far more restricted.

It’s not.

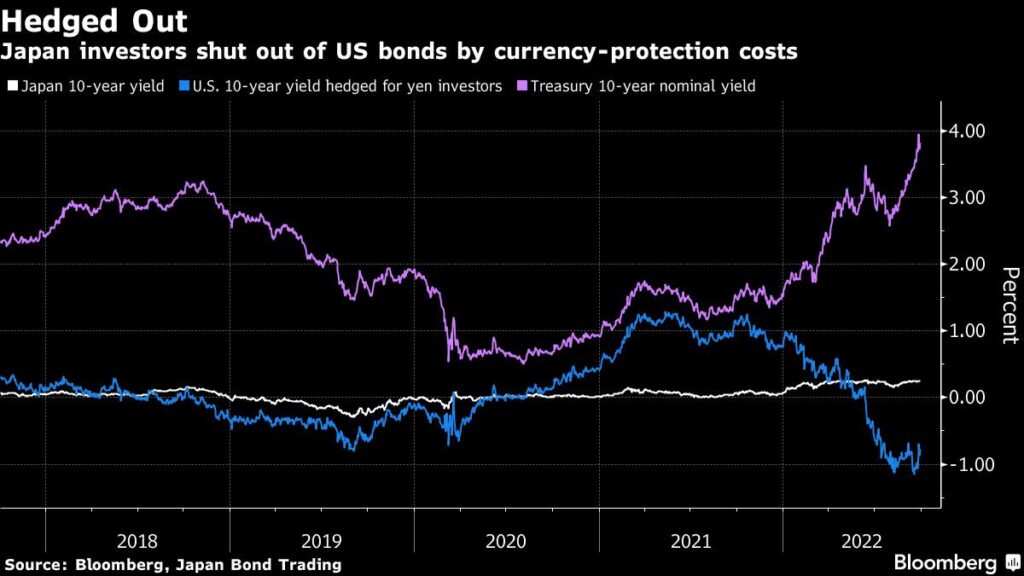

Prohibitively steep hedging prices have basically frozen Tokyo’s large pension and life insurance coverage firms out of the Treasury market as properly. Yields on US 10-year notes have slumped properly beneath zero for Japanese patrons who pay to remove foreign money fluctuations from their returns, at the same time as nominal charges have jumped above 4%.

Hedging prices have surged in tandem with the greenback, which has climbed greater than 25% this yr versus the yen, probably the most in knowledge compiled by Bloomberg going again to 1972.

Because the Fed has continued to spice up charges to tame inflation in extra of 8%, Japan in September intervened to help its foreign money for the primary time since 1998, elevating hypothesis the nation might have to begin promoting its hoard of Treasuries to additional prop up the yen.

And it’s not simply Japan. International locations world wide have been working down their foreign-exchange reserves to defend their currencies in opposition to the surging greenback in latest months.

Rising-market central banks have trimmed their stockpiles by $300 billion this yr, Worldwide Financial Fund knowledge present.

Which means restricted demand at greatest from a bunch of price-insensitive buyers that historically put about 60% or extra of their reserves into US greenback investments.

Peter Boockvar, chief funding officer at Bleakley Monetary Group, mentioned Monday it’s harmful to only assume that the US Treasury will “finally discover patrons to take the place of the Fed, foreigners and the banks.”

Citigroup Inc. flagged concern that the drop in overseas central financial institution holdings could set off contemporary turmoil, together with the potential for so-called value-at-risk shocks when sudden market losses power buyers to quickly liquidate positions.

Buyers ought to guess on a drop in swap spreads “to place for continued CB promoting and for additional dash-for-cash fashion liquidity occasions,” Jason Williams, a Citigroup strategist, wrote in a report. VaR-shock-type occasions are extra probably “given Fed dangers are nonetheless pointed hawkish,” in accordance with the report.

Banks Bail

Over the previous decade, when one or two key patrons of Treasuries has seemingly backed away, others have been there to select up the slack.

That’s not what’s occurring this go round, in accordance with JPMorgan Chase & Co. strategist Jay Barry.

Demand from US industrial banks has dissipated as Fed coverage tightening drains reserves out of the monetary system. Within the second quarter, banks bought the least quantity of Treasuries for the reason that closing three months of 2020, Barry wrote in a report final month.

“The drop in financial institution demand has been beautiful,” he mentioned. “As deposit progress has slowed sharply, this has diminished financial institution demand for Treasuries, notably because the period of their property have prolonged sharply this yr.”

All of it provides as much as a bearish undertone for charges, Barry mentioned.

The Bloomberg US Treasury Whole Return Index has misplaced about 13% this yr, virtually 4 instances as a lot as in 2009, the worst full yr consequence on document for the gauge since its 1973 inception.

But because the structural help for Treasuries offers manner, others have stepped in to select up the slack, albeit at greater charges. “Households,” a catch-all group that features US hedge funds, noticed the most important leap in second-quarter Treasury holdings amongst investor sorts tracked by the Fed.

Some see good motive for personal buyers to seek out Treasuries enticing now, particularly given the danger of Fed coverage tightening tipping the US right into a recession, and with yields at multidecade highs.

“The market remains to be attempting to evolve and work out who these new finish patrons are going to be,” mentioned Gregory Faranello, head of US charges buying and selling and technique for AmeriVet Securities. “In the end I feel it’s going to be home accounts, as a result of rates of interest are shifting to a degree the place they’re going to be very enticing.”

John Madziyire, a portfolio supervisor at Vanguard Group Inc., mentioned massive swimming pools of extra financial savings held at US banks incomes subsequent to nothing will immediate “individuals to shift into the short-end of the Treasury market.”

“Valuations are good with the Fed getting nearer to the tip of its present mountaineering cycle,” Madziyire mentioned. “The query is whether or not you’re prepared to take period threat now or keep within the front-end till the Fed reaches its coverage peak.”

Nonetheless, most see the backdrop favoring greater yields and a extra turbulent market. A measure of debt-market volatility surged in September to the best degree for the reason that world monetary disaster, whereas a gauge of market depth just lately hit the worst degree for the reason that onset of the pandemic.

“The Fed and different central banks had for years been those suppressing volatility, and now they’re truly those creating it,” Mischler’s Capelo mentioned.

(Updates so as to add costs in sixth paragraph, and feedback from Citigroup in twenty second and twenty third)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.