With the second half of 2023 nicely underway, it’s a good time to evaluate the present state of the inventory market and look at which equities analysts are deciding on as their ‘High Picks’ for the rest of the 12 months.

The analysts have analyzed every inventory, bearing in mind its previous and present efficiency, traits throughout varied time frames, in addition to administration’s plans. They think about each side earlier than making their suggestions, which provide worthwhile steering for establishing a resilient portfolio.

A number of of those ‘high picks’ are actually well worth the further discover, and a have a look at the latest particulars on three of them, drawn from the TipRanks platform, tells the tales. The inventory picks make an attention-grabbing bunch, from quite a lot of segments and that includes a rage of various attributes. Let’s take a more in-depth look.

Franklin Covey (FC)

First up, Franklin Covey, is a management coaching firm providing management and life teaching companies. The corporate is known as for the 2 bases of its strategy: the writings of Benjamin Franklin and the management analysis of Stephen Covey, the creator of The 7 Habits of Extremely Efficient Folks. Franklin Covey makes use of what it describes as ‘timeless ideas of human effectiveness,’ and works to offer each learner ‘the mindset, skillset, and toolset’ obligatory to maximise efficiency for outcomes.

Franklin Covey has undergone a change in its strategies over time. It began with publishing and distributing books and printed management supplies, then expanded to providing in-person management lessons, coaching, and seminars. Later, the corporate launched on-line reside video programs and finally transitioned to primarily conducting on-line programs through reside feed by way of a subscription mannequin. At the moment, the corporate presents programs in additional than 160 international locations and boasts over 15,000 consumer engagements yearly. Moreover, its ‘The Chief in Me’ faculties, which give lessons designed for Ok-12 college students, exceed 5,000 in quantity and can be found in 50 international locations.

All of this makes Franklin Covey a large within the self-help trade. The corporate noticed $262.8 million in complete income for its fiscal 12 months 2022, and it’s persevering with to indicate a robust efficiency throughout its fiscal 12 months 2023.

Franklin Covey not too long ago reported its fiscal Q3 monetary outcomes, revealing report quarterly gross sales. On the highest line, the corporate posted Q3 income of $71.44 million, representing an 8% year-over-year improve and surpassing the forecast by $1.81 million. This development was primarily pushed by an 18% improve within the agency’s Training Division revenues. On the backside line, Franklin Covey achieved an EPS of 32 cents, exceeding expectations by 15 cents per share.

Taken collectively, all of this explains why Franklin Covey is a High Choose for Northland’s 5-star analyst Nehal Chokshi. Chokshi lays out his bullish case level by level, writing: “We’re elevating FC to a high decide inside our protection given (1) Invoiced worth y/y development ticks up, different main metrics trending positively too. (2) ~3x upside our 12-month PT represents, (3) what we consider is de minimus draw back danger given shares are buying and selling at ~12x EV/FCF regardless of mid-teens EBITDA development and excessive teenagers FCF margin and (4) FC BoD strongly indicating their perception shares are severely undervalued with an accelerated fee of buyback and growing % of FCF utilized for share buybacks.”

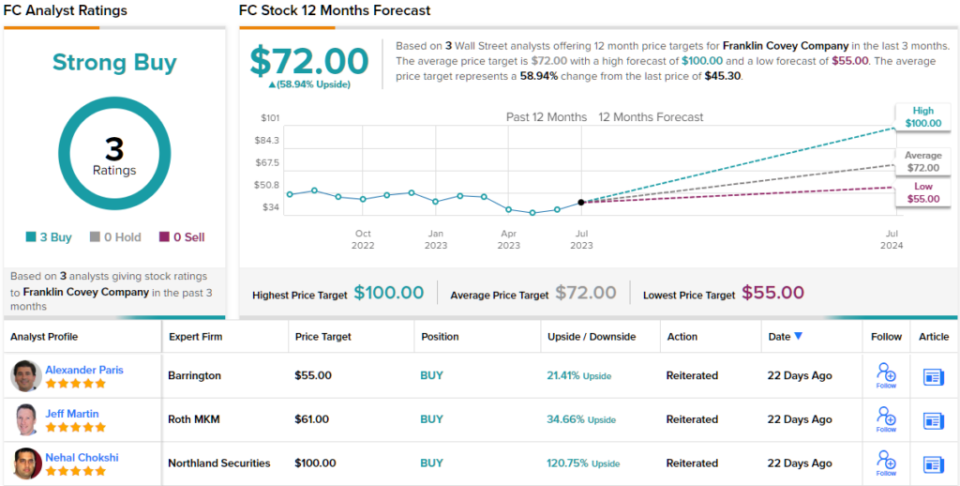

Together with ‘high decide’ standing, Chokshi charges FC shares as Outperform (i.e. Purchase), with a $100 worth goal that means a sturdy one-year upside potential of ~121%. (To look at Chokshi’s monitor report, click on right here)

Like Chokshi, different analysts additionally take a bullish strategy. FC’s Robust Purchase consensus ranking breaks down into 3 Buys and no Holds or Sells. The inventory is promoting for $45.30, and its common worth goal of $72 suggests ~59% achieve on the one-year horizon. (See FC inventory forecast)

Phreesia, Inc. (PHR)

The second inventory on this record of high picks is Phreesia, a software program firm within the healthcare world. Phreesia presents SaaS utility to healthcare organizations, for the automation and upkeep of affected person consumption – together with registration, scheduling, scientific assist and follow-up, and funds.

Healthcare is a big trade, anticipated to make up $6.8 trillion in US financial system simply 5 years from now. This provides Phreesia an unlimited subject for enlargement, and the corporate is working to fill it with high quality companies. Thus far, the outcomes bode nicely. Some 89% of Phreesia’s purchasers acknowledge that the corporate has created seen enhancements in their very own organizations, whereas 9 out of 10 purchasers describe the service as ‘top quality’ and would suggest it to a good friend. Phreesia boasts that its companies facilitate over 120 million affected person healthcare visits per 12 months.

Phreesia ended its fiscal 12 months 2023 this previous January 31, and did so with a bang. The corporate introduced in annual revenues for fiscal ’23 of $280.9 million, a 32% year-over-year achieve. Phreesia posted this robust achieve whilst its annual income per healthcare companies consumer fell 6% y/y, to $72,599. The corporate’s common variety of healthcare companies purchasers throughout the 12 months, nonetheless, grew by 38% from the prior 12 months, to 2,856.

Entering into fiscal 2024, Phreesia continues to indicate robust performances. The fiscal Q1 outcomes, launched this previous Could, confirmed a high line of $83.8 million, for one more 32% y/y improve and coming in $2.63 million above expectations. The quarterly common variety of healthcare companies purchasers reached 3,309, growing by 31% y/y. On the backside line, Phreesia’s Q1 earnings got here to unfavorable $0.70 per share. This was a hefty enchancment from the 99-cent loss reported within the prior 12 months quarter, and it beat the estimates by 5 cents.

For buyers, this provides as much as a robust firm rising into an increasing area of interest. Analyst Jessica Tassan, masking the inventory for Piper Sandler, is optimistic in regards to the firm’s potential. Tassan consists of Phreesia on her ‘high decide’ record and expresses confidence in its future prospects.

“We’ve got confidence that PHR can obtain a $500M income run-rate exiting FY25; and consider there could also be upside to the corporate’s FY25 profitability targets. Whereas we predict the enterprise is undervalued on a standalone foundation, we additionally see strategic worth in PHR doubtlessly being a key acquisition goal for giant, vertically built-in MCOs whose intentions are to construct diversified healthcare banking operations with B2B lending and DTC capabilities,” Tassan opined.

“PHR facilitates $1B+ in quarterly affected person fee quantity, which confers visibility into all follow collections. As such, MCOs can ship improved income cycle instruments; construction and time reimbursement to incentivize acceptable care; and supply aggressive working capital bridge loans to suppliers. We consider such initiatives, with PHR’s innate potential to deal with staffing challenges, might encourage new suppliers to affix the MCO’s community,” Tassan added.

These feedback include an Obese (i.e. Purchase) ranking, and Tassan’s worth goal, set at $43, factors towards an upside of ~37% over the subsequent 12 months. (To look at Tassan’s monitor report, click on right here)

Turning to the remainder of the Road, the bulls have it on this one. With 8 Buys and 1 Maintain assigned within the final three months, the phrase on the Road is that PHR is a Robust Purchase. At $39, the common worth goal implies 24% upside potential. (See PHR inventory forecast)

Afya Restricted (AFYA)

Final however not least is Afya, one other noteworthy inventory within the medical sector. Working primarily in Latin America, with its headquarters based mostly in Brazil, Afya has established itself as a number one pressure within the area’s medical training panorama. The corporate’s major focus lies in offering a complete “end-to-end physician-centric ecosystem” for medical college students and physicians in Brazil. From guiding them by way of the journey of medical faculty to supporting their residency packages and steady medical training, Afya collaborates intently with medical doctors to make sure they continue to be on the forefront of medical information all through their follow.

As well as, Afya presents a number of medical-service-oriented apps that medical professionals and college students alike can use, to succeed in related medical content material and to seek out scientific assist for medical selections. The important thing right here, as with Afya’s entire strategy, is to place information on the practitioner’s fingertips. The corporate has seen robust demand for its companies, particularly post-COVID.

Within the not too long ago reported 1Q23, Afya confirmed a stable 25% year-over-year improve in complete income, to R709.4 million, or US$147.8 million at present change charges. The corporate’s income beat the forecasts by roughly US$7.8 million. Afya’s earnings additionally got here in higher than anticipated. The non-GAAP adjusted EPS was listed at R$1.77, or 36 cents in US forex, and was 4 US cents above the forecast. Afya had a money place on the finish of Q1 of R$722.7 million. The corporate’s robust outcomes have been set on a buyer base of ~295,000 month-to-month energetic customers, physicians and med college students utilizing Afya digital companies.

Valuation and enterprise mannequin kind the premise for JPMorgan’s Marcelo Santos’ selection of Afya for high decide standing.

“Afya is the upper training firm the place we see most upside at present, buying and selling roughly in-line with its friends at 5.6x EV/EBITDA (vs. 5.7-6x vary), whereas having a superior enterprise based mostly on medication which presents way more visibility and a beautiful FCF profile. Furthermore, we consider the announcement of a brand new Mais Medicos program is a key overhang, which we anticipate to be over in August and may take away strain from the inventory… We reiterate Afya as our high decide in training,” Santos wrote.

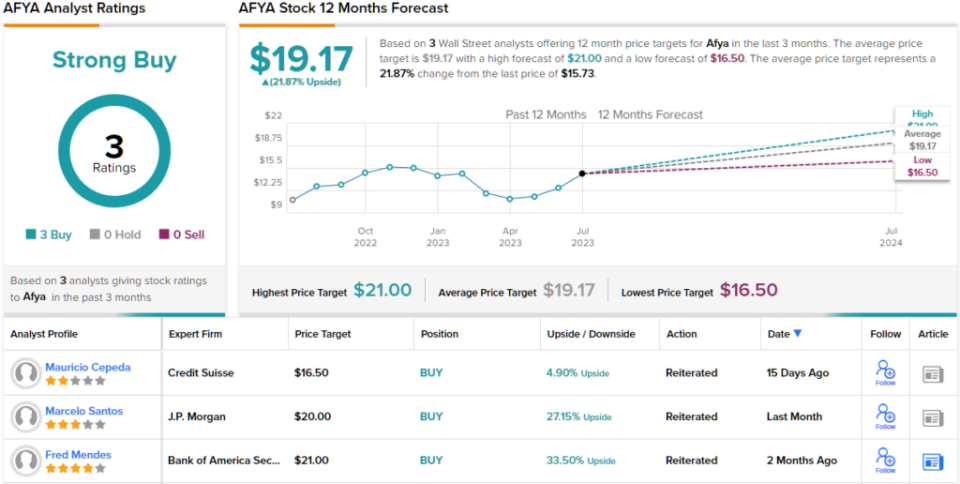

Trying forward from right here, Santos charges AFYA shares as Obese (i.e. Purchase), and offers them a US$20 worth goal that means AFYA will achieve 28% on the one-year timeframe. (To look at Santos’ monitor report, click on right here)

General, there are 3 latest analyst opinions on this inventory, and all are optimistic – giving AFYA a unanimous Robust Purchase consensus ranking. Shares are priced at $15.73 and the $19.17 common goal suggests ~22% upside on the one-year timeline. (See AFYA inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.