Inventory markets have lengthy moved to their very own drummer, responding to forces which are generally fairly totally different than what we anticipate. For traders, the important thing to success is to determine simply what power – or mixture of forces – goes to affect the markets subsequent.

In a current report from the UK-based Chatham Home suppose tank, economic system and finance program director Creon Butler factors to local weather change as the subsequent market game-changer. In reality, Butler sees local weather points inflicting a pointy market correction inside 5 years.

Butler factors out a number of the potential fallout dangers of a quickly warming local weather, and their affect on markets. His checklist of dangers consists of the emergence of latest ailments, alterations in crop cycles lowering meals provides, tighter authorities regulation on carbon emissions, and an actual property pull-back from coastal areas. That final level, on property, is already impacting California, the place a number of main house insurers have stopped writing property insurance policies attributable to an elevated threat from pure disasters.

“Regardless of the causes for the markets’ present equanimity on local weather dangers, a pointy adjustment appears to be like more and more possible. The longer it’s delayed, the sharper it’s prone to be – and the extra potential triggers emerge,” Butler summed up.

Nevertheless it’s not all doom and gloom – some shares will thrive on this new climate-change period. We’ve used the TipRanks database to pinpoint two names that may play an important position in shaping the rising ‘inexperienced’ economic system. Let’s test the main points.

Brookfield Renewable Companions (BEP)

First up, Brookfield Renewable, an proprietor and operator of renewable energy property. The corporate owns a various portfolio of vitality property world wide, together with distributed vitality and sustainable options in addition to wind, photo voltaic, and hydroelectric energy era amenities.

Brookfield is below 60% possession of Brookfield Asset Administration, considered one of Canada’s largest different funding administration companies. This provides the partnership vitality agency strong monetary backing, which it has used to construct up its capabilities in utility-grade energy era installations. Thus far, Brookfield Renewable Companions has an influence improvement pipeline, in renewable vitality tasks, totaling 126,000 megawatts. Some 5,000 megawatts of that capability is on observe for commissioning this yr.

This partnership agency will launch its 2Q23 earnings on Friday (August 4), however within the meantime it’s useful to look again on the Q1 outcomes for a snapshot of the place the corporate stood earlier this yr. The highest line in Q1 got here to $1.33 billion, up 17% year-over-year and coming in $54.8 million forward of the forecasts. BEP had a funds from operations (FFO, a key metric in partnership corporations) of 43 cents per share, for a 13% y/y improve.

Additionally essential, Brookfield Renewable Companions elevated its money holdings in Q1, to $1.14 billion from $998 million on the finish of December. This represented a 14% achieve quarter-over-quarter.

Scotiabank analyst Robert Hope is impressed by what he sees on this agency, particularly within the threat/reward profile of its portfolio growth and the agency’s strong money/liquidity place. Hope writes, “We see BEP as having one of many stronger development profiles in our protection universe with 13% / 12% FFOPU development in 2023E / 2024E. It is usually spectacular to us that the corporate is ready to generate this development with restricted single-project building threat and whereas sustaining robust liquidity. We view Brookfield Renewable as a high-quality and high-growth option to take part within the world renewable energy and decarbonization theme…”

Trying ahead, Hope offers BEP an Outperform (i.e. Purchase) ranking with a $38 value goal, suggesting a 29% upside for the yr forward. (To look at Hope’s observe file, click on right here)

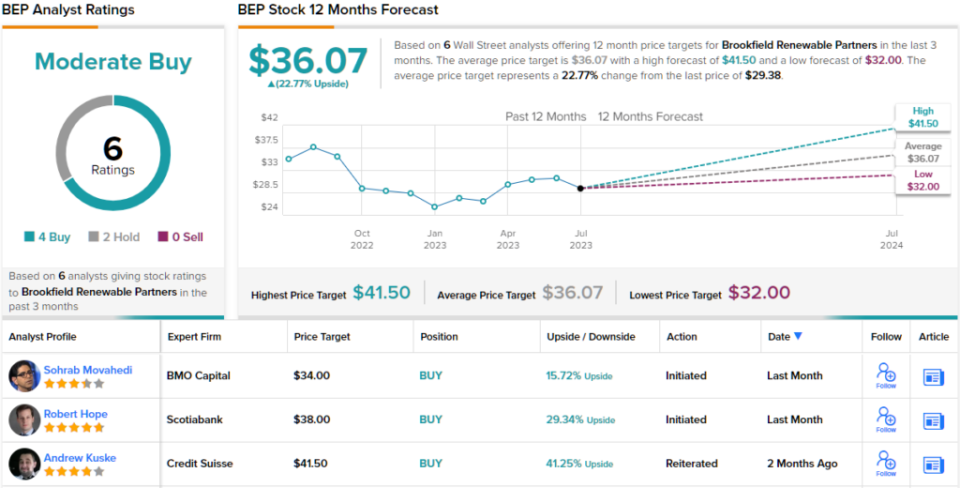

This renewable vitality agency will get a Average Purchase ranking from the consensus of the Road’s analysts, primarily based on 6 current analyst opinions that embody 4 Buys and a pair of Holds. The inventory is promoting for $29.38 and has a median goal value of $36.07, implying a one-year upside potential of ~23%. (See BEP inventory forecast)

Sunrun, Inc. (RUN)

Subsequent up on our checklist is Sunrun, a number one agency within the residential solar energy area of interest. Sunrun designs, builds, and installs a variety of home-based solar energy installations, providing clients bundle offers designed-to-order for every particular person house. The packages embody the whole lot wanted to suit the set up to the actual location and energy wants, together with rooftop photovoltaic panels, energy storage batteries, and sensible management techniques, in addition to connections to the native electrical energy grid.

Sunrun doesn’t cease with solar energy house installations, although. The corporate additionally provides financing choices, permitting clients to decide on to pay in full up entrance or to amortize the price as a lease, on a long-term or month-to-month foundation. Clients also can take loans with Sunrun, to facilitate the acquisition. By way of the top of Q1 this yr, Sunrun may boast of 700,000 clients, in 22 states in addition to DC and Puerto Rico.

Curiosity in solar energy has been rising in recent times, supported by each governmental and societal pushes to advertise clear energy. This helped push Sunrun to greater than 30% gross sales exercise development within the final quarter reported, 1Q23. The corporate’s highest development area was California, which has each a robust legislative push to advertise solar energy in addition to a favorably sunny local weather; Sunrun noticed 80% gross sales development in California in Q1. Trying forward, Sunrun can really feel safe – its has $1.1 billion in annual recurring income, and the common contract life remaining is 17.6 years.

Attending to the brass tacks, we discover that Sunrun reported a complete of 240 put in megawatts in Q1, producing $589.9 million in income, for 19% y/y prime line development, and beating the forecast by greater than $72 million. The corporate’s EPS was a internet loss, of $1.12 per share, and missed the expectations, coming in 97 cents per share beneath estimates. We’ll see Sunrun’s Q2 outcomes subsequent week (Wednesday, August 2).

Regardless of the earnings miss, the robust gross sales development and income beat together with a number one place in an ‘underpenetrated’ market received this inventory discover from Mark Strouse, 5-star analyst with JPMorgan. Strouse writes of Sunrun, “RUN is a frontrunner in residential vitality providers together with photo voltaic, storage, EV charging, house vitality administration, and so forth., an underpenetrated market that we anticipate to develop at a double-digit CAGR for the foreseeable future. The corporate has robust visibility into future income owing to long-term buyer contracts, worth per buyer ought to enhance as extra providers are adopted, and we imagine RUN is positioned for market share features owing to favorable ITC guidelines in addition to the corporate’s main scale.”

Strouse follows up his feedback with an Chubby (i.e. Purchase) ranking for the inventory, plus a $38 value goal that underscores his confidence in a 107% upside on the 12-month horizon. (To look at Strouse’s observe file, click on right here)

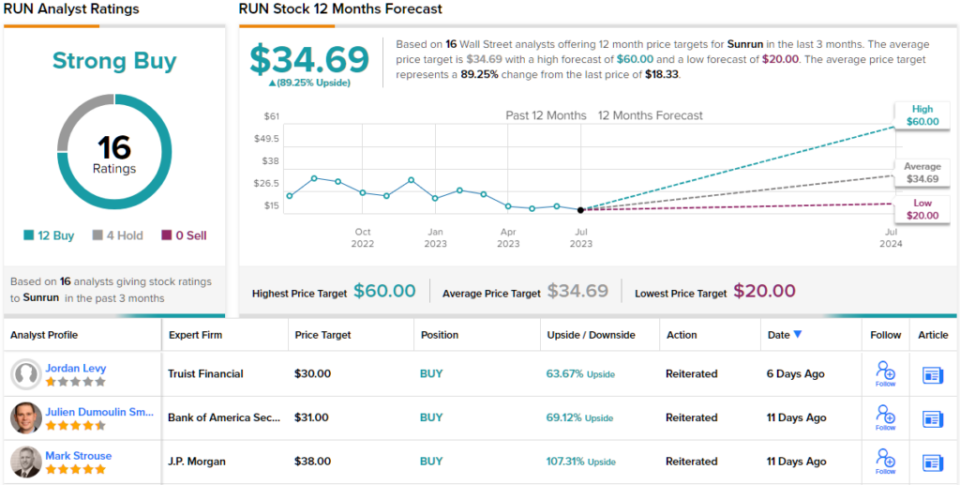

General, there are 16 current analyst opinions for RUN shares, breaking down 12 to 4 in favor of Buys over Holds, for a Robust Purchase consensus ranking. The inventory is buying and selling for $18.33 and has a median value goal of $34.69, implying {that a} achieve of 89% is in retailer for the approaching yr. (See Sunrun inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your individual evaluation earlier than making any funding.