For the reason that finish of the Second World Struggle, the US has been the 800-pound gorilla of the world financial system – the most important in financial phrases, the most important producer, the most important innovator, the most important monetary market. That dominance has been challenged within the final couple of many years, with the rise of China to grow to be the world’s second-largest financial system, the enlargement of Taiwan’s semiconductor chip business to international management, the ingenuity of South Korean tech corporations – particularly in AI, and the enlargement of India’s financial system as that nation has grow to be the world’s largest by inhabitants.

For billionaire hedge supervisor Mark Mobius, the emergence of latest gamers among the many world-leading economies opens up new alternatives for a extra diversified portfolio – and the famously profitable investor lately acknowledged that his personal portfolio is totally divested from US-based corporations. Mobius isn’t simply boosting and selling rising economies and markets – he’s placing his cash the place his mouth is, and going all-in.

Mobius is especially intrigued by the potential of Taiwan, South Korea, and India. In a current interview, he emphasised, “We’re searching for corporations which have established worldwide diversification, and we’ve come throughout quite a few enterprises with exceptional technological prowess that permits them to broaden their investor outreach.” Mobius goes on to quote the booming high-tech in Taiwan and South Korea, and India’s quick GDP progress of seven% and inhabitants of 1.40 billion. Mobius sees all three of those international locations as financial leaders for the approaching many years.

Wall Road’s analysts are discovering loads to agree with in that evaluation, and so they’ve been choosing out rising market shares which are poised to realize going ahead from right here. Utilizing TipRanks’ database, we pinpointed two such names which are thought of ‘Robust Buys.’ To not point out appreciable upside potential is on the desk right here. Let’s take a more in-depth look.

Taiwan Semiconductor (TSM)

Taiwan has grow to be the world’s chief in semiconductor chip output, offering some 60% of the worldwide provide of those very important pc elements, and Taiwan Semiconductor is without doubt one of the nation’s largest chip makers. The corporate operates primarily as a foundry, a complicated manufacturing plant that takes third-party contracts to fabricate semiconductor chips in mass runs. The consumer corporations deal with the design work and prototypes, whereas TSM handles the common manufacturing; the mannequin has confirmed profitable for the business.

It’s confirmed profitable for TSM, particularly, too. The corporate has roughly 58% market share of Taiwan’s chip foundry enterprise, and a market cap of greater than $514 billion.

Taiwan Semiconductor’s monetary outcomes confirmed a number of quarters of optimistic outcomes, and constant beneficial properties, popping out of the pandemic interval and thru the tip of final yr. The corporate discovered help in elevated product demand post-COVID. This yr, nonetheless, slowing chip demand – attributable to a mixture of continued provide chain disruptions, a slower-than-hoped reopening in China, increased rates of interest inflicting a tighter credit score surroundings, and elevated inflation forcing shoppers to pare again spending – has impacted the chip foundry’s high and backside traces.

Within the final reported quarter, 2Q23, TSM confirmed revenues of US$15.68 billion. Whereas this was down 13.7% from 2Q22, it beat the analyst expectations by US$300 million. The underside line determine, an EPS of $1.14 in US forex, additionally fell 26% year-over-year, however got here in higher than anticipated, by 6 cents per share.

Mehdi Hosseini, a 5-star analyst from Susquehanna, highlights TSM’s robust place within the business and its adeptness in leveraging this benefit to drive additional market share progress. These qualities lie on the core of his evaluation of the inventory, the place he presents a compelling long-term outlook based mostly on the next elements: “1) COWOS capability is predicted to roughly double contributing to margin and income accretion. 2) New product ramps resembling AWS Graviton and finally Meteor Lake, Grace, Genoa/Sapphire Rapids are driving progress into 2024. 3) Server AI processors (CPU, GPU, and AI accelerators for coaching and inference) account for ~6% of TSM’s income and are anticipated to develop to account for a low teenagers % of income. 4) N3e begins to scale in 2024 because of increased EUV throughput from ASML’s 3800E. 5) Incomes energy within the subsequent up cycle is estimated within the $8-$10 vary, or ~2x that of CY23 EPS estimate.”

Quantifying this stance, Hosseini provides TSM shares a Purchase ranking with a 36% one-year upside based mostly on a $135 worth goal. (To look at Hosseini’s monitor report, click on right here)

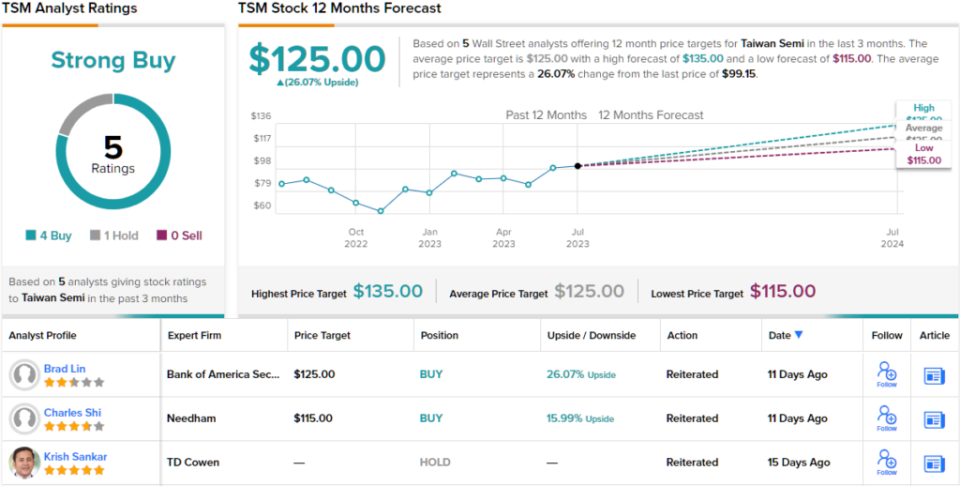

Total, this main chip maker has picked up 5 current analyst evaluations, with a 4 to 1 breakdown favoring Buys over Holds for a Robust Purchase consensus ranking. The inventory is buying and selling for $99.15, and its $125 common worth goal implies a one-year upside potential of ~26%. (See TSM inventory forecast)

WNS Restricted (WNS)

WNS is a world enterprise course of administration agency based mostly in Mumbai, India. Strategically positioned in a rustic that has grow to be an financial powerhouse during the last decade, WNS serves enterprise purchasers in 10 industries worldwide. With operations in 13 international locations throughout 4 continents, the corporate’s success is fueled by a mixture of know-how and digital analytics, boasting over 400 purchasers and using greater than 59,000 folks.

The final financial uncertainty of current months – the mixture of excessive rates of interest and excessive inflation, the elevated probabilities of a US recession, China’s sluggish reopening – have put a premium on enterprise effectivity, precisely the form of problem to which WNS guarantees options. The corporate has seen a modest upward pattern in each revenues and earnings for the previous a number of quarters.

The final quarterly report, for Q1 of fiscal yr 2024, confirmed this pattern persevering with. The corporate had a income whole of $317.5 million on the high line, for will increase of 15.5% year-over-year – and beat the forecast by $12.9 million. On the backside line, WNS’ $1.01 non-GAAP EPS beat expectations by 8 cents per share, and was up from 90 cents within the year-ago interval.

The corporate’s stable progress in a troublesome international surroundings caught the attention of Needham analyst Mayank Tandon, who wrote of WNS, “We stay bullish on WNS given the wholesome working surroundings and powerful execution from administration regardless of the unsure macro circumstances. We imagine that WNS’ mission important options grow to be much more necessary throughout instances of financial pressure, and count on administration to drive double-digit income and EPS progress regardless of the difficult macro. With the shares buying and selling at an ex-cash P/E a number of of 15x our FY25 estimate, we view the risk-reward as compelling. WNS stays our high choose for 2023.”

Trying forward, Tandon charges this ‘high choose’ as a Purchase, and his $115 worth goal implies an upside potential of 66% for the yr forward. (To look at Tandon’s monitor report, click on right here)

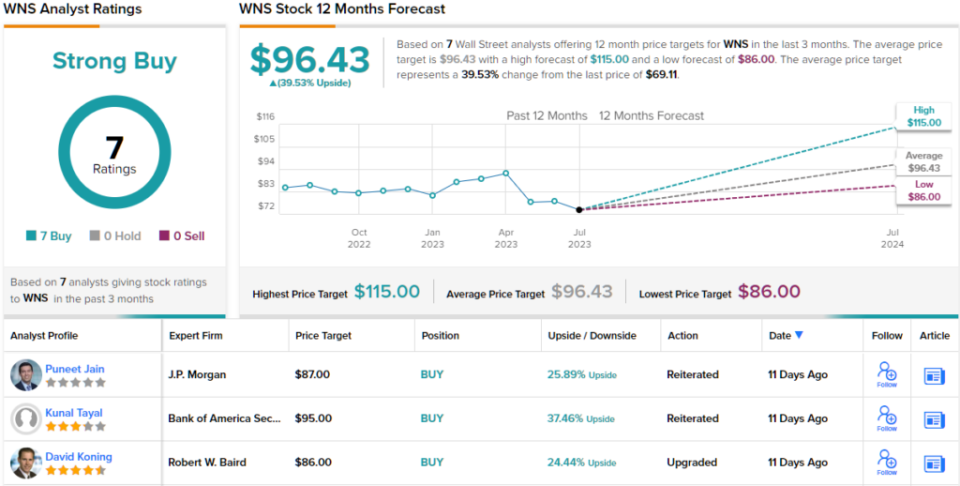

Total, all 7 of the current analyst evaluations on WNS are optimistic, for a unanimous Robust Purchase consensus ranking on the inventory. The typical worth goal of $96.43 and buying and selling worth of $61.11 mix to recommend a 12-month upside potential of 39.5%. (See WNS inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.