-

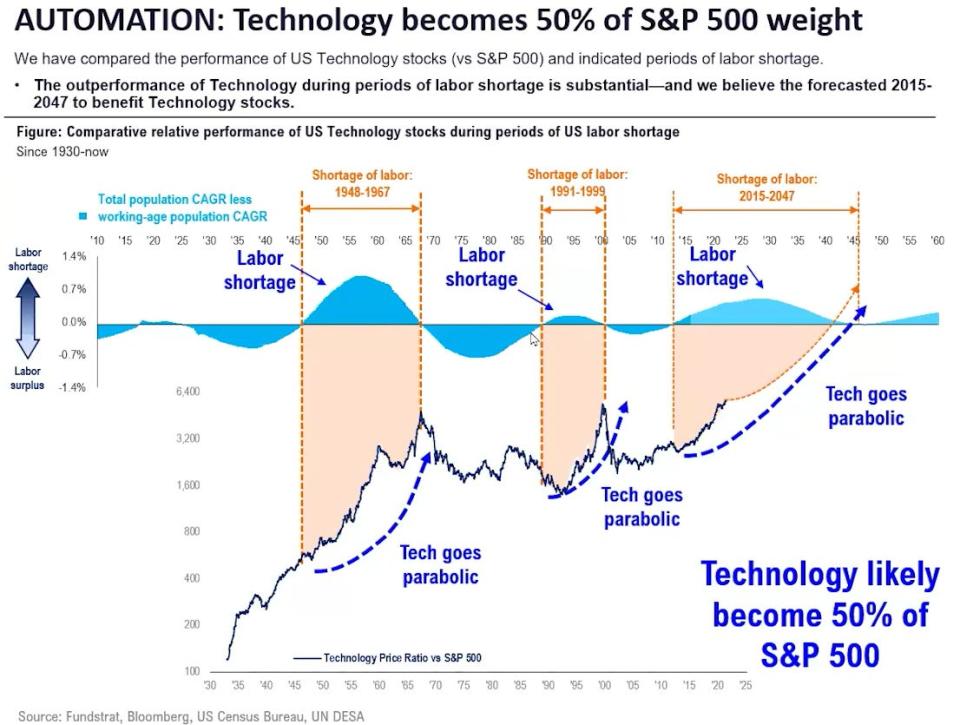

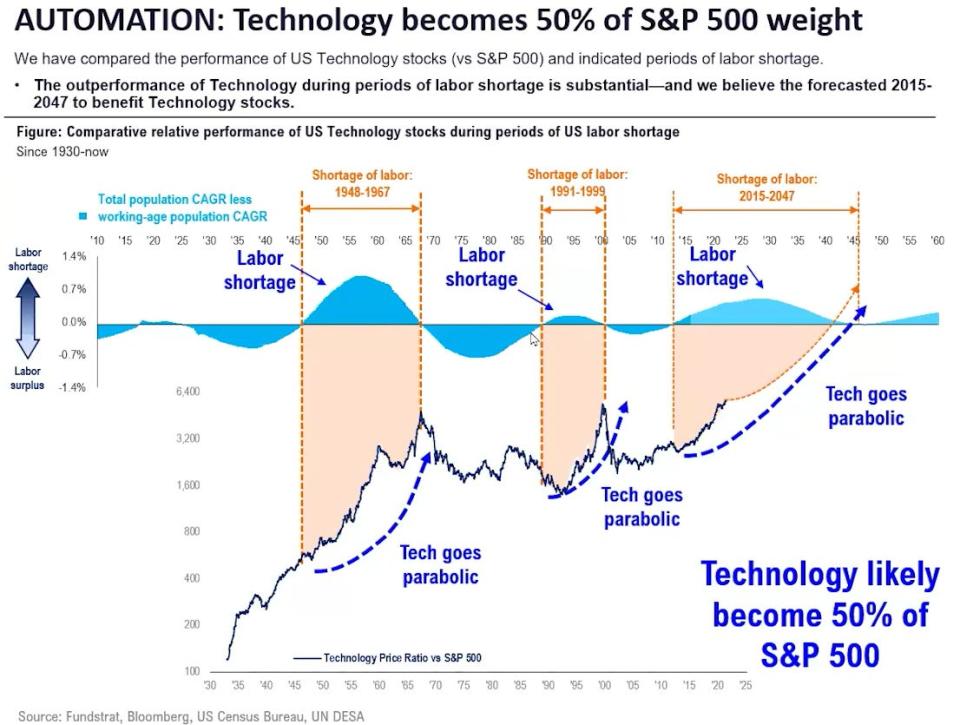

A world labor scarcity of about 80 million employees will make tech shares go parabolic, in line with Fundstrat’s Tom Lee.

-

Lee argued that the know-how sector will finally make up 50% of the S&P 500.

-

“I feel AI is absolutely addressing a worldwide labor scarcity of roughly 80 million employees by the tip of 2030,” Lee stated.

A world labor scarcity of about 80 million employees by the tip of 2030 goes to ship know-how shares hovering, in line with Fundstrat’s Tom Lee.

Lee stated in a video to shoppers final month that he expects the know-how sector will develop to 50% of the S&P 500 from its present weight within the benchmark index of round 30%.

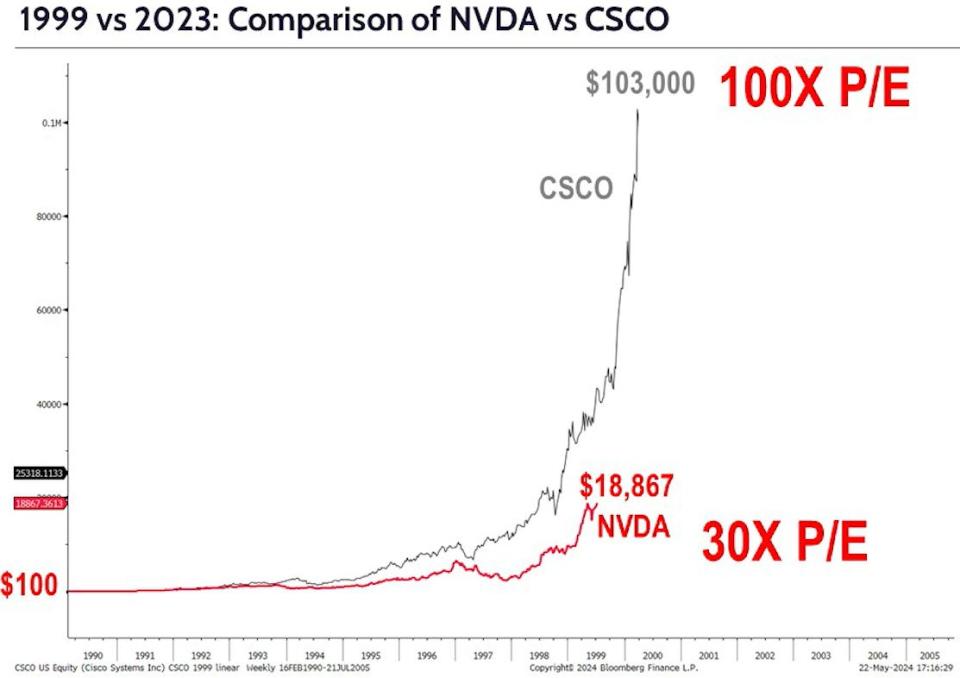

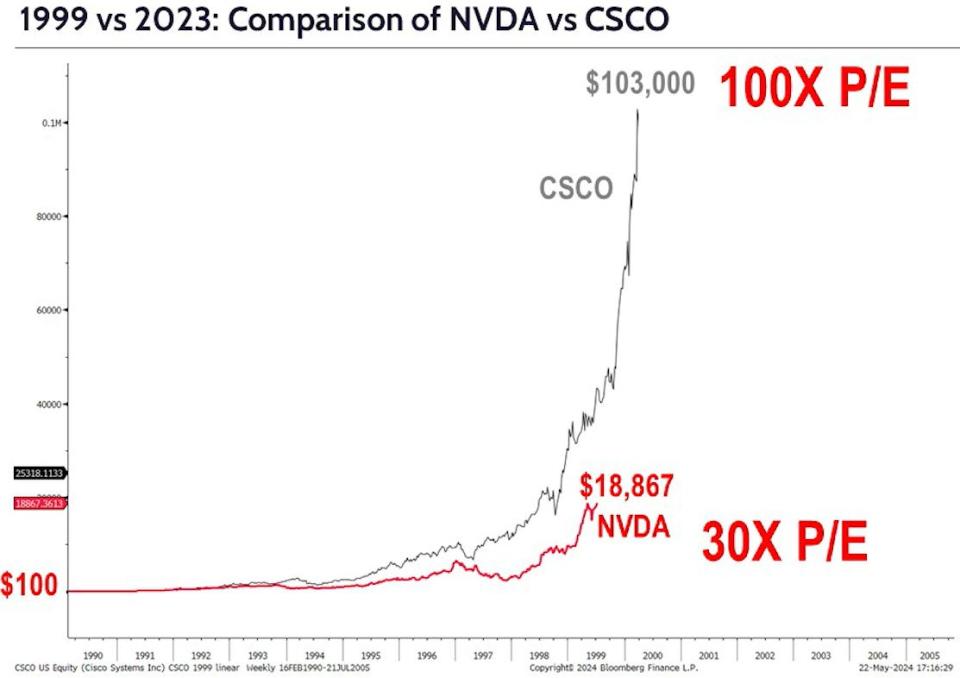

Lee made the feedback shortly after Nvidia posed a blockbuster first-quarter earnings report, which despatched the inventory hovering to report highs. Nonetheless, in line with Lee, it is nonetheless early days for the AI story as a result of it is going to assist increase productiveness and deal with a looming labor scarcity downside.

“The prime age workforce is rising slower than the overall world inhabitants and by the tip of the last decade that hole is round 80 million employees. So until there’s a productiveness increase which is what AI will do, it should create a variety of stress on firms or incentives for them to innovate. And meaning you are going to see a shift from annual wage spend to silicon spend,” Lee stated.

Lee estimates that firms will spend roughly $3.2 trillion per yr on AI tech to handle the rising labor scarcity.

Nvidia, which is approaching about $120 billion in annual income, stands to learn from that spending in a giant approach, Lee stated.

This is not the primary time a worldwide labor scarcity has led to a parabolic transfer greater in know-how shares as tech firms helped increase productiveness.

“Between 1948 and 1967 there was a worldwide labor scarcity and know-how shares went parabolic. And between 1991 and 1999 there was a worldwide labor scarcity and know-how shares went parabolic, so that is what’s occurring right now,” Lee stated.

And as as to whether Nvidia is in a bubble much like the dot-com bubble, when shares of Cisco soared to report highs on the promise of the web, Lee put issues into perspective.

“Consider Nvidia sells a $100,000 chip because it’s scarce, nobody else actually sells it. Against this Cisco bought a $100 router in the course of the web increase, and but they acquired to a 100x P/E. I feel Nvidia’s 30x P/E appears fairly engaging and that is why we predict it is early days,” Lee stated.

This story was initially revealed in Might 2024

Learn the unique article on Enterprise Insider