-

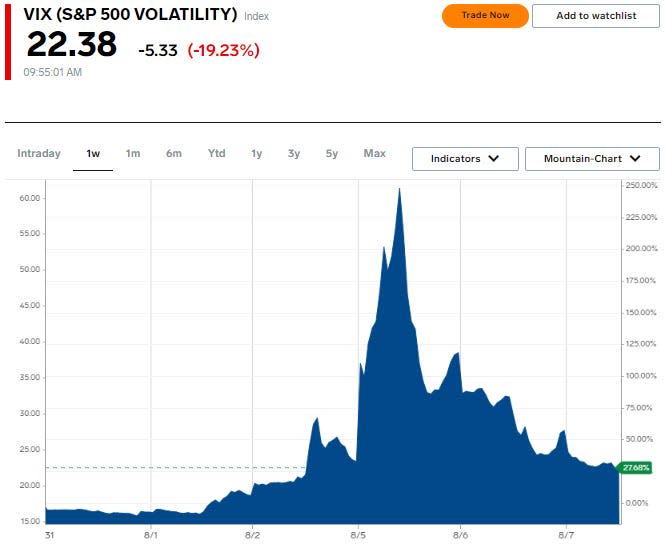

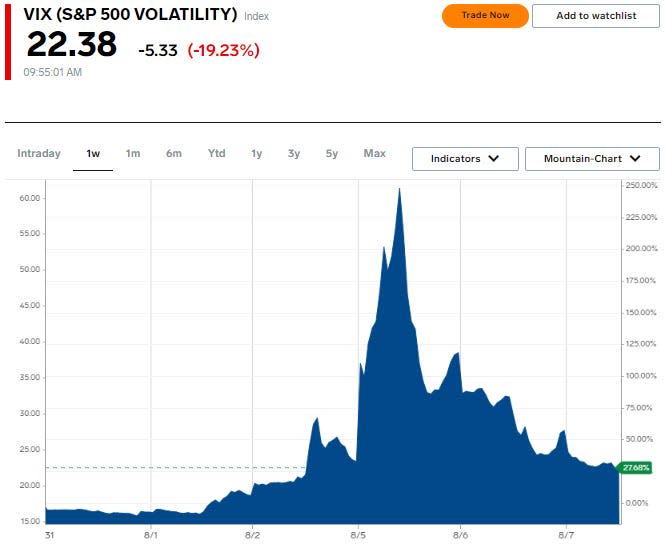

Wall Road’s worry gauge has reversed course after a historic surge earlier this week.

-

The VIX hit its third-highest stage ever on Monday as a result of a violent unwind of the yen carry commerce.

-

The diploma of the VIX’s reversion since then reveals the worst of the scare is over, says Fundstrat’s Tom Lee.

The historic surge and subsequent decline of Wall Road’s worry gauge means that the worst of the inventory market’s “development scare” is over.

That is in accordance with Fundstrat’s Tom Lee, who mentioned in a Wednesday be aware that the CBOE Volatility Index, higher often called the VIX, is behaving like a backside within the inventory market is in.

The VIX made historical past on Monday when it soared a document 172% intraday to the 65.73 stage, representing its third-highest stage ever. The surge got here amid a violent unwind of the yen carry commerce, which knocked down threat belongings throughout the globe.

The one time the VIX hit a better stage was at its 89.53 peak reached in the course of the Nice Monetary Disaster in October 2008 and its 85.47 peak hit in the course of the COVID-19 pandemic in March 2020.

However since hitting its third-highest stage ever on Monday, the VIX has sharply declined, falling from 65.73 to 27.71 on Tuesday, representing a peak-to-trough decline of 58%. Nonetheless, it stays markedly above the place it was buying and selling previous to the market sell-off.

“VIX falling from 66 to 27 is a optimistic signal and additional signal this can be a ‘development scare’ with the worst probably behind us,” Lee mentioned, including that the normalizing VIX affirms that the inventory market plunge over the previous week isn’t a scientific disaster.

On a closing foundation, the VIX closed down 28.2%, representing its second-sharpest every day decline on document, solely being eclipsed by the 29.6% decline seen on Could 10, 2010, which was the buying and selling day after a flash crash despatched the Dow Jones Industrial Common plunging about 9% in a matter of minutes.

Carson Group chief market strategist Ryan Detrick instructed Enterprise Insider on Wednesday that when the VIX experiences such swift declines, the inventory market tends to see some sizable positive aspects going ahead.

“The VIX closed down greater than 10 factors yesterday, which could be very uncommon. This final occurred after the Flash Crash in Could ’10, the US debt downgrade in August ’11 and March 2020. All three of these instances had been fairly bullish instances for traders and a yr later the S&P 500 was increased every time and up 37% on common,” Detrick mentioned.

Fundstrat’s new be aware from Wednesday referenced commentary from final Friday suggesting shares may backside this week. At that time the VIX was up 65% over the course of three days. Notice that it spiked one other 65% on Monday because the S&P 500 noticed its worst day in two years.

The agency’s discovering confirmed that because the VIX’s inception in 1990, there have been 9 instances when the VIX noticed a three-day surge of greater than 65% and closed above the 25 stage.

In almost half of these cases, shares discovered their backside inside a number of brief days and the S&P 500 delivered a three-month median return of seven% over the following three months with a 100% win price.

“Every time the VIX surges like this, half the time you are on the finish of a decline and also you backside inside two days, so I believe the rally that began right now sort of falls inside these parameters,” Lee mentioned in a video replace to purchasers on Tuesday.

For the reason that VIX peaked on Monday, the S&P 500 has rebounded 4% whereas the Nasdaq 100 is up about 5%.

Wanting forward, decrease rates of interest have lengthy been seen as a optimistic catalyst for shares. As of proper now, traders anticipate the Fed to chop charges by 100 foundation factors between now and the tip of the yr, in accordance with the CME FedWatch Device.

“There’s going to be an actual value of cash decline,” Lee mentioned, which ought to “profit tremendously” for customers taking out house loans, auto loans, and different kinds of lending automobiles like bank cards and enterprise loans.

“Backside line, markets are definitely exhibiting sturdy indicators of gaining their footing. And we additionally view this panic as in the end being a development scare,” Lee mentioned.

Learn the unique article on Enterprise Insider