-

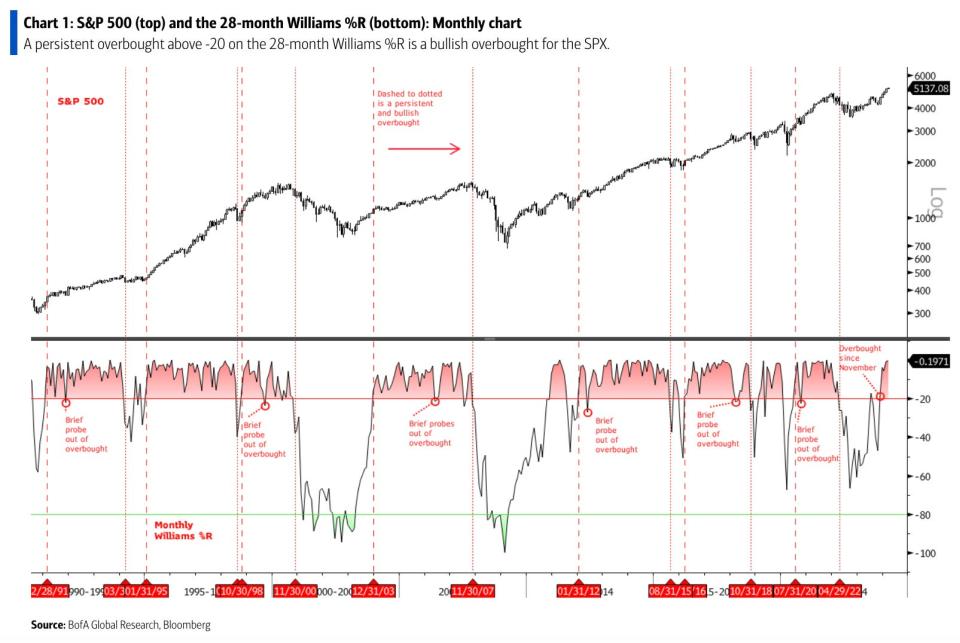

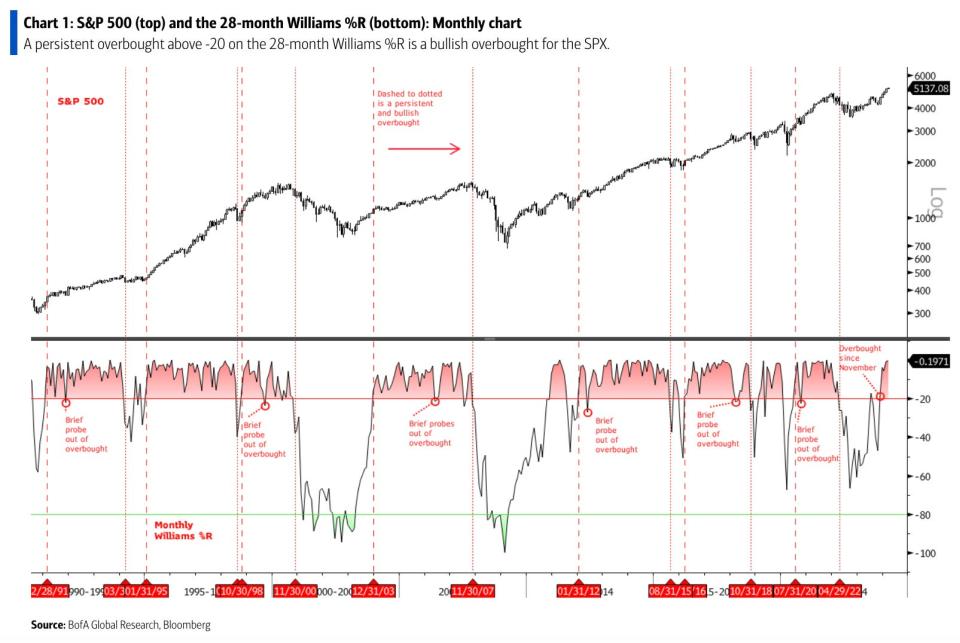

A key long-term indicator of an overbought market has been flashing since November.

-

When it flashes for 12 months, the S&P 500 is constructive 100% of the time, Financial institution of America mentioned.

-

Markets have turned extra uneven when it doesn’t keep overbought ranges.

Three months into 2024 and the inventory market is off to a stellar begin.

Document highs have are available bunches, and traders have clamored to take part within the synthetic intelligence-driven euphoria that is powered rallies in names like Nvidia and Microsoft.

A technical indicator that alerts circumstances within the inventory market are “overbought” — a time period merchants use to explain when shares are buying and selling above truthful worth — has been flashing for 4 months and might be pivotal as to if equities keep scorching by way of year-end, in accordance with Financial institution of America.

“A persistent overbought above -20 on the 28-month Williams %R is a bullish overbought for the S&P 500 (SPX),” strategists wrote in a Tuesday notice. “This longer-term value momentum indicator moved to overbought in November 2023 and stayed overbought in December, January and February.”

When the indicator flashes “overbought” for a complete calendar 12 months, the S&P 500 is constructive 100% of the time, the financial institution mentioned.

In these constructive situations, the S&P 500’s common and median returns have been 19.0% and 16.8%, respectively. On the identical time, nonetheless, the common and median pullbacks these years have been 6.4% and 6.9%.

However, throughout years when the benchmark index is overbought in January however then loses it later within the 12 months on a month-to-month closing foundation, markets turn out to be extra “erratic” and fewer sturdy, notably when the indicator strikes out of “overbought” for 3 consecutive months or extra.

“Staying overbought is the important thing for 2024,” the strategists mentioned.

In the meantime, Financial institution of America’s newest fund supervisor survey confirmed traders have not been this bullish on shares in two years, with many companies dashing into the tech commerce.

And the current energy in shares has invited whispers of a possible bubble. Market veteran Jon Wolfenbarger, for one, has been bearish to begin the 12 months. He has warned {that a} deterioration in earnings is on the best way and has pointed to alerts just like the early-2000s Tech Bubble.

“The market is very weak to falling to new bear market lows,” Wolfenbarger wrote in a January notice. “Most traders don’t see this coming, as they’re being misled by the persistent energy of a handful of megacap Tech shares. They’ve already forgotten how a lot these shares fell in 2022. We imagine they are going to be reminded quickly how a lot overvalued Tech shares can fall in a recession.”

The S&P 500 is up greater than 7% year-to-date. After noon on Tuesday, the index hovered at 5,086.39.

Learn the unique article on Enterprise Insider