(Bloomberg) — Meme-stock investor Ryan Cohen has taken a stake in Alibaba Group Holding Ltd. and is pushing the e-commerce chief to purchase again extra of its shares, in a uncommon case of activism concentrating on a distinguished Chinese language agency.

Most Learn from Bloomberg

Cohen, who rallied particular person inventory traders to assist propel shares of moribund firms like GameStop Corp., constructed up a stake price a whole bunch of tens of millions of {dollars} within the second half of final yr, an individual acquainted with the matter mentioned, asking to not be recognized discussing non-public communications.

The entrepreneur, who turned an idol to newbie traders after championing well-known however languishing shares like Mattress Tub & Past Inc., contacted Alibaba’s board in August to make the case its shares had been undervalued, the particular person mentioned, confirming a report within the Wall Avenue Journal. That’s primarily based on a view it may well obtain double-digit gross sales development and nearly 20% development in free money stream over the following 5 years.

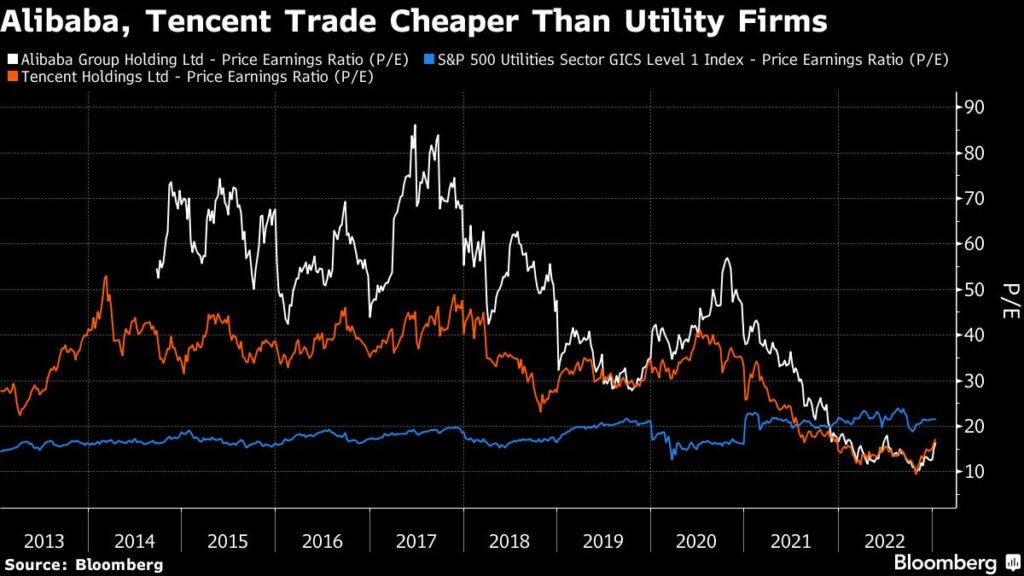

Such a efficiency would require a return to the scorching development charges that China’s largest e-commerce firm as soon as routinely delivered — earlier than it turned a high-profile goal of Beijing’s crackdown on know-how giants. The federal government in 2021 compelled Alibaba and friends like Tencent Holdings Ltd. to revamp enterprise practices, wiping out top-line development at a time Covid Zero curbs weighed on the economic system. The corporate co-founded by billionaire Jack Ma posted a shock loss in its newest quarter, as income once more barely grew.

However Cohen is getting in at a possible inflection level for the world’s No. 2 economic system.

From Goldman Sachs Group Inc. to Morgan Stanley, a rising variety of strategists have made bullish calls following Xi Jinping’s Covid Zero exit and vows to finish a clampdown on the tech sector. The shifts have spurred a roughly 60% rally within the Dangle Seng Tech Index since an October trough, a world-beating feat regardless that the gauge’s market worth continues to be half of its February 2021 peak.

“Cohen’s entry could be broadly constructive for Alibaba’s inventory and given his broad following it ought to elevate sentiment for Chinese language tech typically,” mentioned Jin Rui Oh, a director at Mariana UFP LLP in Singapore.

Cohen helped construct Chewy.com right into a pet provide big that was offered for $3 billion, after which chaired a board committee tasked with reworking video-game retailer GameStop.

His attraction amongst traders was cemented by tweets hitting again at critics, together with a poop emoji with a picture of a Blockbuster retailer (in response to comparisons of GameStop to the largely defunct film rental franchise) and an obvious screenshot from a Pets.com tv advert (a nod to those that in contrast Chewy to the failed pet items retailer).

It’s unclear when he took a particular curiosity in Alibaba, which for years symbolized the rise of Chinese language web know-how and innovation. The entrepreneur final yr tweeted cryptically, “I’ve a crush on China.” The activist has to this point been silent on Alibaba itself.

The entrepreneur is getting right into a market pushed by ideas many Western traders are much less acquainted with. Simply this month, a authorities entity took so-called “golden shares” in an Alibaba entity, which in concept permits the federal government to appoint administrators or sway vital firm choices and guarantee longer-term management over the sector.

“Whereas Ryan is influential and the information is constructive for BABA, it’s unlikely to have a lot sway with the board” given Chinese language authorities have that golden share, mentioned Hao Hong, an economist with Develop Funding. “BABA has been going up, however not due to Ryan Cohen.”

Beijing nevertheless hasn’t publicly opposed shareholder returns. Tencent has been frequently shopping for again its personal inventory and distributing shares in main investees resembling JD.com Inc. and Meituan to its backers. Alibaba itself in November permitted a $15 billion enlargement to an current $25 billion buyback program, whereas extending the length to 2025.

“Activist Ryan Cohen’s presence on Alibaba’s board would possibly assist increase public shareholders’ governance over the corporate’s strategic choices, notably as Beijing takes a stake within the web big,” Bloomberg Intelligence analyst Catherine Lim mentioned.

Learn extra: As China Tech Shares Roar Again, a New Regular Will Check Upside

–With help from Edwin Chan and Abhishek Vishnoi.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.