The Supreme Courtroom on Friday implored the Union authorities to place in place a “strong framework” by amending legal guidelines and strengthening supervisory management in an effort to shield hundreds of traders who’ve been hit after a report by US agency Hindenburg Analysis accused the Adani Group of fraud, main to an enormous slide in its shares.

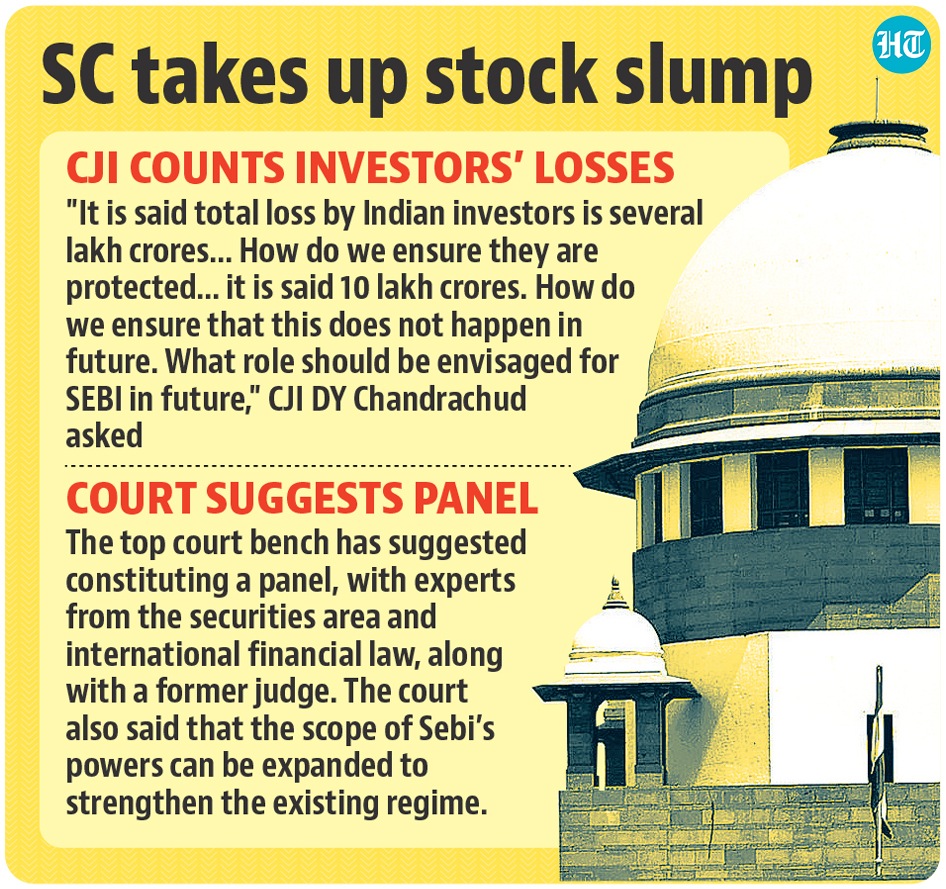

Coping with two public curiosity litigations (PIL) that highlighted how the shares of the listed corporations of the Adani Group misplaced a file $120 billion (near 50% of worth) inside a matter of days, and led to large losses to traders, a bench headed by Chief Justice of India (CJI) Dhananjaya Y Chandrachud proposed the structure of an skilled committee beneath the supervision of a retired decide to formulate the way in which ahead.

“If the Union (authorities) is able to settle for the suggestion, the required suggestion of the committee could also be made,” mentioned the court docket in its order, whereas asking solicitor normal (SG) Tushar Mehta, who appeared for the Centre and the market regulator Sebi, to submit by February 13 an in depth report on the present regime and the modifications that may be deliberate to make it extra strong sooner or later.

Additionally learn | Gautam Adani skips International Buyers’ Summit in Lucknow

The bench, additionally comprising justices PS Narasimha and JB Pardiwala, maintained that it was primarily involved about defending traders and facilitating a secure growth of the securities market in order that the controversy such because the one which hit the Adani Group doesn’t lead to an enormous drain on the capital market and losses for people in future.

“The purpose that actually bothers us, is how can we shield the curiosity of the Indian traders? The petitions have alleged this to be a results of brief promoting (by Hindenburg founder Nathan Anderson and his associates). If this was taking place in small scale, no person bothers. But when the overall lack of Indian traders goes as much as a number of lakhs of crores, how can we guarantee we have now a strong mechanism in place getting into future?” the bench requested the SG.

To make sure, the decline available in the market worth of shares by lakhs of crores doesn’t at all times imply traders have really misplaced that a lot cash. The losses are a perform of the worth at which the traders purchased the shares (and even then, until they promote the shares, the achieve or loss is just notional) and likewise corresponds to the extent of inheritor holding. Within the case of the Adani Group’s listed firms, their low free-float (proportion within the fingers of public traders) means this was possible low.

“Now we have indicated to SG our concern with regard to making sure that regulatory mechanism inside the nation is duly strengthened in order that Indian traders are protected in opposition to sudden volatility which has been witnessed in latest two weeks… The response can comprise present regulatory framework, the related causal elements, the necessity for placing into place strong mechanism to guard traders,” the court docket mentioned in its order.

Hindenburg’s report, launched on January 24, claimed “brazen accounting fraud” and “inventory manipulation” by the Gautam Adani-led group. Although Adani Enterprises rejected the report as “unresearched” and “maliciously mischievous”, the Hindenburg report triggered an enormous rout of Adani shares and market worth, with the flagship agency shedding over $120bn in days, forcing the cancellation of a $2.5 billion FPOafter it had scraped via.

Throughout the listening to, the bench noticed that it was aware about “treading with warning” in a matter like this as a result of “inventory markets work on sentiments” and the court docket might solely have a restricted function of facilitating a dialogue so {that a} “higher mechanism” to guard the traders might be advanced.

“Can we ponder having an skilled committee, presumably from banking, funding space, headed by a smart guiding power in type of a retired decide? We’re simply pondering out aloud… It’s a brand new world and capital inflows are seamless. It may well occur once more… this broad physique can consider modification of statutory of regulatory provisions which finally authorities can take a name on,” the bench instructed the SG.

Mehta, on his half, mentioned that Sebi has been “on prime of the matter” and has been wanting into it from all angles of statutory and regulatory regime. He assured the court docket that each one attainable measures are being contemplated, lamenting that the set off, the Hindenburg report, was exterior the territorial jurisdiction of the nation.

The bench, in its order, clarified that its remark shall not be a mirrored image on the discharge of statutory perform by Sebi or another statutory authority, and noticed that the train proposed to be undertaken by the court docket might also have a look at a “wider function” for the market regulator given the truth that the inventory markets have modified considerably through the years.

“India right now shouldn’t be the way it was once in Nineties and inventory market can also be not the place just for the wealthy. However right now, the inventory market can also be for the extensive space of center class… you possibly can come again and tell us what’s going to assist the method alongside,” it instructed Mehta whereas fixing the subsequent listening to on Monday.

The court docket was listening to the PILs filed individually by advocates Visha Tiwari and ML Sharma associated to the American short-seller Hindenburg Analysis’s report.

Tiwari’s plea centered on the “monumental loss to traders” and claimed the Hindenberg report must be investigated to establish if a calculated try was made to tarnish the nation’s picture and influence its financial system. The lawyer demanded a court-monitored probe.

Sharma, alternatively, questioned Sebi’s failure to droop buying and selling of Adani Group shares quickly after the report got here out and demanded a legal prosecution of the brief sellers. His petition named Hindenburg founder Nathan Anderson and his associates as brief sellers, whom it accused of hatching a “legal conspiracy” by releasing a “concocted information” as analysis report back to trigger heavy losses to the shareholders of Adani shares.

The fallout of the Hidenburg report has since triggered an enormous row, with the Opposition concentrating on the ruling Bharatiya Janata Get together over alleged hyperlinks between Prime Minister Narendra Modi, and his authorities, and the Adani Group.

The federal government has distanced itself, pointing to regulatory our bodies able to taking required motion. Final week Union finance minister Nirmala Sitharaman referred to SBI and LIC statements that mentioned their exposures had been “effectively inside limits”. State Financial institution is a lender to the Adani Group whereas LIC is a major investor in shares of its listed entities.