The Adani Group, after pulling its ₹20,000 crore fairness fundraising plan final week as a consequence of a inventory rout set off by Hindenburg Analysis’s fraud allegations towards the conglomerate, is planning to trim its capital spending plans, Mint reported on Monday citing folks near the event,

Whereas offering extra collateral within the type of inventory pledges to lenders, the group might average its capex plans in a few of its companies, the newspaper reported.

“At Adani, there’s a rethink on the capex. The group might average its capex plans in a number of the companies. So, as a substitute of focused development over 12 months, they might have a look at a time-frame of 16-18 months for that quantum of development in sure companies,” the newspaper quoted one of many two folks as saying.

The conglomerate will return to its normal tempo of development as soon as normalcy returns. It additionally reported the group may have a look at 16-18 months for development in sure companies, as a substitute of a 12-month goal.

The corporate will use various funding channels from inner accruals, promoter fairness funding and personal placements to fund tasks, Mint reported.

The Adani Group generates ₹57,000- ₹60,000 crore of Ebitda yearly, and out of this, round half is offered to the group as money, which the group plans to make use of for capex, working capital necessities and assembly rapid repayments, that are price round $300 million over the following six months, the 2 folks added.

On pledges, the transfer to supply extra collateral is after shares of group corporations confronted a rout available in the market final week after the Hindenburg report levelled allegations of inventory manipulation and accounting fraud.

The group will plan to utterly scale back its share pledges, the newspaper quoted an govt near the event as saying.

“The corporate can pay down all share-backed loans; that can occur very shortly. Second, they may construct up extra cash buffers in these companies, they’re already very sturdy, and this will likely be demonstrated subsequent week when the outcomes are out,” he mentioned.

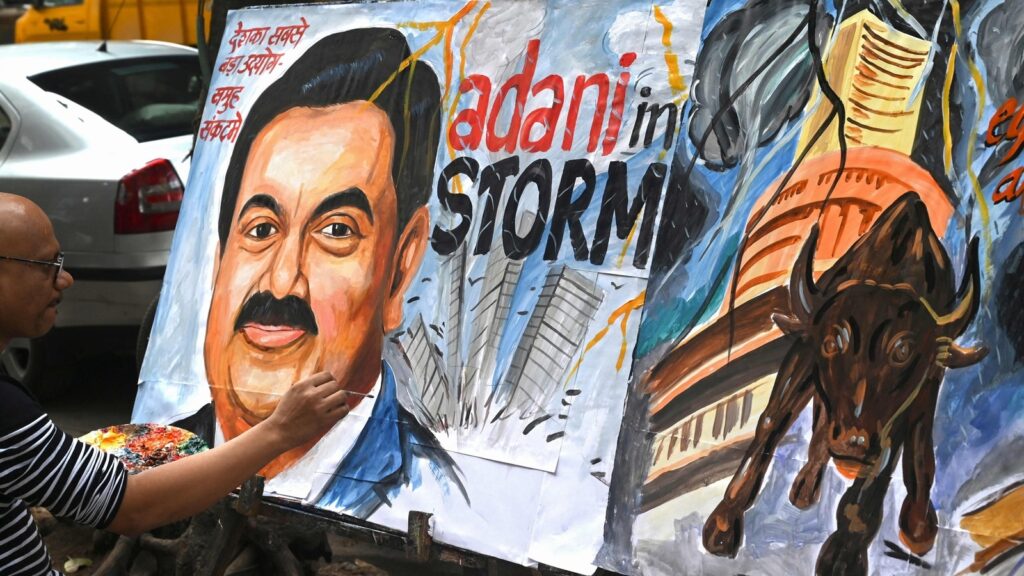

The market worth of billionaire Gautam Adani’s corporations has slumped by nearly half since Hindenburg Analysis launched a report on January 24 accusing the conglomerate of inventory manipulation and accounting fraud. The group has denied Hindenburg’s allegations of company wrongdoing and threatened authorized motion.

(With inputs from businesses)